Defined contribution pension (DC) is a type of private pension that accumulates contributions on its own. Initially called the Japanese version of the 401k, it is now often called the DC. In addition to corporate DCs, personal DCs became available to all working generations in 2017 with the nickname of “iDeCo”, expanding the range of people who can use them.

Twenty years have passed since the Defined Contribution Pension Plan was established. During that time, the number of users reached 9.4 million due to the growing awareness of preparing for old age through self-help efforts, partly due to the problem of “20 million yen in old age”.

Defined Contribution Pension (DC) membership is increasing, but still only 10% of the working population (From Fidelity Investment Trust Materials)

Defined Contribution Pension (DC) membership is increasing, but still only 10% of the working population (From Fidelity Investment Trust Materials)

However, this is still only 10% of the working population. Fidelity Investment Trust conducted a survey on DC awareness of 12,000 people 20 years after the introduction of the system. From there, we can see the problem that while people who use DC have gained successful experiences, many people are stalling due to the complexity of the system.

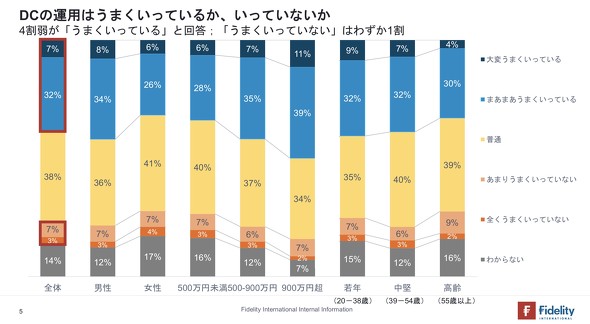

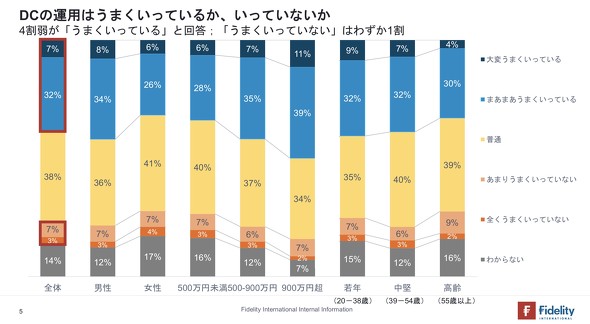

DC users are “successful” in operation

Among those who use DC, 39% answered that “the operation is working well”. Only 10% of the respondents said that they were not doing well. However, the quality of investment differed depending on the investment destination selected.

) DC management is successful for most people (from Fidelity Investment Trust materials)

) DC management is successful for most people (from Fidelity Investment Trust materials)

Only investment trusts are used Forty-seven percent of the respondents said they were “successful,” while 24% of those who managed only with a principal-securing type such as a time deposit, a difference of about double.

As for the reason why it is working well, 35% of the respondents think that the market environment was good, while 34% said that they practiced long-term operation. It can be said that the DC system, which cannot be withdrawn until the age of 60 and is premised on long-term investment, is contributing.

Copyright © ITmedia, Inc. All Rights Reserved.

Note: This article have been indexed to our site. We do not claim ownership or copyright of any of the content above. To see the article at original source

Click Here