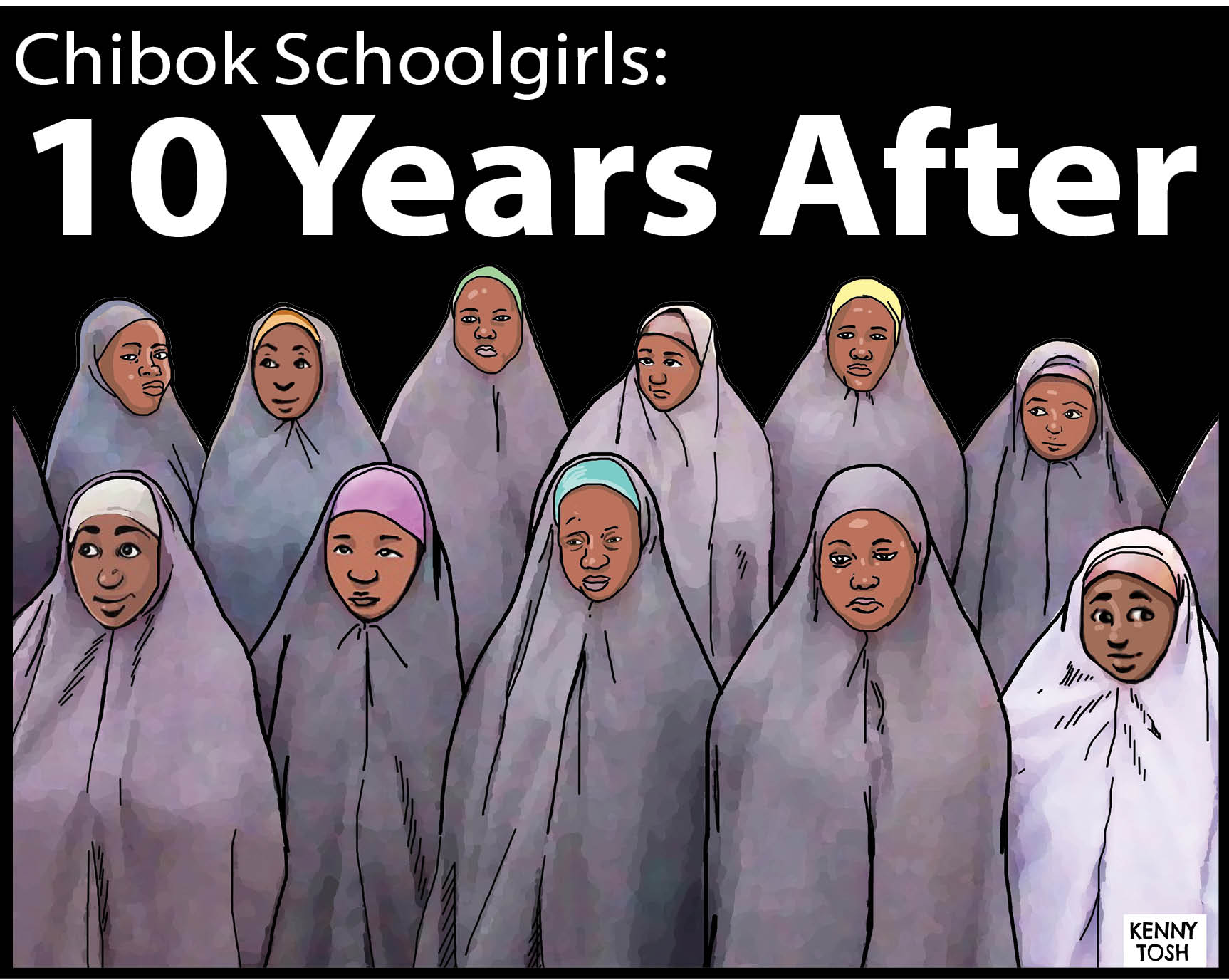

The Indi Home Shopping Arcade in downtown Tsuen Wan

In their 13th major asset disposal in six months, the family of Hong Kong’s late “Shop King” Tang Shing-Bor have started the new year on a familiar note, taking in a reported HK$650 million ($83.3 million) with the disposal of the retail podium of the Indi Home tower in the New Territories.

The buyer, identified by sources familiar with the deal as an entity related to the Ma family which owns the Oriental Daily newspaper, reportedly paid about HK$13,500 per square foot of floor area to acquire the Indi Home Shopping Arcade, which spans 48,000 square feet (4,459 square metres) at the base of the 56-storey residential complex.

With the sale of the property ten minutes walk east of the Tsuen Wan Park MTR station the Tang family, which has been under pressure to to liquidate assets for over a year, has sold a total of more than HK$6.5 billion from major disposals since July of 2021, according to Mingtiandi’s tally.

The disposal by the family, whose real estate assets are now managed by Tang Shing-bor’s youngest Stan, came as Hong Kong’s market for shopping space showed signs of life in the fourth quarter, with total investment volume for retail transactions valued at HK$20 million and above increasing 8.8 percent year on year to HK$33.2 billion in the period from October through December, according to research from JLL.

Losing Out On Retail

Indi Home Shopping Arcade is a two-storey neighbourhood retail centre located at 138 Yeung Uk Road, and is home to restaurants and fast food chains including Maxim’s MX, as well as Wellcome, which is Hong Kong’s longest-established supermarket chain, and a post office.

Stan Tang has been selling fast in the past year

Aside from the Tang family’s recently sold commercial portion, the 2006-vintage tower also includes 48 storeys of one to three-bedroom residential units, serviced apartments, a podium garden, clubhouse and car parks.

The Tangs had purchased their section of the property from Joseph Lau’s Chinese Estates in 2012 for HK$360 million, reported local media. After holding the retail podium for about a decade, the family is now taking advantage of the city’s recovering retail demand as analysts say the sector may have finally bottomed out, following a more than two year retail downturn triggered first by civil unrest and then the COVID-19 pandemic.

Hopes that mainland authorities could soon open their border with Hong Kong and allow the return of 1.4 billion shoppers have raised investor hopes and boosted interest in retail assets, said Tom Ko, executive director and head of capital markets at Cushman & Wakefield Hong Kong.

About two months ago, New World Development reportedly sold more than a combined 85,000 square feet of retail space in Kowloon’s Lai Chi Kok neighbourhood for HK$455 million to veteran investors David Chan Ping-Chi and Raymond Tsoi Chi-chung.

In June of last year, the Tangs had sold H Cube, a 9,580 square foot retail property just a 1-minute walk from the Indi Home Shopping Arcade for HK$120 million to an unnamed buyer, according to local media.

Hong Kong’s Biggest Estate Sale

The latest Tang family sale came about a year after the clan was hit with a lawsuit over an outstanding debt of HK$265 million to an elderly care operator which the family had invested in the preceding year.

Since that time the billionaire clan has been marketing industrial, office, retail and hospitality assets around the city, including selling an 80 percent holding in a Kowloon City property to Sino-Ocean Group last summer for an undisclosed amount. The mainland developer just secured the remaining piece of that 63,270 square foot asset in the final week of December through a compulsory sale which valued the asset at HK$705 million.

In July of last year, Stan Tang’s Stan Group sold the East Asia Industrial Building (Phase One) in the New Territories to China Resources Group for HK$2.24 billion, with the family following two weeks later with the HK$695 million sale of the Mineron Centre in Fanling to another unit of China Resources.

About a year before his passing, Tang Shing-Bor was said to have been facing legal trouble, after failing to pay more than HK$12 million in rent for a building at 182 Nathan Road in the city’s Tsim Sha Tsui area.

Note: This article have been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here