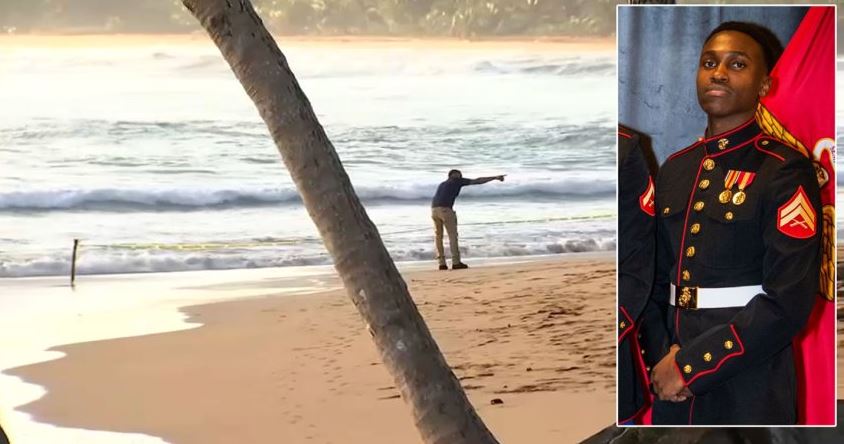

Patrizia’s team in Germany has some big plans for Japan (Patrizia)

German asset manager Patrizia has launched a EUR 1 billion ($1.03 billion) Japan-focused fund to acquire core and value-add multi-family assets across the country’s top cities, according to the company’s top executive for the region.

In an interview with Mingtiandi on Monday, Patrizia Asia Pacific head Thomas Hirschvogel said the fund, which is backed by an Asian institutional investor, has already been seeded with four apartment buildings in the country’s top two cities worth a combined JPY 7.5 billion (EUR 52 million). Hirschvogel said his firm plans to deploy the rest of the capital into core-plus and value-add multi-family opportunities in Tokyo and other major urban centres in the country over the next two to three years.

Following earlier vehicles which targeted Japan’s largest cities of Tokyo and Osaka, along with Nagoya and Fukuoka, Hirschvogel said that, in terms of “fresh deployable capital” this latest fund is the firm’s largest ever in the region. The record capital raising comes as Patrizia aims to double its real assets portfolio in Asia Pacific by 2027, with the company pointing to the favourable borrowing environment in Asia’s second largest economy as key to its focus on the country.

“By keeping the interest rates low, you have actually sustained the environment for real estate overall in Japan and that makes us actually quite bullish on the Japanese market,” Hirschvogel said. “From a core plus space where we have most of our managed capital, we like to develop further into the core markets in Asia and that is Japan and Australia for us. Our second tier markets are South Korea, Singapore and Hong Kong.”

Bullish on Japan

While Hirschvogel declined to reveal the identity of its investor on confidentiality grounds, he said Patrizia is keeping a single-digit ownership in the account with its partner holding the remainder. The strategy has a seven-year lifetime with a target internal rate of return of 8 to 10 percent.

Thomas Hirschvogel, head of Asia Pacific for Patrizia

“This is all residential and can have a certain amount of mixed use,” he said. “Overall, we like to buy slightly smaller assets and portfolios so we don’t want to compete with the Japanese mega-REITs in the residential space – we want to be the one to have a certain edge over these kinds of competitors.” Hirschvogel declined to provider further details on the seed portfolio.

The billion-dollar fund builds on a series of earlier Patrizia ventures in the Japanese residential market over the past five years. In January 2019, Patrizia took over Tokyo-based property advisory and investment firm Kenzo Capital Corp with the acquisition giving it control of the Kenzo Japan Residential Fund that the two firms had jointly established in 2017.

The Kenzo strategy was put together with a maximum investment volume of EUR 550 million and targets Greater Tokyo, Greater Osaka, Nagoya and Fukuoka with an initial seed portfolio of four apartment buildings worth EUR 30 million.

With a pension fund and a major Frankfurt investment management and consulting firm as its two cornerstone investors, the Kenzo fund has a seven-year lifespan and an 8 percent target IRR. Unlike its latest Japan fund, the Kenzo vehicle was only available to institutional investors in Germany.

APAC Expansion

Following the launch of its new strategy, Patrizia has set up its second regional hub in Singapore to buttress its APAC expansion. The new office, located at Tuan Sing Holdings’s 18 Robinson Road, will supplement its first regional base in Hong Kong as well as its five other locations in Tokyo, Seoul, Sydney, Canberra and Melbourne.

“We have invested about 17 percent of Patrizia’s Global AUM with money from Asia Pacific and that’s an important lesson that we get a lot of APAC capital to be invested globally,” he said.

With EUR 57 billion in assets under management worldwide, the fund manager is aiming to double its real estate and infrastructure investments in Asia Pacific by 2027. During the same period, Patrizia aims to double its investments in Japan to where the country accounts for 10 percent of its APAC portfolio with around EUR 2 billion in assets.

“A vast percentage of the urbanisation globally will happen in Asia Pacific and that’s why we think the market still has a steeper growth outlook than, for example, the US or Europe,” he said. The company is also looking for opportunities for investments in green infrastructure as Asia heads for a carbon zero future.

“If you look into the whole decarbonisation and sustainability measures, there’s a huge gap between the required infrastructure investments in the region to catch up and what is needed,” he added. “I think there will be a lot of private investment going forward in the infrastructure space – and that also extends to real estate.”

Besides its Japanese strategy, Patrizia is also aiming to invest broaden its Australian presences to include the residential market, particularly in the multi-family and student or senior housing segments, according to Hirschvogel.

“We have commercial real estate but we have not expanded into the typical multifamily space in Australia, we think that is an area where we see a growth so we’d like to expand our business in the multifamily sector in Australia,” he said, adding that the build-to-rent space focusing on student apartments and senior housing is also an attractive space to go into.

Note: This story has been updated to remove a reference to Patrizia’s APAC assets under management. The company has not stated a figure for AUM in the region. Mingtiandi regrets the error.

Note: This article have been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here