Logo of Nayifat Finance Co.

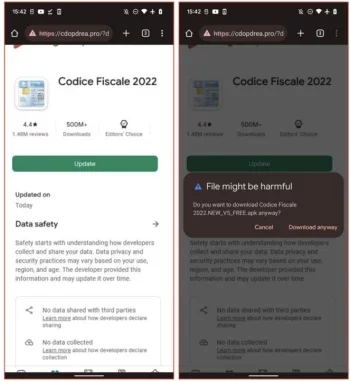

The board of Capital Market Authority (CMA) approved Nayifat Finance Co.’s request to offer 35 million shares, representing 35% of the company’s share capital, in an initial public offering (IPO).

The company’s prospectus will be published within sufficient time prior to the start of the subscription period, CMA said in a statement.

The prospectus includes all relevant information that the investor needs to know before making an investment decision, including the company’s financial statements, activities, and management.

A subscription decision without reading the prospectus carefully or fully reviewing its content may involve high risk. Therefore, investors should carefully read the prospectus, which includes detailed information on the company, the offering and risk factors. Thus, providing potential investors the ability to evaluate the viability of investing in the offering, taking into consideration the associated risks.

If the prospectus proves difficult to understand, it is recommended to consult with an authorized financial advisor prior to making any investment decision.

The CMA’s approval on the application should never be considered as a recommendation to subscribe in the offering of any specific company. It merely means that the legal requirements as per the Capital Market Law and its Implementing Regulations have been met.

The CMA’s approval on the application will be valid for six months from the CMA board resolution date. The approval shall be deemed cancelled if the offering and listing of the Company’s shares are not completed within this period.

According to data compiled by Argaam, CMA approved on March 31, 2019, the request of Nayifat Finance to offer 36.5 million shares for IPO, representing 30.04% of the company’s shares.

However, the company decided in June 2019 to reschedule the presentation to the participating parties and the book-building process to offer its shares for IPO, which was scheduled for June 24, 2019.

Note: This article have been indexed to our site. We do not claim ownership or copyright of any of the content above. To see the article at original source Click Here