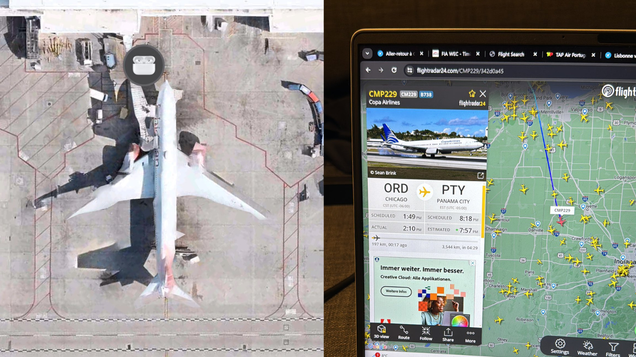

Enlarge / A customs officer inspects imported lithium carbonate at Longwu Branch Terminal of Shanghai İnternational Port Co., Ltd.

The industrial port of Kwinana on Australia’s western coast is a microcosm of the global energy industry. From 1955, it was home to one of the largest oil refineries in the region, owned by British Petroleum when it was still the Anglo-Persian Oil Company. It once provided 70 percent of Western Australia’s fuel supplies, and the metal husks of old tanks still dominate the shoreline, slowly turning to rust in the salt air.

The refinery shut down in March 2021, but it isn’t just oil below the region’s red soil: Australia is also home to almost half of the world’s lithium supply. The trucks and machinery are humming once again, but now they’re part of a race to secure the clean energy sources of the future—a race being dominated by China.

Over the past 30 years, lithium has become a prized resource. It’s a vital component of batteries—for the phone or laptop you’re reading this on, and for the electric vehicles that will soon rule the roads. But until recently, the lithium mined in Australia had to be refined and processed elsewhere. When it comes to processing lithium, China is in a league of its own. The superpower gobbled up about 40 percent of the 93,000 metric tons of raw lithium mined globally in 2021. Hundreds of so-called gigafactories across the country are churning out millions of EV batteries for both the domestic market and foreign carmakers like BMW, Volkswagen, and Tesla.

China’s share of the market for lithium-ion batteries could be as high as 80 percent, according to estimates from BloombergNEF. Six of the 10 biggest EV battery producers are based in China—one of them, CATL, makes three out of every ten EV batteries globally. That dominance extends through the supply chain. Chinese companies have signed preferential deals with lithium-rich nations and benefited from huge government investment in the complex steps between mining and manufacturing. That’s made the rest of the world nervous, and the United States and Europe are now scrambling to wean themselves off Chinese lithium before it’s too late.

An electric car battery has between 30 and 60 kilos of lithium. It’s estimated that by 2034, the US alone will need 500,000 metric tons of unrefined lithium a year for EV production. That’s more than the global supply in 2020. Some experts fear a repeat of the oil crisis sparked by Russia’s invasion of Ukraine, with geopolitical tension spilling over into a war of sanctions. Such a scenario could result in China shutting off its supply of batteries just as Western automakers need them to power the switch to EVs.

“If China decides to stick with the home market, lithium-ion batteries are going to be more expensive outside China,” says Andrew Barron, a professor of low carbon energy and the environment at Swansea University. That makes Western efforts to expand battery production capacity “more imperative than ever,” he says.

Those efforts are taking shape, albeit slowly. If everything goes to plan, there will be 13 new gigafactories in the United States by 2025, joined by an additional 35 in Europe by 2035. (That’s a big if, with many projects beset by logistical problems, protests, and NIMBYism, most notably Tesla’s controversial gigafactory near Berlin.)

But those gigafactories are going to need lithium—and lots of it. In March, US president Joe Biden announced plans to use the Defense Production Act to fund domestic mining of lithium and other critical battery materials under the auspices of national security. Across the Atlantic, the European Union is advancing legislation to try and create a green battery supply chain within Europe, with a focus on recycling lithium.

Note: This article have been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here