In an ever-changing industry, the construction forecast can seem both volatile and encouraging. To get insight into the 2023 construction outlook, Procure teamed up with Censuswide, and surveyed industry professionals across the U.S. and Canada. Their responses provided a look into the current climate of construction, essential scopes of focus, the state of technology adoption and data maturity, workforce insights, and crucial areas for improvement in the industry.

Top of mind for respondents were five key areas: confidence in market conditions, data-driven construction, improving project performance, digital transformation in response to economic conditions and the current state of insurance and payments.

To discover more about how the U.S. and Canada are building in 2023read on for insight into these five construction industry trends:

1. Business confidence is high despite economic instability.

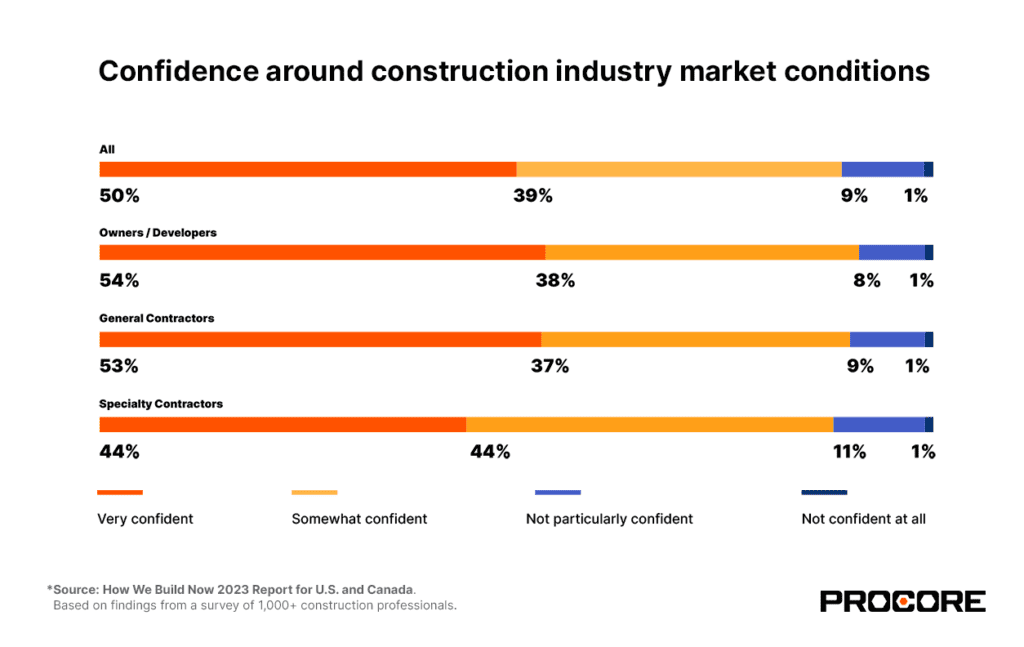

Ninety percent of respondents feel confident about market conditions over the next 12 months, while 50% feel very confident. Despite economic uncertainty and inflation across the U.S. and Canada, 74% of respondents expect both the number and value of projects completed by their organizations to increase in the next 12 months. This significant business confidence is unique in light of the weak overall economic outlook.

This confidence is partially due to significant investment in government infrastructure and public transportation across both countries — the U.S. Bipartisan Infrastructure Law and the Investing in Canada program. The construction economy is far from shrinking, and many organizations have significant backlogs.

2. Data-driven construction is the future.

Clean, accessible data is critical to planning effectively — and construction technology is vital in achieving this. In fact, 43% of respondents say having access to historical info would help them make better decisions. Respondents also feel that an average 13% of total spending on projects can be saved by capturing and standardizing data more effectively. It’s clear that getting data out of silos and accessible to decision makers is critical.

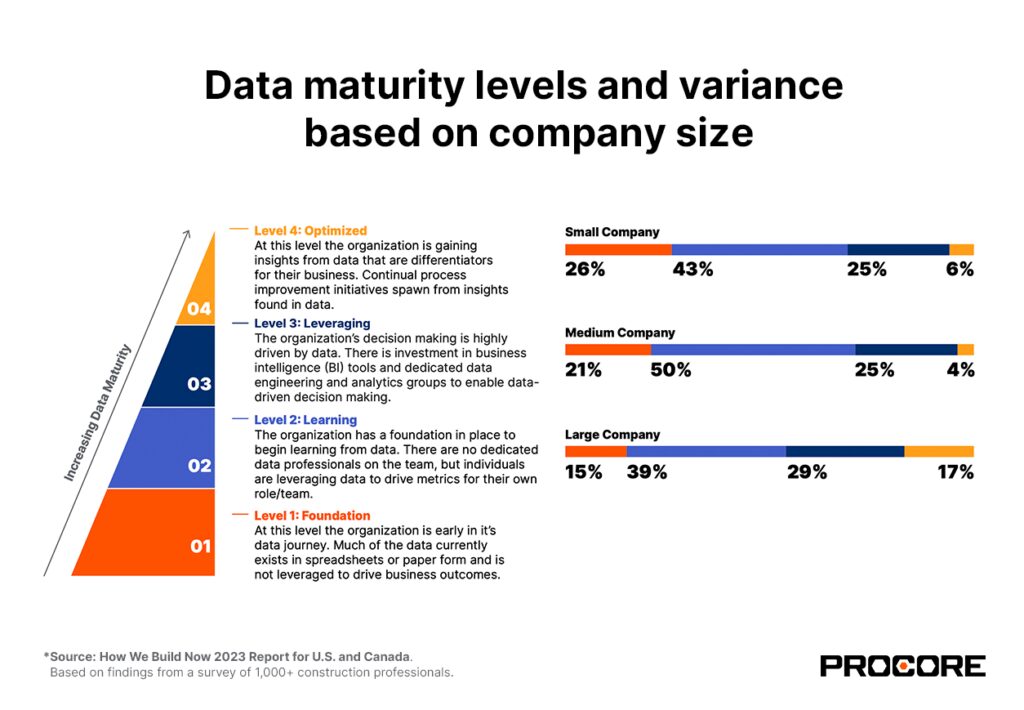

One way to understand how effective organizations are at leveraging and gaining insights into their data is through the lens of data maturity. Based on Procore’s data maturity model, we found just 8% of respondents are at Level 4 (the highest level of data maturity), 26% are at Level 3, a whopping 45% are at Level 2 and 21% are only at Level 1. Data maturity is also a factor of company size, with larger companies tending to be more data-mature than smaller organizations.

3. Project performance leaves room for improvement.

Rework is the bane of construction, with 28% of total project time spent on it, while 18% of project time is spent searching for data. These factors significantly impact performance, as nearly half of projects go over time and budget, creating waste and displeasing clients.

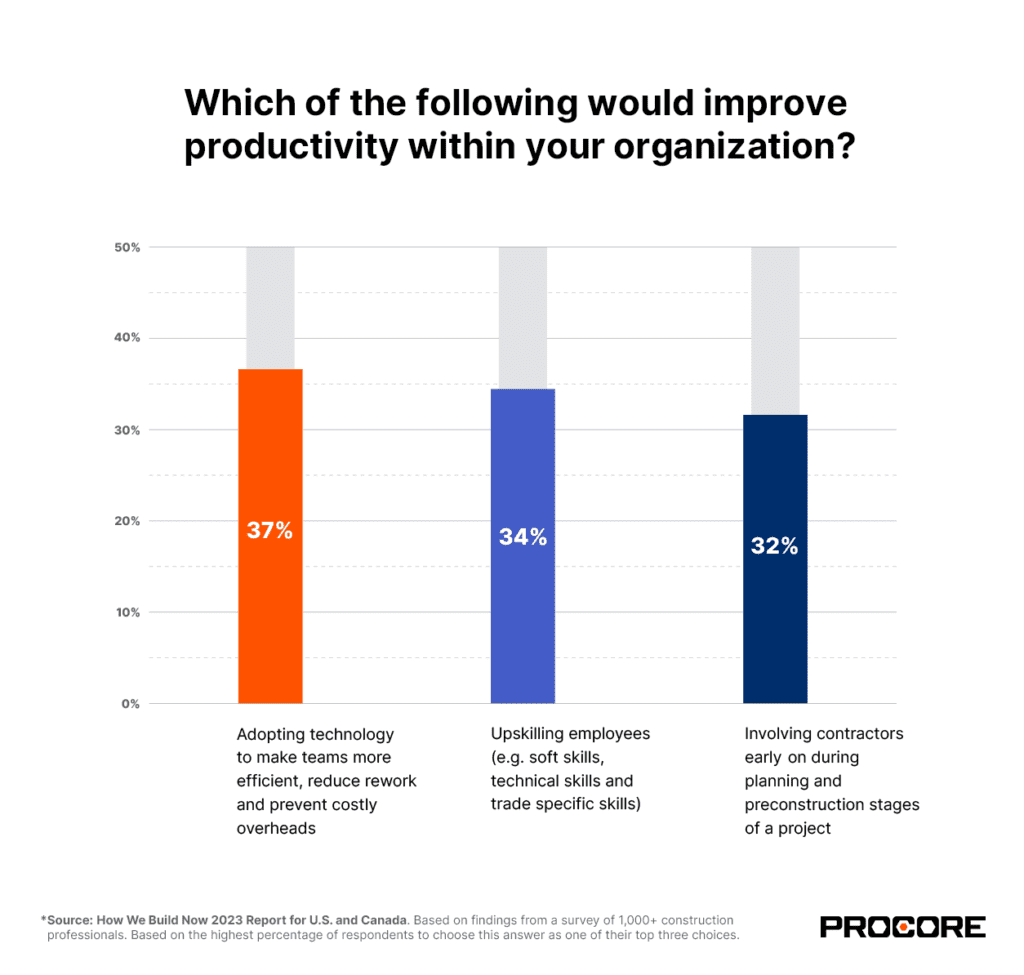

With project performance in sharp focus, it seems respondents are looking at technology to help them improve productivity and profitability. When asked about the factors that would improve productivity within their organization, one of the top answers from respondents was adopting tech to make teams more efficient, along with involving contractors early on during the planning and preconstruction stages of a project and upskilling employees.

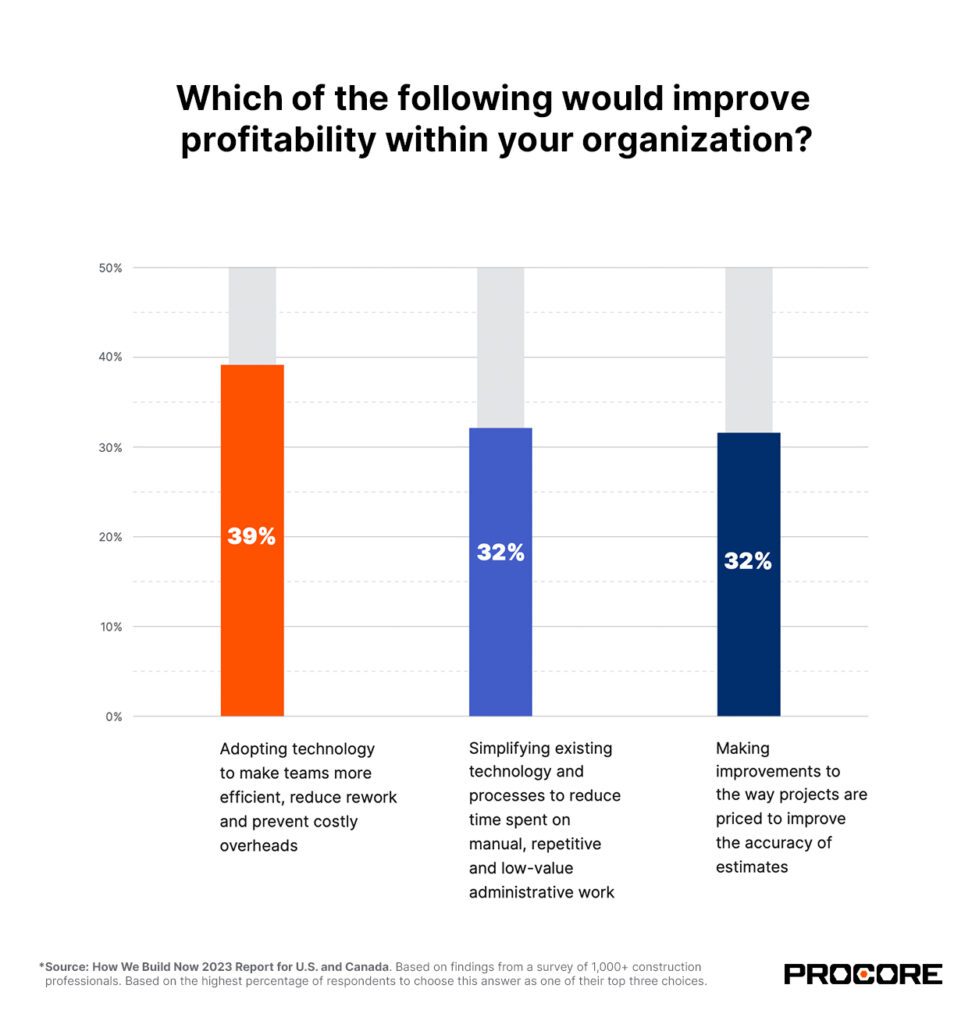

Similarly, when asked about the factors that would improve profitability within their organization, the top responses were simplifying existing tech and processes, making improvements to the way projects are priced to improve the accuracy of estimates, and adopting tech to make teams more efficient.

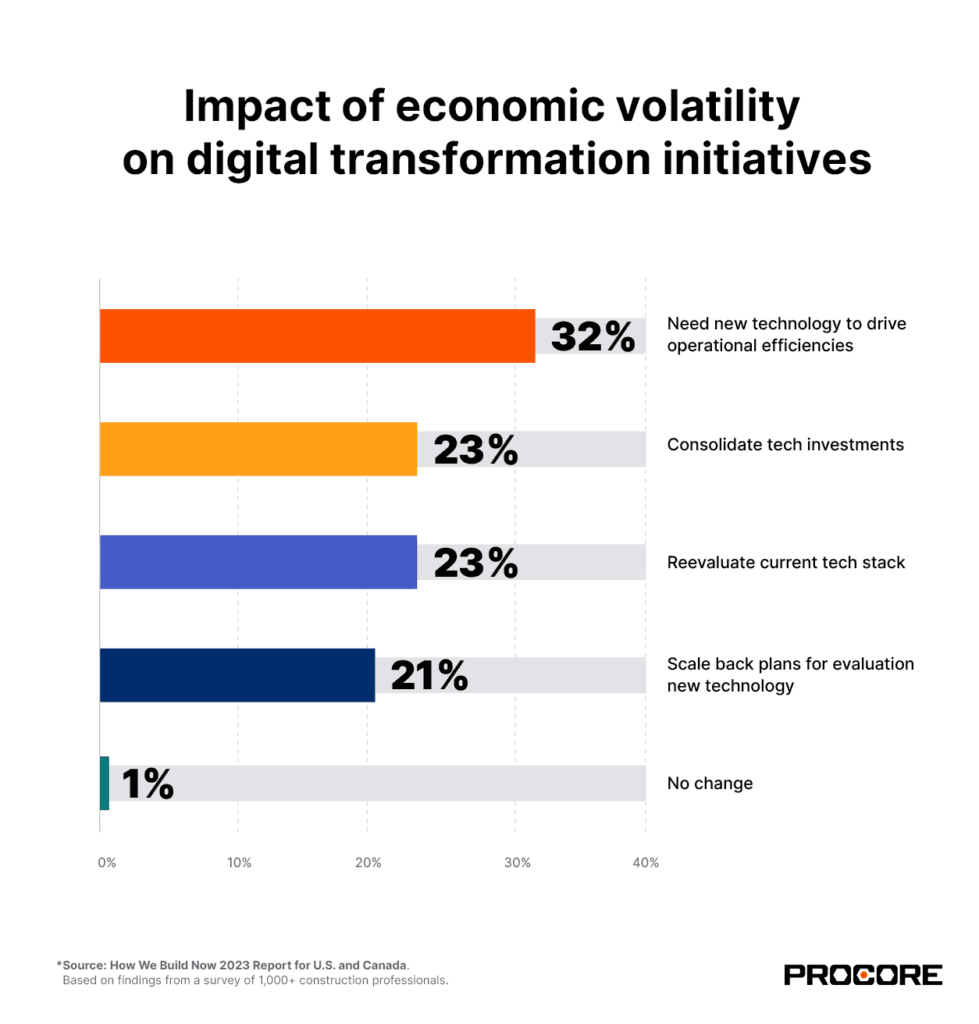

4. Economic volatility could help accelerate digital transformation.

Owners, general contractors and specialty contractors are all reviewing their tech stacks and business needs in light of industry unpredictability. Thirty-two percent of respondents report they need new technology to help drive operational efficiencies and cost controls in reaction to the economic conditions. Meanwhile, 22% of respondents are examining their existing technology to understand what’s working and what’s not.

As the industry seeks to adopt technology to help them navigate difficult times, digital transformation is on the rise, with owners leading the way. While many seek to become a digital-first business, 26% of respondents still use paper-based records or non-digital processes as part of their workflows. Digital transformation isn’t an overnight change, and many organizations are making a concerted effort to spur their journey on.

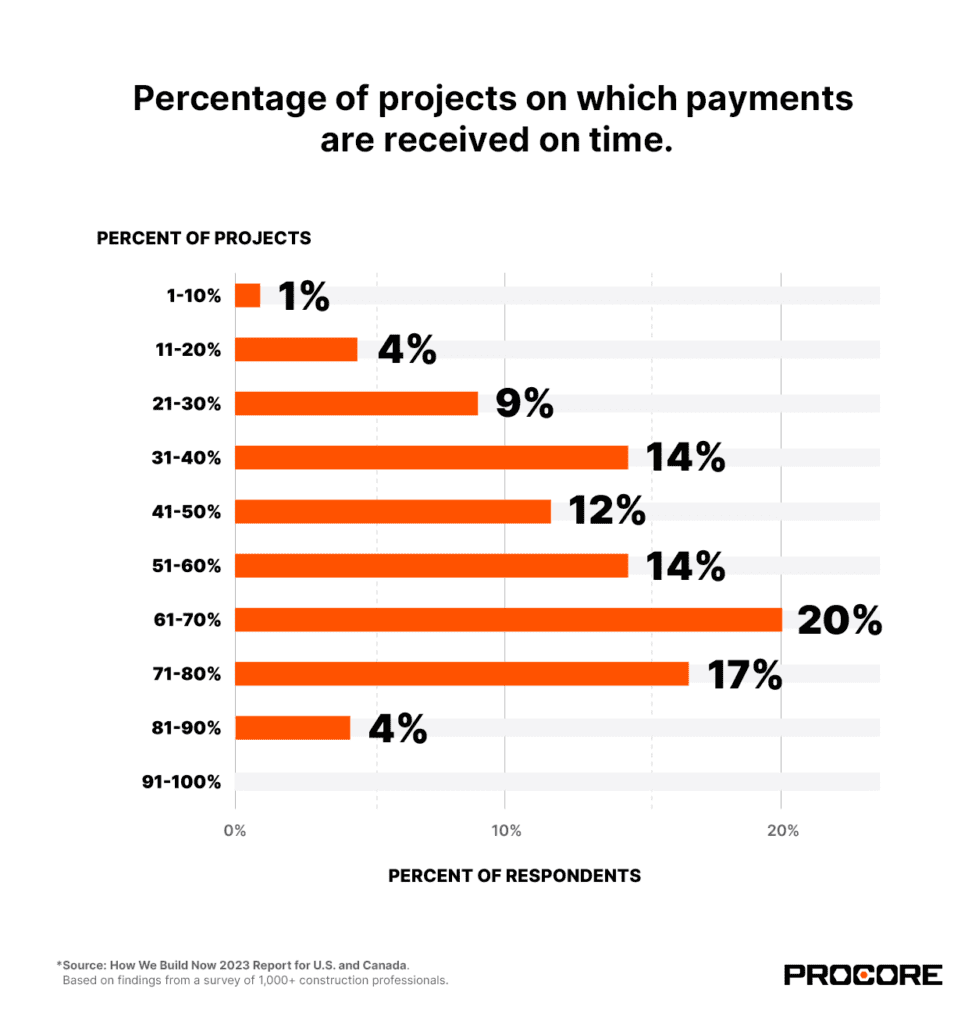

5. Respondents are dissatisfied with the current state of payments and insurance.

Delayed payments have long plagued the construction industry, resulting in cash flow problems, especially for specialty contractors who have to finance their materials up-front. In fact, 47% of specialty contractors and 39% of general contractors report experiencing cash flow problems arising from delayed payments. Additionally, 36% of owners say that delays from not getting payments made quickly have cost them money.

It’s no surprise that bettering the payments and insurance processes in construction is top of mind across the industry. Fifty-five percent of respondents feel the industry can do a better job of leveraging existing data to simplify payments and improve insurance programs. Regarding their efforts to manage risk, one in three (36%) respondents report frustration with the time it takes to get construction insurance quotes. It’s evident — the insurance industry can improve by utilizing operational data to account for the technology-enabled risk mitigation contractors are implementing.

Construction trends may shift and change, but with a resilient and dedicated industry, building for the future is achievable. To gain even more insights into how the U.S. and Canadian construction markets are building in 2023, download the full report.

Gain even more insights into how the U.S. and Canadian construction markets are building in 2023.

Veronica Stone

Veronica Stone is a content writer at Procore. She’s passionate about writing stories from the industry and sharing construction with the world.

Reader Interactions

Note: This article have been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here