Fintel reports that on April 21, 2023, Barclays maintained coverage of Newmont (NYSE:NEM) with a Equal-Weight recommendation.

Analyst Price Forecast Suggests 20.79% Upside

As of April 6, 2023, the average one-year price target for Newmont is $57.83. The forecasts range from a low of $48.48 to a high of $70.35. The average price target represents an increase of 20.79% from its latest reported closing price of $47.88.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Newmont is $11,905MM, a decrease of 0.08%. The projected annual non-GAAP EPS is $1.98.

What are Other Shareholders Doing?

Intrust Bank No holds 8K shares representing 0.00% ownership of the company. In it’s prior filing, the firm reported owning 6K shares, representing an increase of 15.54%. The firm increased its portfolio allocation in NEM by 125.42% over the last quarter.

ONEO – SPDR Russell 1000 Momentum Focus ETF holds 8K shares representing 0.00% ownership of the company. In it’s prior filing, the firm reported owning 6K shares, representing an increase of 18.76%. The firm increased its portfolio allocation in NEM by 22.55% over the last quarter.

KAUAX – Federated Kaufmann Fund Shares holds 1,400K shares representing 0.18% ownership of the company. In it’s prior filing, the firm reported owning 1,100K shares, representing an increase of 21.43%. The firm increased its portfolio allocation in NEM by 60.67% over the last quarter.

Managed Account Series – BlackRock GA Disciplined Volatility Equity Fund Class K holds 15K shares representing 0.00% ownership of the company. In it’s prior filing, the firm reported owning 15K shares, representing an increase of 3.97%. The firm increased its portfolio allocation in NEM by 27.98% over the last quarter.

Madison Asset Management holds 427K shares representing 0.05% ownership of the company. In it’s prior filing, the firm reported owning 444K shares, representing a decrease of 3.99%. The firm decreased its portfolio allocation in NEM by 99.90% over the last quarter.

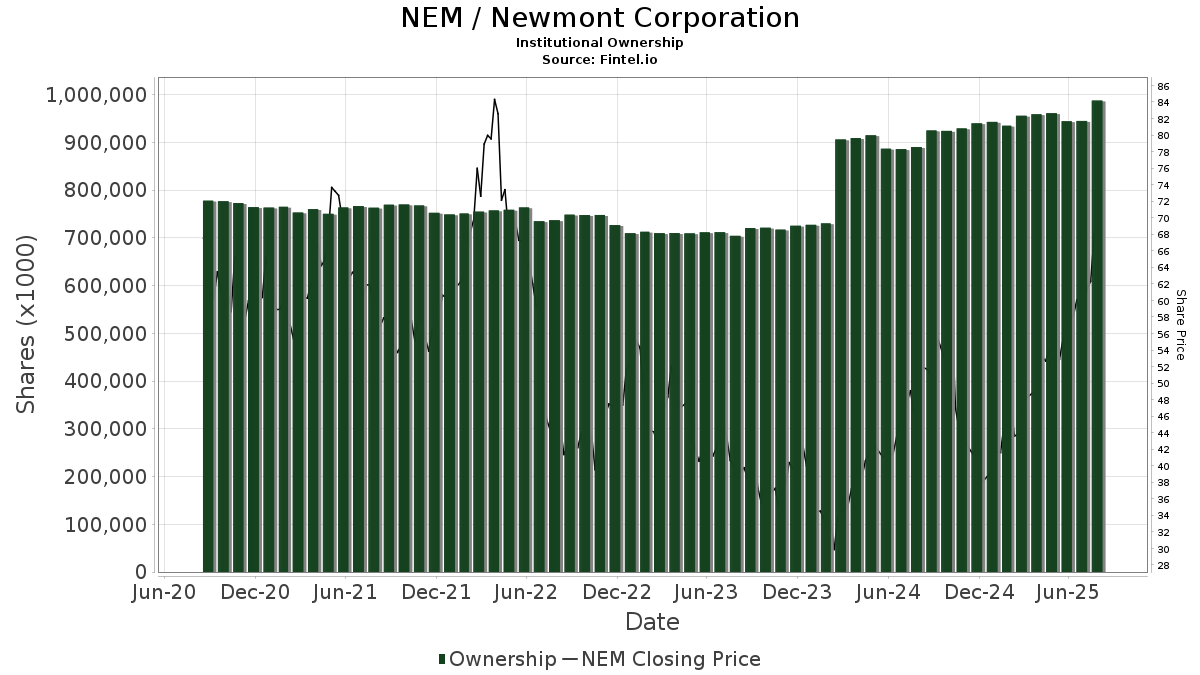

What is the Fund Sentiment?

There are 1907 funds or institutions reporting positions in Newmont. This is an increase of 33 owner(s) or 1.76% in the last quarter. Average portfolio weight of all funds dedicated to NEM is 0.48%, an increase of 7.58%. Total shares owned by institutions decreased in the last three months by 0.01% to 710,446K shares.  The put/call ratio of NEM is 0.57, indicating a bullish outlook.

The put/call ratio of NEM is 0.57, indicating a bullish outlook.

Newmont Background Information

(This description is provided by the company.)

Newmont is the world’s leading gold company and a producer of copper, silver, zinc and lead. The Company’s world-class portfolio of assets, prospects and talent is anchored in favorable mining jurisdictions in North America, South America, Australia and Africa. Newmont is the only gold producer listed in the S&P 500 Index and is widely recognized for its principled environmental, social and governance practices. The Company is an industry leader in value creation, supported by robust safety standards, superior execution and technical expertise. Newmont was founded in 1921 and has been publicly traded since 1925.

See all Newmont regulatory filings.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Note: This article have been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here