As of Wednesday afternoon, one Bitcoin on the Bitstamp trading platform cost around $43,900. Since hitting a new all-time high on November 8, 2021, the Bitcoin price has been falling steadily, even briefly falling below the $40,000 mark on January 10. Since then, the bitcoin price has recovered and climbed above $43,000 again on Wednesday.

Experts see one reason for the Bitcoin price drop in the fear of rapidly rising interest rates in the USA. Another reason for the bitcoin price drop could be the unrest in Kazakhstan.

In the past few months, depending on the news situation, the price quickly collapsed. As late as July 2021, the price of the oldest and largest cryptocurrency had repeatedly fallen to just under $29,000 within a few weeks, but then the countermovement started. Since November 8, 2021, however, Bitcoin has again recorded severe losses.

Many analysts are currently assuming that the Bitcoin price will continue to rise in the long term. Investing in Bitcoin is considered risky among investors.

Top jobs of the day

Find the best jobs now and

be notified by email.

Current news and messages from today about Bitcoin and the current price

12. January 2022 – US inflation rate rises to seven percent – Bitcoin price recovers

In addition to Bitcoin and Ethereum, more and more smaller cryptocurrencies are conquering the market. Investors speculate on exorbitant returns. But few alternative coins live up to their promises – some are even scams.

US inflation continued to rise in December and is now at 7 percent. This is the highest value since 1982. As the numbers become known, the Bitcoin price is rising and is approaching the $44,000 mark. The price has continued to recover since Monday’s fall to $39,800.

According to the analysis house Coinmarketcap, the oldest cryptocurrency is currently trading at around 43,850 dollars (as of 15: 9 am). In a 24-hour comparison, Bitcoin recorded a plus of around five percent.

Here you can see the current Bitcoin price in US dollars in real time. The value can therefore deviate from the rates given in the text.

10. January 2022 – Bitcoin falls below $40,000

Bitcoin has been in a downtrend for around two months now, briefly dipping below $40,000. The Bitcoin price was last below that in September 2021.

Experts see one reason for the ongoing sell-off in the cryptocurrency in the fear of rapidly rising interest rates in the USA. The Fed had recently indicated rapid rate hikes. Investors are therefore withdrawing from riskier investments such as Bitcoin, Ethereum and Co. This depresses the prices on the crypto market.

In addition, there is the ongoing unrest in Kazakhstan. In the course of the protests, the state telecommunications company shut down the internet in virtually the entire country – presumably to prevent reporting on the unrest. This step has serious consequences for the crypto market – far beyond the borders of Kazakhstan. Because the country has now become one of the most important locations for global bitcoin mining.

13. December 2021 – Savings banks want to enable cryptocurrency trading – Bitcoin is trading at $48,000

At the beginning of the week, Finance Forward, Finanz-szene and Capital reported that the savings banks will offer their customers the in the coming year Want to enable cryptocurrency trading. Accordingly, customers should be able to control digital currencies such as Bitcoin directly via the current account. The use of a special crypto exchange such as Coinbase is then no longer necessary.

“The interest in crypto assets is enormous, and the Sparkassen-Finanzgruppe also sees that,” said the German Giro and Savings Banks Association (DSGV) on request.

7. December – Bitcoin Gains and Trades Above $50,000

The Bitcoin price rises above the 50,000 dollar mark on Tuesday night. According to data from the analysis house Coinmarketcap, the Bitcoin course is currently trading at $ 51,066 (as of 9:11 a.m.) .

Bitcoin is thus continuing to recover from the price drop early on Saturday. Over the weekend, the price had fallen by around a fifth to just under $42,000 in less than an hour, but was then able to recover somewhat by Sunday evening and is now up around six percent in a 24-hour comparison.

6. December – Hacking of BitMart

The crypto exchange BitMart has probably become the victim of a hacker attack. Hackers have stolen about $150 million in cryptocurrencies from BitMart wallets, Sheldon Xia, CEO of the crypto platform, shared via Twitter: “We have a large-scale security breach related to one of our ETH hot wallets and one of our BSC hot Wallets detected,” Xia tweeted. The blockchain security company PeckShield Inc. had uncovered the hacker attack.

Currently, all payouts at BitMart have been temporarily suspended. Users of the crypto exchange are asked to be patient.

Affected tokens included meme tokens such as Shiba Inu (SHIB) as well as stablecoin USD Coin (USDC), theblockcrypto.com reported, citing PeckShield.

4. December – Bitcoin down by a fifth

Bitcoin remains highly volatile after recently hitting a new all-time high of 68,744, 03 Dollars had risen and thus more expensive than ever in its history it fell significantly at the weekend. Bitcoin temporarily lost a fifth of its value on Saturday. Market participants attributed this to profit taking and macro concerns. The rate of the oldest cryptocurrency gave by up to 22 percent. Currently Listed He at $41,967.50.

3. December 2021 – Bitcoin Holds at $57,000

Last week, Bitcoin lost around 10 percent when the new coronavirus variant Omikron became known. The rate of the oldest and most important cryptocurrency It subsequently fell below $54,000 for a short time, but was able to recover quickly and has been between the $57,000 and $59,000 mark for five days now, which Bitcoin has not yet been able to break through. According to the analysis house Coinmarketcap, the Bitcoin is currently trading at around 56,700 dollars ).

Crypto analyst Roman Reher, known to crypto investors as YouTuber Blocktrainer, points out that despite the last sell-off, the number of so-called futures contracts has not decreased. This would mean that these positions would have to be liquidated by a short-term falling Bitcoin price. A high number of open futures contracts could be a sign that the market is about to correct, the block trainer said. However, this is no guarantee that prices will continue to fall.

On Nov. 26, when the market corrected on the Omicron news, $131 million worth of futures positions were liquidated, which is only a middling number for the bitcoin derivatives market. Basically, this process is a normal occurrence in financial markets. Roman Reher analyzes that this was not the case with the omicron correction.

Furthermore, the behavior of long-term Bitcoin investors is important for the course of the cryptocurrency. They usually sell their coins when prices rise. When the price fell as a result of the Omikron variant becoming known, a decrease in the positions of the long-term holders could be observed. Something similar last happened in March 2020, when the news about the corona virus caused the Bitcoin price to drop sharply. At that time, too, the position of long-term Bitcoin holdings had decreased before increasing again with the rising prices after the Corona shock.

Crypto analyst Reher considers the shock from the new corona variant Omikron to be only a short-term event on the crypto market. Numerous on-chain data would suggest that the Bitcoin price would recover in the long term.

29. November 2021 – Bitcoin bounces off $53,000

Bitcoin starts the new week with a plus of around five percent. The price of the oldest cryptocurrency had recently fallen repeatedly to as much as $53,650, which served as support. On the night of Monday, Bitcoin then broke out at a peak of up to $ 58,000. Over the past week, the entire crypto market has plummeted by up to 10 percent amid fears of a setback to the global economy from the newly discovered omicron variant of the coronavirus.

26. November 2021 – Bitcoin falls below $55,000

The new corona variant from South Africa is not only creating a sales mood on the stock exchanges. The sell-off is also hitting the crypto market. The price of Bitcoin, the oldest and most important digital currency, falls four percent below the $55,000 mark, its lowest level since mid-October. Bitcoin is currently around 20 percent below its all-time high of October 20, 2021.

18. November 2021 – Bitcoin trades around $60,000

Since last week’s all-time high, bitcoin has fallen by more than $9,000. The oldest cryptocurrency is currently trading at around $59,300. For two days now, the price has been moving in the corridor between $58,500 and $60,900. If the support at $58,000 breaks, another sell-off to $56,000 is imminent.

Numerous analysts are currently assuming that the Bitcoin price will need to correct itself, as the cryptocurrency has risen by more than 40 percent in the past few months. The last sell-off on the crypto market was also not due to any negative news.

16. November 2021 – Bitcoin falls back to $60,500

The Bitcoin recorded a significant minus on Tuesday night. The oldest crypto currency loses eight percent in a 24-hour comparison and falls back to $ 60,500.

The second largest cryptocurrency Ethereum also loses more than eight percent. Here the price is currently around 4,300 dollars (as of 9:04 am). However, the sell-off can be observed on the entire crypto market, which according to data from the analysis company Coimarketcap is more than seven percent and now has a market capitalization of $2.67 trillion.

10. November 2021 – Highest Inflation in US for 30 years; Bitcoin marks new all-time high

US inflation continues to rise in October. According to the US Department of Labor, consumer prices in the world’s largest economy fell by 6.2 percent compared to the same month last year. This means that inflation in October is higher than previously assumed – experts had expected an increase to 5.8 percent. In September, prices had risen by 5.4 percent.

Bitcoin reacts to this development with a price increase and breaks through its previous record high of $ 68,520.34. This token set the oldest cryptocurrency first on November 9, 2021. According to the analysis house Coinmarketcap, the Bitcoin price rose at its peak 68,744.03 dollars. Bitcoin has never been so expensive.

Currently, the oldest cryptocurrency is trading at $68,199.11 (as of 3:39 p.m.). With another record high, Bitcoin continues the rally of the past few weeks. Since the low for the year in July, Bitcoin has risen by around 130 percent – the market value is almost 1.3 trillion dollars.

Ethereum’s upward trend also continues unabated. The second largest cryptocurrency also set a new all-time high at $4,851.98. The rally will be fueled again by the launch of a US exchange-traded fund (ETF) on the cryptocurrency Ethereum, said analyst Kyle Rodda from brokerage house IG. In addition, institutional investors have become increasingly interested in these products, while the authorities did not want to over-regulate this new asset class. The Ethereum course is also reacting with significant increases to the increased inflation in the USA.

8th. November 2021 – Bitcoin Breaks All-Time High

According to the analysis house Coinmarketcap, at noon the Bitcoin price rises to around 68,500 dollars and posted a new record high. Bitcoin has never been so expensive. In a 24-hour comparison, the oldest cryptocurrency recorded an increase of more than six percent. The previous all-time high was just under $64,900 located.

29. October 2021 – Cryptocurrency Ethereum at record high

In the slipstream of the recent Bitcoin price records, investors are also stocking up on Ethereum. The second most important cybercurrency rose 3.5 percent on Friday to a record high of $4,404.55. The price has thus increased almost sixfold since the beginning of the year. Bitcoin is only up a good 100 percent.

According to the analysis house Coinmarketcap, Bitcoin is currently trading at around $61,100. (as of 8:24 a.m.). In a 24-hour comparison, the oldest cryptocurrency recorded an increase of 3.66 percent.

19. October 2021 – Bitcoin Holds $62,000, Crypto ETF Ahead of Approval

According to the analysis house Coinmarketcap, the Bitcoin is currently trading at around 62,200 dollars (as of 2:35 p.m Clock) Thus, only almost four percent are missing to the all-time high of 64,800 dollars. The Bitcoin ETF from the provider ProShares will start under the ticker Bito this Tuesday, as confirmed by CEO Michael Sapir. The Bitcoin ETF is suitable for investors who trade stocks and ETFs but don’t want to deal with “opening an account with a crypto exchange or learning how to store their own cryptocurrencies,” Sapir said.

18. October 2021 – SEC Approves Crypto ETF

The US Securities and Exchange Commission has approved the Bitcoin ETF. Trading is scheduled to start the next day at the start of the US stock market. The Bitcoin price continues to hold above the $ 60,000 mark, only a few percent below the all-time high.

15. October 2021 – Bitcoin Breaks $60,000, Crypto ETFs Ahead of Approval

According to a report by the Bloomberg news agency, the US Securities and Exchange Commission could for the first time list Bitcoin ETFs in the USA allow. Commenting on the pending applications, SEC Chairman Gary Gensler raised hopes that up to four Bitcoin ETFs could start trading on Wall Street as early as October.

Investors reacted correspondingly positively. The cyber currency rose to just under $59,900 on Friday morning. Late in the evening (As of: 10:30 p.m.) the largest and oldest cyber currency on the Bitstamp trading platform broke the $60,000 mark for the first time since mid-April.

12. October 2021 – Bitcoin rally remains unabated

Earlier in the week, the major cybercurrency surged above $57,000 for the first time since May. On Tuesday afternoon (as of 3:15 p.m.) according to the Coinmarketcap trading platform, Bitcoin was quoted at $57,200. In a 24-hour comparison, the crypto currency is up around one percent.

Analysts are outdoing each other with growth fantasies. Based on chart patterns, record prices of $80,000 to $85,000 are possible, said Vijay Ayyar, head of Asia Pacific at cryptocurrency exchange Luno.

6. October 2021 – Bitcoin Breaks $55,000 and Continues Uptrend

The oldest cryptocurrency continues its uptrend, briefly breaking through $55,000 to a daily high of $55,172. This showed the psychologically important $50,000 mark, that Bitcoin broke yesterday as strong support. Bitcoin is now slowly heading towards the all-time high of $64,8895.22. Until then, however, it is still around 18 percent.

According to the analysis house Coinmarketcap, the Bitcoin price is currently quoted at 54,400 dollars (as of 15: 30 p.m.). This means that the price is up around nine percent in a 24-hour comparison. On a weekly basis, Bitcoin even recorded a price increase of almost 29 percent.

5. October 2021 – Bitcoin Breaks $50,000

Bitcoin is on the up again, breaking through the psychologically important $50,000 mark. The statements made by US Federal Reserve Chairman Jerome Powell last week also provided tailwind. Powell said the US wants to regulate cryptocurrencies, not ban them.

1. October 2021 – Shutdown in the USA Stay off

The impending shutdown in the USA was probably averted at the last minute. Also in the negotiations about the infrastructure package, about the originally on Should be voted on Thursday in the House of Representatives , it seems that an agreement is about to be reached. White House spokeswoman Jen Psaki said the deal was closer than ever. “But we’re not there yet, so we need a little more time to complete the work.” This will be continued on Friday.

The infrastructure package, which is intended to modernize roads, bridges and other transport and energy networks in the USA, passed the Senate in August after lengthy negotiations – with the support of Republicans. The final vote in the House of Representatives is still pending. In total, including previously budgeted funds, the package is worth more than $1 trillion. The infrastructure package is also said to be funded by taxing cryptocurrency transactions, thereby impacting Bitcoin and the crypto market as a whole. So this uncertainty could soon be cleared up.

The Bitcoin price recovered significantly after this news at noon and is around 11 percent up in a 24-hour comparison according to the analysis house Coinmarketcap at around $47,500. Bitcoin is now back above the 200-day line, which runs just above the $ 45,000 mark. The line draws the average price of the past 200 trading days and is currently being observed by long-term investors: If the Bitcoin price is above this line, this is a sign of an upward trend.

24. September 2021 – China calls crypto trading illegal – Bitcoin collapses

New bans in China unsettle investors in the cryptocurrency market. Bitcoin fell from around $45,000 to $40,936.56 in a matter of minutes. This means that the recovery of the last two days has come to an end for the time being. Also the second largest cryptocurrency Ethereum is currently at around 2,800 dollars and thus also clearly in the red. The Chinese central bank had previously declared all activities related to cyber foreign exchange illegal and banned foreign crypto exchanges from providing any services to customers in China. Violations of this prohibition would be severely punished.

22. September 2021 – Bitcoin price recovers slightly after the all-clear at Evergrande

The oldest cryptocurrency in the world is recovering after yesterday’s sell-off. The recovery is also due to positive news from Evergrande attributed. The group’s real estate unit said it had reached an agreement on part of its interest payments due this week.

21. September 2021 – Possible bankruptcy of Evergrande impacts the crypto world

Chinese real estate giant Evergrande may face bankruptcy. This is also noticeable in the Bitcoin course. According to data from the crypto platform Coinmarketcap, the Bitcoin price fell to around 40,500 US dollars on Tuesday night. This was followed by a slight recovery to $43,264. In a weekly comparison, however, Bitcoin is still 5.8 percent in the red. On a 24-hour perspective, the minus is 3.8 percent.

13. September 2021 – Litecoin will not be an accepted form of payment at Walmart

The rumor that the US company Walmart could accept the Litecoin cryptocurrency as a means of payment in the future, the prices of Litecoin and numerous other cryptocurrencies rose by more than thirty percent within a very short time. A press release had appeared on the internet for A caused a stir by announcing a partnership between the group and the Litecoin network. However, this turned out to be a hoax. As a Walmart spokesman said the statement about Litecoin was “inauthentic”, the price fell back to around $180.

Bitcoin was also down 3.8 percent in the afternoon in a 24-hour comparison. At the time of the news, the Bitcoin price had risen to over $46,000, but fell through after the denial Walmart but at $43,770.

8th. September 2021 – Bitcoin Plunges to $45,000

The crypto industry continues to suffer from the adoption of Bitcoin as legal tender in El Salvador. On the Coinmarketcap platform, Bitcoin is currently trading at $45,805, down more than 13 percent in a 24-hour comparison. At times, the course even crashed to $43,000 within a very short time. Bitcoin thus remains below the important $50,000 mark. Ethereum even loses almost 15 percent compared to the previous day and stands at 3331 dollars.

7. September 2021 – El Salvador adopts Bitcoin as national currency and falls below $50,000

As of today, Bitcoin is the official means of payment in El Salvador for the 6.5 million inhabitants. This makes the Central American country the first in the world to officially make cryptocurrency legal tender. The corresponding law was only passed around three months ago. From now on, El Salvadorians can not only pay for their purchases with Bitcoin, but also their taxes. The government under President Nayib Bukele had around 200 ATMs set up for this purpose. US dollars, El Salvador’s national currency, can be exchanged for Bitcoin at these machines – a historic day for the world’s oldest cryptocurrency.

Bitcoin price has seen significant gains over the past few days, confirming the current uptrend. At times, the price even broke out well above the $52,000 mark – but then bounced off at $52,800 and recently fell well below the $50,000 mark again.

23. August 2021 – Bitcoin breaks the $50,000 mark for the first time since May

Bitcoin breaks the $50,000 mark for the first time since May. Most recently, a bitcoin on the Bitstamp trading platform cost $50,299, a good two percent more than the day before. Since the interim low in mid-July, Bitcoin has increased by around 75 percent.

The decision of the US trading platform Coinbase to increase its own holdings of cryptocurrencies had provided additional momentum and pushed the Bitcoin above the psychologically important mark.

19. August 2021 – Hackers steal five million bitcoins from Japanese crypto exchange Liquid

According to information from blockchain analysis company Elliptic, more than 94 million dollars were stolen in a hacker attack on the Japanese crypto exchange Liquid.

Accordingly, the hacker obtained more than $94 million in digital coins – including around $31 million in Ethereum, $5 million in Bitcoin and $13 million in XRP. Bitcoin price drops to $44,400.

11. August – Bitcoin price increases by around 57 percent within three weeks

After Bitcoin bounced off the $29,000 mark again on July 21, 2021, the oldest cryptocurrency has recovered significantly. According to data from the analysis company Coinmarketcap, Bitcoin rose to around $46,000 within three weeks – an increase of almost 57 percent within 21 days. In a 24-hour comparison, Bitcoin is currently showing a positive trend with an increase of around 1.5 percent.

The recovery of the Bitcoin has a positive effect on the entire crypto market. Ethereum, the second largest cryptocurrency after Bitcoin, has also seen significant gains since July 21 and is currently trading above the $3,200 mark.

21. July 2021 – Bitcoin back above $30,000

The Bitcoin price is again just above the psychologically important $ 30,000 mark. According to Coinmarketcap, the price is around $30,900 and is therefore almost four percent up in a 24-hour comparison.

Bitcoin has bounced off the $ 29,000 mark again for the time being – however, it remains to be seen whether the Bitcoin price can now remain above $ 30,000 in the long term. The situation on the crypto markets therefore remains tense.

20. July 2021 – Bitcoin falls below $30,000 again

Bitcoin price falls below $30,000 mark again. This had served as a strong support until the very end. The digital currency was trading at $29,731 as of Tuesday morning and thus almost 2000 dollars lower in a 24-hour comparison.

The Bitcoin price last fell below $30,000 a month ago on June 22, 2021 – at that time the price slide was used as a purchase opportunity or as an entry into the crypto world. If the price does not sustainably break through $30,000 again, there could be a risk of a crash until the next strong resistance at $20,000.

17. July 2021 – Grayscale makes parts of its Bitcoin fund tradable

Grayscale is one of the billionaire investors – the so-called crypto whales – who dominate the comparatively young crypto market with their investments. Grayscale is one of the world’s largest digital asset managers and currently holds around 650,000 Bitcoin. This corresponds to a value of the equivalent of $20.2 billion – which corresponds to around 3.5 percent of the entire Bitcoin market.

The so-called Bitcoin Unlocking gets a lot of attention at Grayscale. In total, the asset manager released shares worth 40,000 Bitcoin, 16,000 of which should be this weekend alone.

Grayscale manages a so-called Bitcoin Trust (GBTC). Bitcoin Trust is a fund that allows investors to easily invest in Bitcoin. These are traded like other fund shares.

6. July 2021 – Hacker group REvil demands $70 million ransom in Bitcoin

The hackers, who attacked hundreds of companies with blackmail software, are demanding 70 million euros in ransom in the form of the digital currency Bitcoin for a master key to the affected computers. The hacker group claims their software has infected more than a million computers.

The hacker group REivel used a vulnerability in the US IT service provider Kaseya and attacked its customers using a program that encrypts data and demands a ransom. The extent of the damage caused by the cyber attack is still difficult to estimate. Kaseya reported that fewer than 40 customers were affected.

In Germany, according to the Federal Office for Information Security (BSI), an IT service provider and several of its customers were affected. According to a spokesman, there are several thousand computers at several companies. According to the government’s knowledge, federal authorities and critical infrastructure facilities “of a size that requires reporting” are not affected, said a spokeswoman for the Federal Ministry of the Interior.

5. July 2021 – Brokerage House TP Icap plans crypto trading platform

The British brokerage house TP Icap, in cooperation with Fidelity and Standard Chartered will launch a cryptocurrency trading platform in the second half of the year due to increased investor interest. Interest in cryptocurrencies has “exploded” in recent months, said ICAP’s co-head of digital assets, Duncan Trenholme.

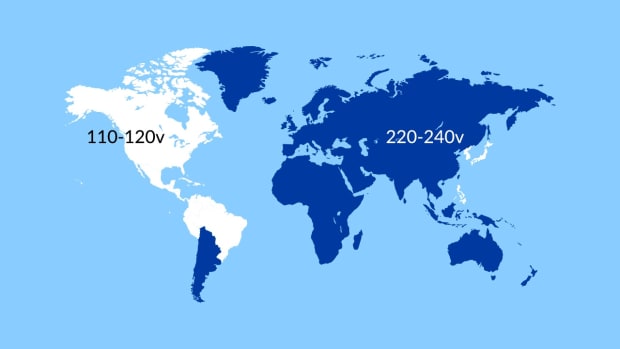

Politicians are concerned about the recent bitcoin boom. A global overview makes it clear: Some states want cryptocurrencies to become “Bitcoin-No-Go-Areas” and ban Bitcoin and Co. For the industry, this development means that relocations around the world are becoming more likely. At the same time, the goals are rare, because only a few countries want to distinguish themselves as the crypto location of the future.

2. July 2021 – Hackers demand ransom for master keys; Bitcoin falls below $33,000

The hacker group REivel attacks hundreds of companies with ransomware. The hackers demand a ransom of 70 million US dollars in the digital currency Bitcoin for a master key to all affected computers. The group claim their software has infected more than a million computers. Should that be the case, this would be the largest ransom attack to date, emphasized Mikko Hyppönen from the IT security company F-Secure.

The Bitcoin price then loses and is subsequently quoted just below the 33,000 US dollar mark. The situation on the crypto market remains tense, the price could fall below $ 30,000 again and thus break the mark. The next resistance would then only be at the $20,000 mark, so that a further fall in the Cryptocurrency could threaten.

The last time the bitcoin price fell below $30,000 was on June 22nd. However, investors use this as an entry or post-purchase option. As a result, Bitcoin rose again up to $35,000.

1. July 2021 – Bitcoin is at $33,000

Bitcoin is trading just above the $33,000 mark according to Coinmarketcap. The price recently fell below $30,000. Analysts then expected another sell-off, as there were many stop-loss orders below this psychologically important level, which would further drive the price down.

However, investors used the price slide as an opportunity to buy more or as an entry into the crypto world. The Bitcoin price then rocketed back to over 35,000 US dollars.

22. June 2021 – Bitcoin slipped below $30,000

Bitcoin fell below the important $30,000 mark on Tuesday. Most recently, according to data from the analysis company Coinmarketcap, the cryptocurrency was down a good nine percent at around $29,800.

For Bitcoin, the $30,000 mark is not just psychologically important. There are many stop-loss levels at this level, a dip below this level could now accelerate the downtrend.

20. June 2021 – Bitcoin price falls below $31,000

China is tightening its course against Bitcoin & Co. Domestic banks and the fintech company Ant Group have been asked to stop offering crypto trading services, which amounts to a ban.

The price of Bitcoin and other cryptocurrencies reacted to this news with significant price losses. Bitcoin price slipped six percent below the $31,000 mark.

At the beginning of the week, Bitcoin had cost more than $40,000. This shows once again how fast-paced the Bitcoin course is. The digital currency has been hovering between $30,000 and $40,000 since mid-May 2021, after rising to almost $65,000 – the current record high – in April.

But despite the recent correction, bitcoin is still well above the level of mid-2020, when bitcoin was trading at around $10,000.

14. June 2021 – Tesla apparently wants to allow Bitcoin as a means of payment again

Tesla will accept Bitcoin as a means of payment again under certain conditions. That gave Tesla CEO Elon Musk in a tweet on June 13, 2021. Bitcoin transactions should be at Tesla will therefore be allowed again – but only if 50 percent of renewable energies are used to produce bitcoins and there is a positive trend in this regard. The Bitcoin price then rose by around 12 percent to $39,535 – but bounced off the $40,000 mark.

More on the subject: Like Elon Musk influenced Bitcoin and Co.

Note: This article have been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here