[wptb id=”129534″ not found ] [wptb id=”129535″ not found ]

Blue Guardian Review

Proprietary trading firms, or prop trading firms, trade financial markets with their capital. These firms offer traders the resources, technology, and funding to execute trades. Blue Guardian is one such prop trading firm. It aims to cultivate trading talent by providing funded accounts and resources for growth.

This article serves as a Blue Guardian review, presenting insights gathered from trading experts at Dumb Little Man and actual customer reviews. Readers will find an objective evaluation that covers pros and cons, security features, bonuses, and more. This information will help traders decide whether Blue Guardian is the right choice for their trading career.

What is Blue Guardian?

Blue Guardian is a forex proprietary firm with a distinct two-step evaluation funding process. Traders must pass this process to prove their trading skills and become funded traders. The aim is to identify individuals with the discipline and experience needed for successful trading.

The first hurdle in the evaluation is Phase 1. This phase spans a 40-day trading period. Traders must meet specific trading objectives to demonstrate their abilities and discipline. This phase is essential for progressing to the following evaluation step.

Phase 2 is the concluding part of the evaluation and lasts 80 days. Successful completion and verified results turn traders into funded traders at Blue Guardian. Once traders reach this level, they enter the Guardian Trader stage.

As a Guardian Trader, you can earn up to 85% of your trading profits. Consistency and responsible trading are crucial for maintaining this status. Additionally, traders may become eligible for an increased account balance through Blue Guardian’s scaling plan if they remain profitable over multiple months.

Blue Guardian Pros and Cons

Pros:

- Generous 85% Profit Share

- Flexible Trading Hours

- Variable Account Options

- Wide Instrument Selection

- Strong Risk Tools

- Regular Bi-Weekly Payments

Cons:

- Low Crypto Leverage

- Costly Elite Accounts

- Lack of Phone Support

Safety and Security of Blue Guardian

Blue Guardian is officially registered in the UK and adheres to regional financial laws. Unlike some other trading platforms, it doesn’t require international regulation. It employs a regulated broker, Eightcap, to bring transactions to the interbank markets.

According to thorough research by Dumb Little Man, you can find all relevant regulation documents for the broker on its official website. This assures traders that their transactions are fairly executed in the interbank market.

For queries or issues, traders can contact Blue Guardian’s technical support. You can also seek legal advice directly from the broker’s lawyers. However, it’s worth noting that external help from regional financial institutions is only available if the trader resides in Great Britain.

Blue Guardian Bonuses and Contests

Blue Guardian is currently running a special promotion for new traders. By using the code DUMBLITTLEMAN during sign-up, newcomers can get a 30% discount. This offer aims to attract new talent and give them a financial advantage as they start their trading journey.

[wptb id=”129536″ not found ]

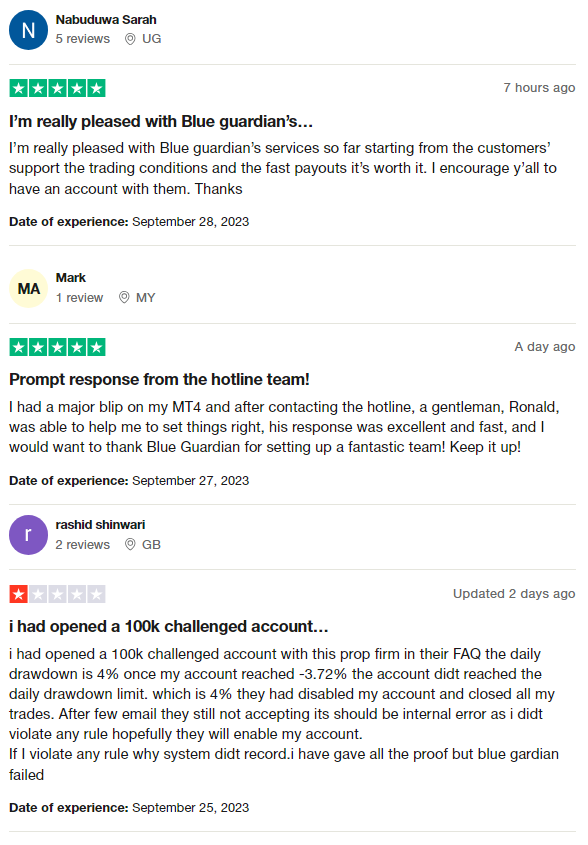

Blue Guardian Customer Reviews

Customer feedback on Blue Guardian shows a mix of experiences. However, it currently holds a 4.8 Star rating on Trustpilot, which is a strong rating contrary to being labeled as poor. Some users commend the customer support and quick payouts, praising the team for their responsiveness and effectiveness.

However, there are also concerns about account management, particularly regarding drawdown limits and trade closures. Overall, the reviews suggest that while many find value in Blue Guardian’s services, others encounter challenges that could affect their trading experience.

Blue Guardian Commissions and Fees

Blue Guardian‘s fee structure is considered standard, with experts often labeling the trading conditions as favorable. Initial fees are determined by the account balance chosen by the trader. These initial fees are refundable upon successfully passing the firm’s trading challenge.

The profit split at the firm is set at 15%, meaning the trader keeps 85% of the profits. Additionally, a universal fee of $3.50 is applied to trades. While similar fees are standard in the industry, not all firms disclose them. Blue Guardian stands out for its 100% transparency.

The firm works with the broker Eightcap to execute trades. It’s important to note that spreads and trading fees depend on this broker. However, traders partnered with Blue Guardian enjoy tighter spreads and lower fees than those who trade directly with the broker.

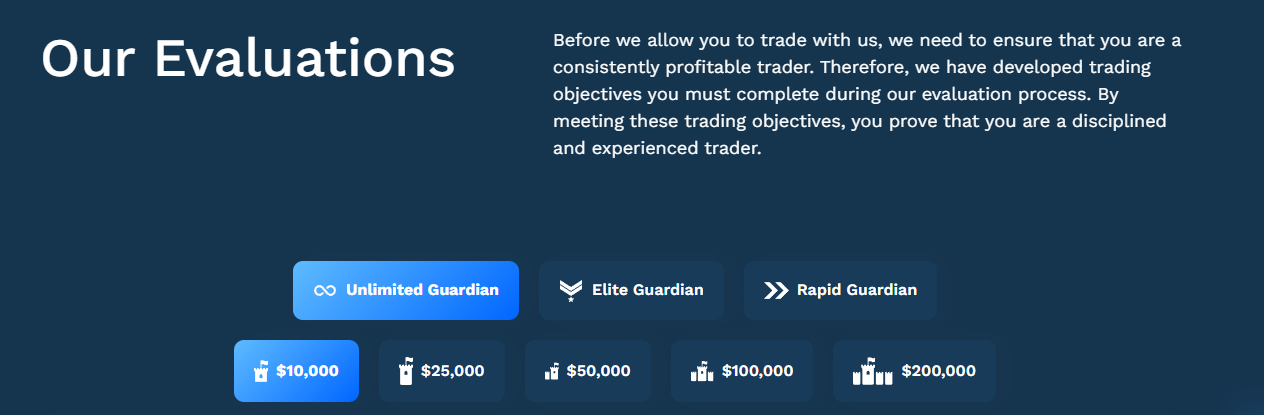

Blue Guardian Account Types

After thorough research by the team of experts at Dumb Little Man, the following types of funded account are available at Blue Guardian:

Unlimited Guardian

- Funding: $10,000 to $200,000

- Time Limit: Unlimited

- Minimum Trading Days: 0

- Profit Target: 8% for phase 1, 4% for phase 2

- Profit Split: 85%

- Maximum Daily Loss: 4%

- Fee: $87 to $947, depends on the funding

Elite Guardian

- Funding: $10,000 to $200,000

- Time Limit: Unlimited

- Minimum Trading Days: 5

- Profit Target: 8% for phase 1, 4% for phase 2

- Profit Split: 85%

- Maximum Daily Loss: 4%

- Fee: $120 to $1,020, depending on the funding

Rapid Guardian

- Funding: $10,000 to $200,000

- Time Limit: Unlimited

- Minimum Trading Days: 0

- Profit Target: 10% for phase 1

- Profit Split: 85%

- Maximum Daily Loss: 4%

- Fee: $97 to $947, depending on the funding

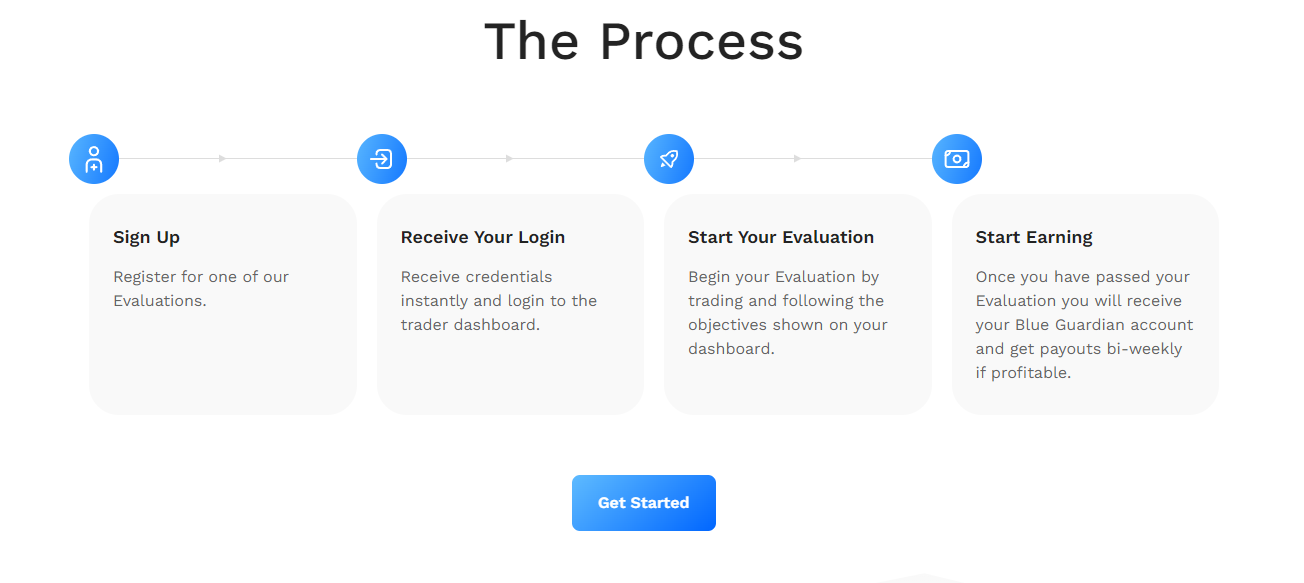

Opening a Blue Guardian Account

- Visit the Blue Guardianwebsite and click the “Get Started” button.

- Review the balance options and trading conditions available.

- Select a balance that fits your trading needs.

- Choose your Challenge Type, Account Balance, and Trading Platform.

- Enter the required details and click “Confirm and Proceed to Payment.”

- Choose your payment method, either Credit Card (Stripe) or cryptocurrencies.

- Click “Place Order” to finalize your payment choice.

- Fill in the required payment details and click “Pay for Order.”

- Once Blue Guardian receives payment, you’ll gain access to your user account.

[wptb id=”129537″ not found ]

Blue Guardian Customer Support

Based on the experience of Dumb Little Man, customer support is a crucial aspect of any prop trading firm. Traders often need technical help for issues they can’t resolve themselves. Despite a user-friendly website and comprehensive FAQs, traders often have unique queries.

Blue Guardian understands this need and offers 24/7 technical support. Multiple communication channels are available for assistance, including email, live chat, and a ticketing system. This round-the-clock support addresses any concerns traders may have, ensuring a smooth trading experience.

Advantages and Disadvantages of Blue Guardian Customer Support

[wptb id=”129538″ not found ]

Blue Guardian Withdrawal Options

Based on tests conducted by a trading professional at Dumb Little Man, Blue Guardian offers straightforward withdrawal options, unlike other prop firms. During the challenge phase, traders use demo accounts and thus don’t generate earnings. However, they are given live accounts once traders move to the funding stage. Their transactions then become part of the interbank market.

On the 15th trading day, traders can submit withdrawal requests. Interestingly, Blue Guardian imposes no minimum or maximum withdrawal limits. Traders can opt for withdrawal methods like bank cards, e-wallets, or crypto wallets.

The withdrawal process is quick, with applications typically considered within a few hours. However, it’s important to note that subsequent withdrawal requests can be made only 14 days after the previous one. All such requests and their status are displayed in a dedicated section within the user account.

Blue Guardian Challenge Difficulties

High Leverage Risks

Blue Guardian offers up to 1:100 leverage, which can be risky. While high leverage can amplify profits, it also increases the potential for substantial losses. Traders might be tempted to take bigger positions, exposing their accounts to more risk.

Drawdown Limits

The firm imposes a 10% maximum drawdown limit, which can be limiting for traders. In a volatile market, just one poor trade can push the account close to this limit. This cap could be a major constraint for those who employ high-risk strategies aiming for big returns.

Limited Trading Instruments

Blue Guardian offers a range of trading instruments, but the selection may not cover all traders’ preferences. While multiple options are available, some traders may find that specific assets they wish to trade are not included. This limitation could affect traders who specialize in less common markets.

[wptb id=”129539″ not found ]

How to Pass Blue Guardian’s Evaluation Process

Passing Blue Guardian’s Evaluation Process is no small feat. To succeed, traders often find that enrolling in a specialized training program can make all the difference. Achieving the trading objectives laid out by Blue Guardian requires discipline, experience, and tactical skills, all of which can be honed through quality education.

Asia Forex Mentor – Rated Best Comprehensive Course Offering by Investopedia

If you are serious about becoming a funded trader, Asia Forex Mentor comes highly recommended by experts at Dumb Little Man. Founded by Ezekiel Chew, a seasoned forex trader with over 20 years of experience, this platform has helped thousands to succeed in prop firm assessments.

Known for racking up six-figure profits per trade, Ezekiel developed Asia Forex Mentor’s One Core Program to train individuals in effective forex trading. The program has roots in Ezekiel’s journey, which started with teaching friends and eventually grew into a comprehensive online course.

With Asia Forex Mentor, you equip yourself with the essential skills to meet and exceed Blue Guardian’s evaluation criteria.

How Could Asia Forex Mentor Help You Pass Blue Guardian’s Challenge?

Asia Forex Mentor is a prime choice for preparing for Blue Guardian’s evaluation. Its credibility is well-established, backed by many awards and positive reviews from trusted financial websites.

- Best Comprehensive Course Offering Award: Investopedia, a leading name in financial content, recognized Asia Forex Mentor’s One Core Program as the most comprehensive course available. This endorsement speaks volumes about the program’s thoroughness and effectiveness.

- Best Forex Trading Course: Benzinga, another reliable source for financial news, named Asia Forex Mentor the best forex trading course for beginners. This course is designed to meet the needs of traders at all levels, from beginner to advanced.

- Best Forex Mentor: Asia Forex Mentor earned the title of Best Forex Mentor in 2021 from the BestOnlineForexBroker website. The accolade confirms that the course can help traders achieve substantial gains in the forex market.

- Excellent Trading System: Besides multiple awards, the trading strategies taught in the Asia Forex Mentor course have received praise from top forex traders and platforms. This attests to its practical utility and effectiveness.

Asia Forex Mentor’s One Core Program offers a well-rounded education, making it an ideal tool to help you pass Blue Guardian’s Challenge. Whether you’re a beginner or an experienced trader, this course is tailored to exceed your expectations and meet your trading objectives.

Asia Forex Mentor Members’ Testimonials

Members of Asia Forex Mentor commonly express gratitude for the comprehensive and impactful education they receive from Ezekiel Chew’s One Core Program. Users highlight the program’s well-structured content and easy-to-follow examples, stating that it builds their confidence and provides in-depth knowledge for trading.

The course is also valuable, blending both affordability and high quality. These testimonials affirm the program’s effectiveness, especially for those looking to pass prop firm evaluations.

>> Also Read: Asia Forex Mentor Review By Dumb Little Man

Conclusion: Blue Guardian Review

Based on the in-depth research conducted by the trading experts at Dumb Little Man, Blue Guardian emerges as a reputable prop trading firm. Its strong customer support and transparent fee structure are standout features that cater to traders’ needs. However, potential clients should be mindful of the firm’s stringent daily loss and drawdown limits, which may only be suitable for some.

To increase your chances of successfully navigating Blue Guardian’s evaluation process, consider enrolling in top-tier courses like Asia Forex Mentor. Its proven track record can equip you with the skills and strategies you need to excel.

>> Also Read: Traders With Edge Review By Dumb Little Man

Blue Guardian Review FAQs

What Are the Account Types at Blue Guardian?

Blue Guardian provides Unlimited Guardian, Elite Guardian, and Rapid Guardian programs with varying funding options, fees, and profit targets.

What Are Blue Guardian’s Withdrawal Options?

Traders can withdraw profits to bank cards, e-wallets, or crypto wallets with no minimum or maximum limits.

How Can I Pass Blue Guardian’s Evaluation Process?

Consider enrolling in a reputable training program like Asia Forex Mentor to improve your trading skills and increase your chance of passing the evaluation.

[wptb id=”129540″ not found ]

Note: This article have been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here