- Cardano sharks and whales have continued to buy the token despite the fall in its price.

- Traders continue to sell heavily in intraday trading sessions.

Following significant coin distribution between February 2021 and May 2022, Cardano [ADA] investors that hold over 100,000 ADA coins have again begun accumulating the crypto asset.

According to Santiment, these investors have continued to “fill their bags” with ADA despite the steady decline in the altcoin’s value. The coin shaved off 35% of its market capitalization in the last four months. At press time, this was $10.16 billion, making it the eighth-largest crypto asset in terms of market capitalization.

🐳 Trader sentiment toward #Cardano continues to be low as its market cap is down 35% since topping 4 months ago. However, the sharks & whales haven’t been as deterred as one may think. There are now 25,294 wallets with 100K+ $ADA, the most in 16 months. https://t.co/Q5XKveRh5n pic.twitter.com/D0dcfM6LAy

— Santiment (@santimentfeed) August 14, 2023

Since this cohort of ADA investors began accumulating the coin, its value has dropped by 69%. As of May 2022, ADA traded above $0.7. At press time, it exchanged hands for under $0.3.

ADA is on a loss-making streak

On-chain assessment of how profitable ADA has been as a digital asset in the last year revealed that the majority of holders have failed to turn profits since April 2022. According to Santiment, the coin’s Market Value to Realized Value (MVRV) ratio turned negative on 7 April that year and remained below the center line.

This metric tracks the ratio between an asset’s current price and the average price of its every coin/token acquired. A high MVRV ratio indicates that the asset is overvalued, while a low MVRV ratio indicates that it is undervalued.

At -51.36% at press time, it meant that if all holders sold ADA at its current value, more than half of them would realize losses.

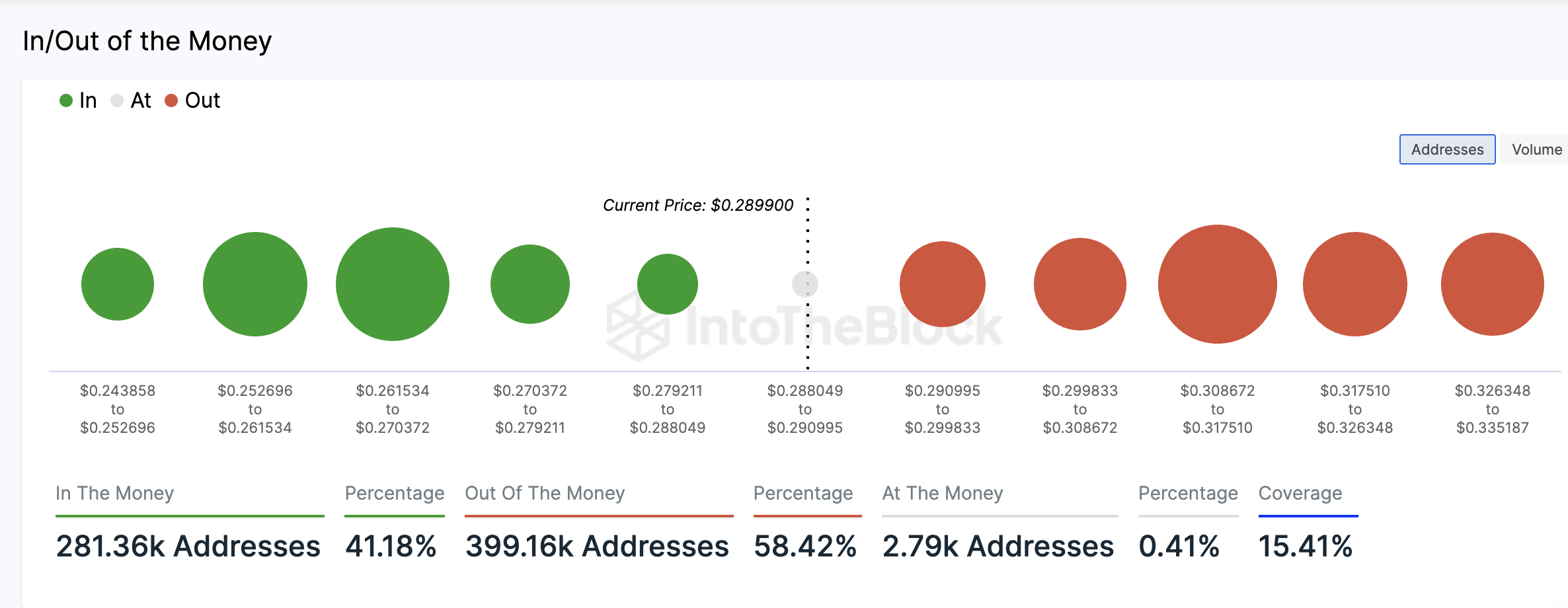

Further, data from IntoTheBlock revealed that 3.94 million addresses that hold ADA are “out of money.” This means they currently hold the altcoin at a loss. This figure represents 89% of all coin holders, as only 10.26% of all addresses holding ADA are at a profit.

No rally in sight

With its price declining further, daily traders have continued to distribute ADA. Its Relative Strength Index (RSI) was 42.99 at press time, while its Money Flow Index (MFI) was 23.67, almost oversold.

Both key indicators resting beneath their center lines since the month started showed a momentum shift from buy-side to sell-side.

The bears controlled the ADA market at press time with the positive directional index (green) beneath the negative directional index (red).

Note: This article have been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here