CDL set a record with its bid for the Tanjong Katong site

Sites for luxury housing development continued to find favour with developers in Singapore’s first land sale of the year, despite new market restrictions put in place just one month ago, with local development giant CDL besting seven other bidders for a site on the city’s lower east coast with a record offer of S$768 million ($569 million), the Urban Redevelopment Authority announced late Monday.

CDL’s hard fought contest for the upscale site at the intersection of Tanjong Katong Road and Jalan Tembusu, stands in contrast to the four bidders who showed up for the tender of a mass market site also offered by the government yesterday, with a consortium bid by CDL’s sister firm Hong Leong Holdings, together with Singapore-listed GuocoLand and its TID Residential joint venture placing the top bid for that plot on Lentor Hills Road in Ang Mo Kio.

The strong reception for the 19,567.4 square metre (210,617 square foot) east coast site shows that developer appetites for sites in high value locations along the coast or other prime areas remains robust despite new challenges posed by cooling measures imposed in December, according to analysts.

These property curbs, however, are already dampening enthusiasm in the mass market after the Hong Leong/GuocoLand consortium offered just S$586.59 million for the site near Lentor MRT.

CDL Returns to the Lower East Coast

Should CDL be named the winner of the site in District 15, it would be set to develop up to 54,789 square metres of homes on the plot located halfway between its Amber Park and Butterworth 33 projects in the same area.

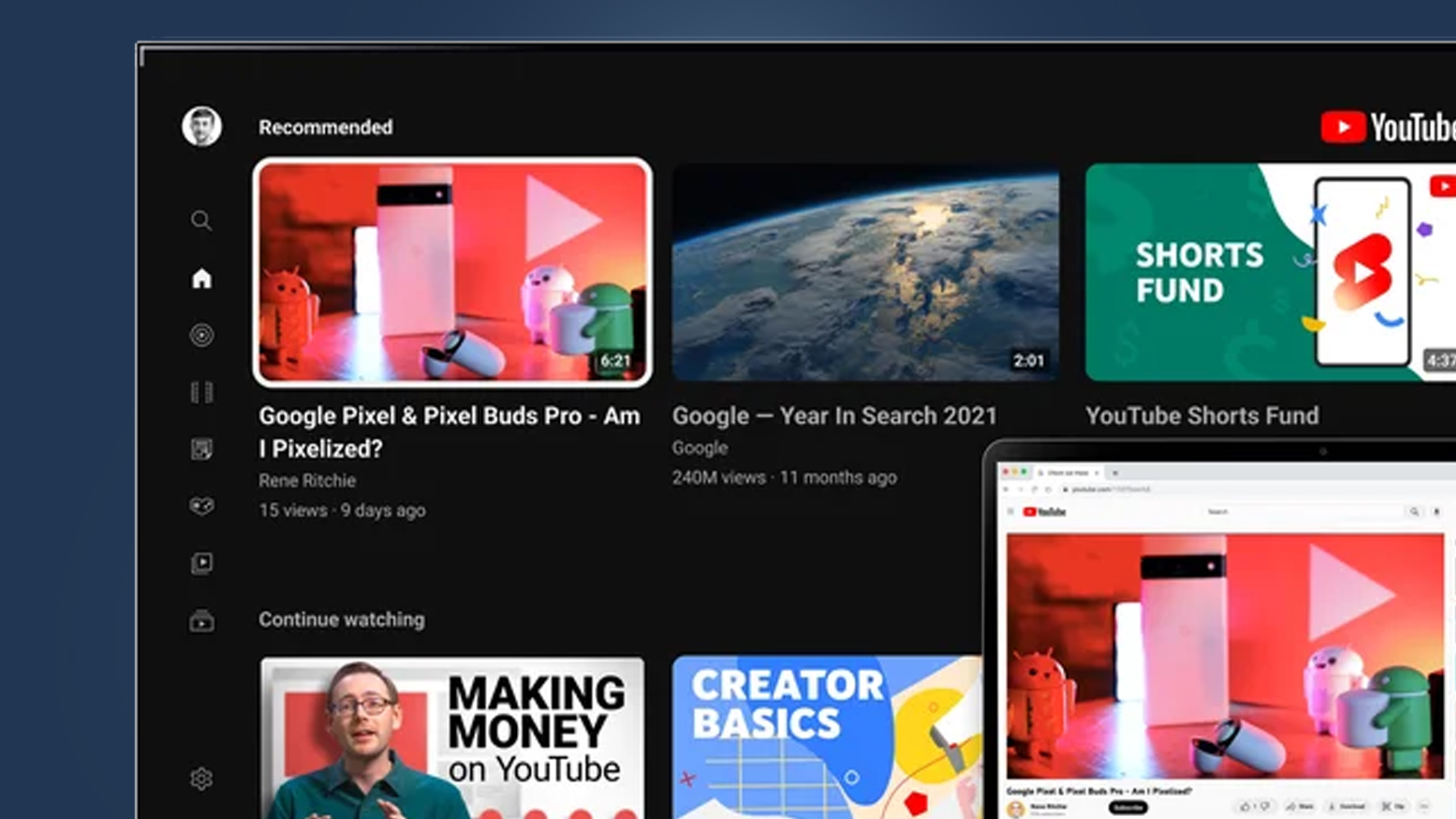

CDL chief executive Sherman Kwek may be hoping to repeat the Amber Park experience

At the premium offered, Singapore’s largest non-government controlled developer would be paying the equivalent of S$1,302.26 per square foot of completed space with CDL saying it will build four residential towers of 20 to 21 storeys on the site, which will add 640 units to its fast-selling east coast pipeline.

“Our residential projects have sold well over the past few years and the acquisition of the sizeable Jalan Tembusu government land sale site will bolster CDL’s development inventory by over 600 units,” said Sherman Kwek, CDL group chief executive officer, in a statement late Monday.

The 99-year leasehold site is less than 10 minutes’ walk from the upcoming Tanjong Katong MRT station along Thomson-East Coast line, while it takes less than 20 minutes to drive from the location to the city’s central business district or Changi Airport via expressways.

Kwek, whose company has sold 90 percent of the units in its Amber Park project a few blocks away since launching sales in May 2019, sounded sanguine regarding market restrictions introduced last month by the government, which included hikes in stamp duty and tighter lending conditions, in a bid to cool a property market where home prices rose 9 percent in 2021.

“While there will be some headwinds on the back of the property cooling measures, we believe that the market remains well-supported by resilient fundamentals such as an improving job market and strong household balance sheets.”

PropNex Realty research and content head Wong Siew Ying said CDL’s bid now stands as the highest offer ever for a government land sale in Singapore’s city fringe, beating the S$1,129 per square foot of plot ratio which CDL and its partner, Hongkong Land affiliate MCL Land, paid for a site on Northumberland Road in May 2021.

Wong noted that the top four bids for the Tanjong Katong site were all above the previous record high in the region, signalling developer enthusiasm for the location, while substantially lower offers from the lower four bidders showed that some players were exercising caution following the introduction of the property market restrictions last month.

Based on the price offered for the land, analysts are projecting prices for condo units at the Tanjong Katong site will range from S$2,100 to S$2,700 per square foot.

Kwek Dynasty Dominates

Beyond showing the enduring appeal of Singapore’s prime locations, the city-state’s first land sale of 2021 also illustrated the ongoing prominence of one of Southeast Asia’s most powerful commercial clans.

Malaysian tycoon Quek Leng Chan joins his cousin in URA’s first round of land sale

With Hong Leong and GuocoLand teaming up for the Lentor Hills Road (Parcel A) site, companies controlled by Singapore’s Kwek family, which is ranked as the 13th richest clan in Asia, and controls both CDL and Hong Leong (Singapore), joined their cousins from the Quek family in Malaysia, who control Guocoland along with Kuala Lumpur-based Hong Leong Group which participated in the bid through its TID Residential joint venture with Japan’s Mitsui Fudosan.

The Kwek/Quek led consortium is now first in line for a 12,137 square metre, 99-year leasehold site, which will entitle them to build up to 51,411 square metres of new housing. The lowest bid for the project came in at S$501 million, with the Hong Leong consortium offering the equivalent of S$1,060 per square foot of built space for the property.

“We plan to build a 600-unit residential development where residents will benefit from the convenience of amenities nearby,” a spokesperson from Hong Leong Holdings said. “With Lentor MRT station located just across the road, we believe this will also add to the site’s overall appeal to buyers.”

Tenders for Lentor Hills Road (Parcel A) came in lower than expected

Market players had been anticipating fewer participants in this auction given the heightened risk for developers following the introduction of last month’s cooling measures, with the project also overshadowed by a large pipeline new homes in the area, said Leonard Tay, Head, head of research at Knight Frank Singapore.

By teaming up, he said developers are spreading the risks that come with suburban condominium developments as construction costs remain high after many workers left town during the pandemic.

With the tender come just six months after Guocoland paid S$784 million to win the nearby Lentor Central residential site, analysts speculated that the pipeline of homes from that 651,001 square foot project near Nanyang Polytechnic could have dampened developer enthusiasm for another site in the same area.

The top bid for the Lentor Hills Road site came in 12 percent below the S$1,204 per square foot which GuocoLand paid for the Lentor Central site last year, showing that builders are becoming more “cautious” with their purchases in the area and that moderate prices can be expected moving forward, said Lam Chern Woon, research and consulting head at Edmund Tie.

New homes in the Lentor Hills project are expected to be priced around S$1,750 to S$2,200 per square foot, according to analysts.

Note: This article have been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here