The USDF Consortium hopes to release a compliant, cash-redeemable stablecoin in the U.S.

Key Takeaways

- A group of U.S. banks has formed the USDF Consortium, which has the goal of creating a bank-backed stablecoin.

- The Consortium says it wants to offer a “more secure” stablecoin option for consumers in the U.S.

- The coin will be built on the Provenance Blockchain, developed by fintech firm Figure Technologies.

A group of five U.S. banks in the U.S. has launched the USDF Consortium with the goal of bringing a bank-minted stablecoin to the U.S.

U.S. Banks Launch Stablecoin Consortium

Centralized stablecoins like USDC and USDT might soon have more competition.

An association of five FDIC-insured U.S. financial institutions has launched the “USDF Consortium” with the goal of establishing a network of banks and creating an interoperable stablecoin called the USDF. The founding members of the association include the New York Community Bank, NBH Bank, FirstBank, Sterling National Bank, and Synovus Bank.

In a press release, the association said that launching the USDF would facilitate the “compliant transfer” of value via blockchain technology, remove “friction in the financial system,” and allow for more people to enjoy the financial opportunities blockchain technology offers.

“USDF opens up endless possibilities for the expanding world of DeFi transactions,” Figure CEO Mike Cagney said. “The ease and immediacy of using USDF for on-chain transactions was demonstrated this fall when NYCB minted USDF used to settle securities trades executed on Figure’s alternative trading systems. We are tremendously excited that NYCB expects to be minting USDF on demand and on a regular basis in the coming weeks.”

The USDF stablecoin will be minted by member banks and redeemable for cash from any bank in the Consortium. It’s set to run on the Provenance Blockchain, which was built by the fintech firm Figure Technologies, whose investors include Digital Currency Group.

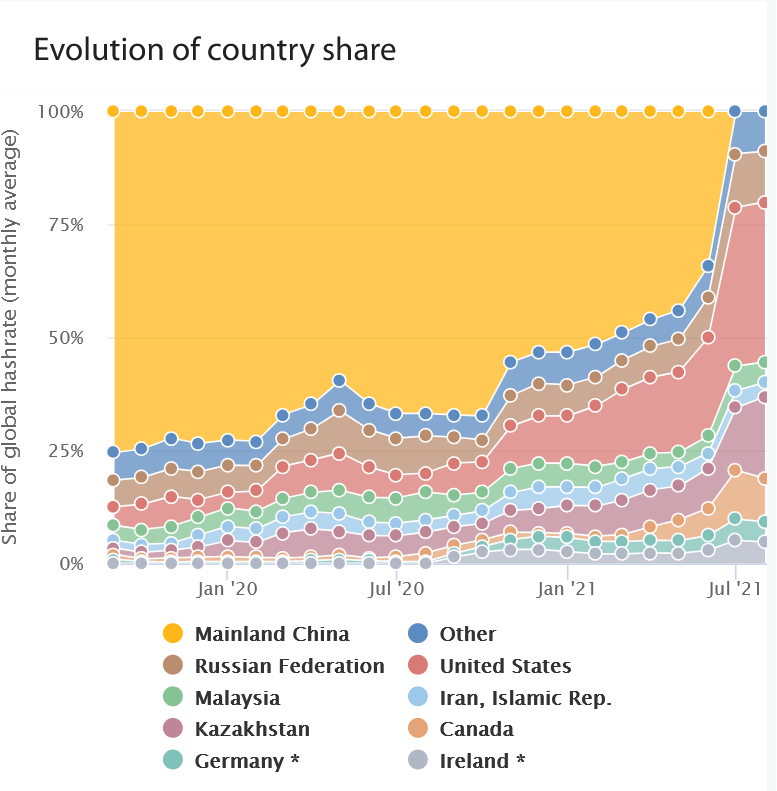

Regulatory compliance appears to be a major point of focus for the Consortium. The press release states that USDF “addresses the consumer protection and regulatory concerns” associated with decentralized stablecoins and “offers a more secure option” for using blockchains. Stablecoins have been a major concern for regulators in the U.S. and worldwide in recent months; multiple members of the Senate, Treasury Secretary Janet Yellen, Federal Reserve Chair Jerome Powell, SEC Chair Gary Gensler, and others have warned against the risks of stablecoins as the DeFi space has grown.

Disclosure: At the time of writing, the author of this piece owned BTC, ETH, and several other cryptocurrencies.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

U.S. Senator Slams Stablecoins

The U.S. Senate Committee on Banking, Housing, and Urban Affairs held a hearing this morning on stablecoin regulation. Senator Sherrod Brown, who chairs the committee, was particularly wary of the technology….

Audience Survey: Win A $360 Subscription To Pro BTC Trader

We’re doing this because we want to be better at picking advertisers for Cryptobriefing.com and explaining to them, “Who are our visitors? What do they care about?” Answer our questions…

Fed Chair Promises CBDC Report “Within Weeks”

In Federal Reserve Chair Jerome Powell’s renomination hearing before the Senate Banking Committee Hearing today, Powell said that a Fed report on central bank digital currencies was expected in the…

Kevin O’Leary Discusses Crypto’s Path to Institutional Ado…

Crypto Briefing sits down with Kevin O’Leary to discuss crypto as software, DeFi, NFTs, and institutional adoption of the asset class. How O’Leary Sees Crypto as Software Kevin O’Leary is…

Note: This article have been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here