Analysts from Bloomberg Economics describe an ideal baseline scenario in which the US and world economies will have a solid recovery. They base their economic expectations for 2022 on optimistic forecasts with latent risks.

It is expected that there will be a progressive decrease in the escalation of prices and that at the end of monetary policies adopted during the pandemic, the global economy emerges stronger with the lessons learned from the crisis.

But the risks that the so-called black swans appear at any time of the year are not ruled out. There are a number of elements of a health, economic and political nature that can put a damper on the recovery.

The virulence of the omicron variant of the covid-19 coronavirus, the high levels of inflation in the United States, the change of monetary policy of the Fed, the impact of the fall of Evergrande in China and the tension produced by the tensions between Russia, the US and Europe could change everything.

Below we present six possible economic scenarios to take into account to invest in 2022.

one. Increasing inflation

It is very important not to neglect this economic variable that is worrying the largest economies in the world. But also to the governments of emerging countries. Its economic growth and performance will depend on the behavior of the inflation indexes.

The beginning of an inflationary spiral that is being observed currently in many industrialized countries it is a direct consequence of the financial stimuli granted during the coronavirus pandemic in 2020 and 2021.

Mountains of money were thrown into the market with the intention of preventing the economic recession from spreading. Additionally, the same pandemic crisis produced the so-called bottlenecks in the production and supply chain of goods and services.

This resulted in a substantial increase in energy and food prices. As economies reopened after the mandatory lockdowns caused by massive Covid-19 infections, price levels rose.

There is still a lot Money on the street. A diminished offer of goods and services and a productive apparatus working at half a machine. Failures in the supplies of raw materials to industry and labor shortages have generated supply problems.

High wages and inflation

In countries like the United States, to encourage employment, companies increased wages substantially. For example, leisure and hospitality jobs that paid an average of $14.58 an hour in July 2020 increased to $16.47 a year later.

The same happened in retail, which in July 2021 paid US $18.62 an hour compared to US $17.50 the same month in 2020. Since then, wages have not stopped increasing and with it the prices of products.

The incessant rise in prices contracts demand and reduces the purchasing power of consumers. It is a vicious circle that affects the entire economic circuit and society in general. And everything suggests that the situation could get even more complicated.

For 2021, US inflation was expected. 2%, but in December it shot up to 7%. That is, 0.5% more than the previous month when it was at 6.8%, according to data from the Department of Labor.

This level of inflation will force the Federal Reserve to raise interest rates in March, if not sooner.

two. Rise in interest rates

The gap between interest rates (currently at 0) and inflation is at record levels as well. These all-time highs have not been seen since 1982, when interest rates peaked at 10.25%.

To stop inflation, the US central bank will necessarily have to raise interest rates. Because for the investors of the 10-year bonds they are not yielding attractive returns.

German 10-year bonds offer a yield of 9.3%, while that of US bonds is 10.2%. The fact is that inflation is already at 7% and may grow more in January. While interest rates are at 0%.

¿ Why have central banks waited so long to raise interest rates?

That is a truism question. Federal Reserve Chairman Jerome Powell and ECB President Christine Lagarde have been repeating for a long time that inflation will be temporary. Although the rest of the world thought otherwise.

A logical explanation by some analysts is that governments wanted to keep their debts low. Even if their money turned into salt and water for savers. The United States and European countries had to borrow at unprecedented levels to face the crisis.

The Spanish public debt, for example, reached all-time highs last year. It stood at 1,253.3% of GDP. By 2021, the US public debt amounted to US$28.427 trillion, according to data from Statista.

While the global public debt after 2020 increased to US $226 trillion, according to figures from the International Monetary Fund . Of course, governments had no interest in raising interest rates so as not to increase their debts.

Less still the big companies, particularly the oil companies, which had to borrow extensively to have cash during the pandemic. Governments and companies had cheap money for almost two years.

The first to stimulate their economies, the companies to stay afloat. But some of that money also helped many pack more of their heavy saddlebags. During the pandemic crisis some companies doubled their market value. Incredible no!

Risks of recession on the horizon

If inflation does not stop, the Fed may raise interest rates in March to 0.5% or even up to 2% and more in the following months. Three possible rate hikes are scheduled for 2022.

If the rate reaches 2.5% to raise Treasury bond yields and cause credit spreads to widen, the effect will be a certain recession in early 2023, Bloomberg analysts warned.

The impact on industrialized economies as well as on emerging markets will be immediate. There will be a high boost in the price of the dollar and a stampede of capital.

That is why it is so important to know how to invest money and crudely analyze the national and world environment. If interest rates skyrocket, the impact on the stock markets and the economic growth of the countries will be catastrophic.

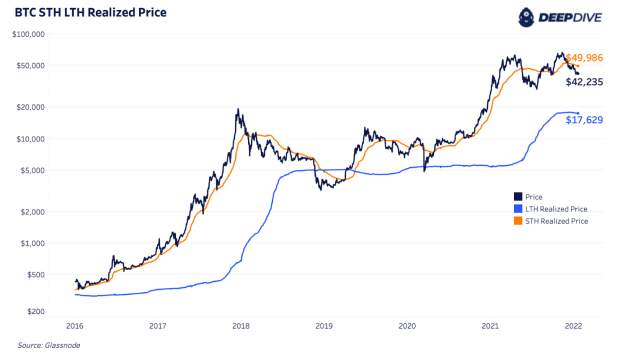

Investors in equity assets will be the first affected. If interest rates rise, securities will plummet. The bubble that is observed in certain sectors such as technology and crypto assets could explode.

With Omicron lurking and economies getting around all these difficulties, any black swan can appear. Nobody knows.

3. Omicron in the environment

The rate of contagion of omicron in the United States and Europe is already alarming. This variant of covid-19 is by far the most contagious of all those known so far (Beta, Delta, Flurona).

Although it has been said that it is less lethal for people vaccinated with two doses of the vaccine. However, the number of hospitalized and dead people continues to rise, forcing governments and companies to take health measures again.

If there is no new confinement to avoid contagion and companies continue to work as before, spending will tend to rebalance, according to Bloomberg Economics. This could boost world economic growth of 5.1%.

But, if restrictive measures are implemented again in restaurants , stores, gyms and travel as in 2020 and part of 2021, growth will be affected. The rate would be reduced to 4.2%.

Increase in infections can cause demand to fall again

Omicron’s behavior will depend a good part of the global economy. Experts predict that this variant will infect almost everyone until it becomes just another flu.

However, the economies would be dragged down and would be greatly weakened. World demand would fall again and the supply problems that countries have had until now would continue.

Transportation restrictions would cause a new drop in oil prices, affecting the producing countries. Although the West’s tensions with Russia over threats of invasion of Ukraine could also raise crude oil prices.

A rise of energy prices would directly affect households in Europe and the US. Gas prices will rise and with them the price of food, transport and all other downstream economic sectors.

To this must be added other disturbing phenomena that are being observed due to climate change. Low temperatures are affecting supplies. If all these elements are combined, a perfect storm would occur that would push the economies towards a stagflationary shock.

4) Expansionary monetary and fiscal policy

The pandemic led to governments to borrow at historical levels as well. Almost all countries had to intensify efforts to raise spending so that businesses could stay open and workers could collect a salary.

The projections of the Swiss bank UBS place world public spending this year at a gigantic 2.5% of global GDP. This figure represents spending five times higher than that approved after the 2008 financial crisis.

According to the Brookings Institution, the policy The US fiscal stopped boosting the economy in order to slow it down in the second quarter of 2021. The Joe Biden administration will throw billions of dollars into the street over the next few years through its Infrastructure Plan.

Other governments are doing something similar. This global indebtedness will have to be paid by someone. The resources approved for the Biden Investment Plan will result in an expansion of the US tax base. New taxes may not pass, but there will be more taxpayers.

5. Fall of the Chinese economy

In the third quarter of last year, China’s economy slowed down by various adverse factors. The impact of the heavy debt of the real estate giant Evergrande, the restrictions generated by the pandemic and the shortage of e energy.

If this figure is reached, it means that it would slow down by 3% with the consequent repercussions throughout the world. Particularly for countries exporting raw materials.

This cluster of elements caused a drop in annualized growth to 0.8%. When the usual in years preceding the pandemic was 6%. Currently, its annualized growth is 4.9%.

China’s growth is slowing and it seems that for a long period. Although the growth forecasts of Bloomberg Economics for the Chinese economy this year are 5.7%.

The current zero covid plan established by Beijing with the appearance of omicron may generate weak weak demand. As well as low funding for the construction industry that comprises about 25% of the Chinese economy.

In addition to Evergrande, other Chinese real estate developers are experiencing financial difficulties as a result of their illegal business practices. Another in trouble is Fantasia. The company recently failed to meet a $106 million payment on a debt issue. Kaisa and Shimao also have liquidity problems.

And this is just the tip of the iceberg. Everything indicates that things could be worse in the economy of the Asian giant. Everyone knows that information transparency is not exactly one of the virtues of the Chinese regime.

6. Geopolitical conflicts with Russia, China and Iran

The presidents of Russia, Vladimir Putin and the United States, Joe Biden.

Russian President Vladimir Putin’s threats of invasion of Ukraine have exacerbated NATO’s moods. Putin calls for the annexation of Ukraine, a country he considers to be part of Russian territory for historical reasons.

Ukraine was part of the Union of Soviet Socialist Republics (USSR) and is at the center of the dispute between Russia and the West. NATO wants to expand to the East by setting up military bases in Ukraine to avoid Russian and Chinese expansionism.

The Russian government’s response this week was a threat from the vice chancellor of that country, Alexander Grushko, suggesting the installation of troops and missiles in Venezuela and Cuba. Something similar to what Nikita Khrushchev did in 1962 provoking the missile crisis with the US .

Putin, who seems to be testing Biden, argues that NATO’s presence in Ukraine threatens Russia’s security . He claims that a missile launched from neighboring Ukraine would reach his country in just 5 or 6 minutes. USA

Increased tensions and a possible confrontation between Russia and the West and between the USA. and China over Taiwan, which the Chinese government has also threatened to invade, would turn the world economy upside down.

Another issue no less alarming is Iran’s nuclear development. The country of the ayatollahs has vowed revenge on the US and threatened with strong military responses if it sees its security threatened. The US is pressing for Iran not to develop its own atomic bomb.

Any of these conflicts would immediately impact the markets . Especially, those of raw materials and energy. But it would spread to other sectors due to the interests at stake and the geopolitical and economic repercussions for the world.

Why are the richest selling shares of their companies?

Another piece of information to complete the analysis of the world panorama to invest is the movements that the world’s super-millionaires have been making. The owners of the big technology companies have started selling large amounts of shares of their companies.

For example, Mark Zuckerberg, owner of Facebook (now Meta), has recently divested 9.4% of his shares worth more than $2 billion. Elon Musk got out of his 9% stake in Tesla. The shares sold are already around 15 million.

The Walton family that owns Walmart supermarkets has done the same. It has sold shares worth $6 billion. Other investors have stopped investing in the stock market to maintain higher levels of liquidity.

In 2021, stock transactions by of many billionaire investors increased by 31%. What do these insiders know that the rest of us mortals don’t know?

Do they handle the possibility that Is there a bear market in early 2022 how is it looking?

Note: This article has been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here