Please try another search

EconomyDec 31, 2021 05:26AM ET

EconomyDec 31, 2021 05:26AM ET

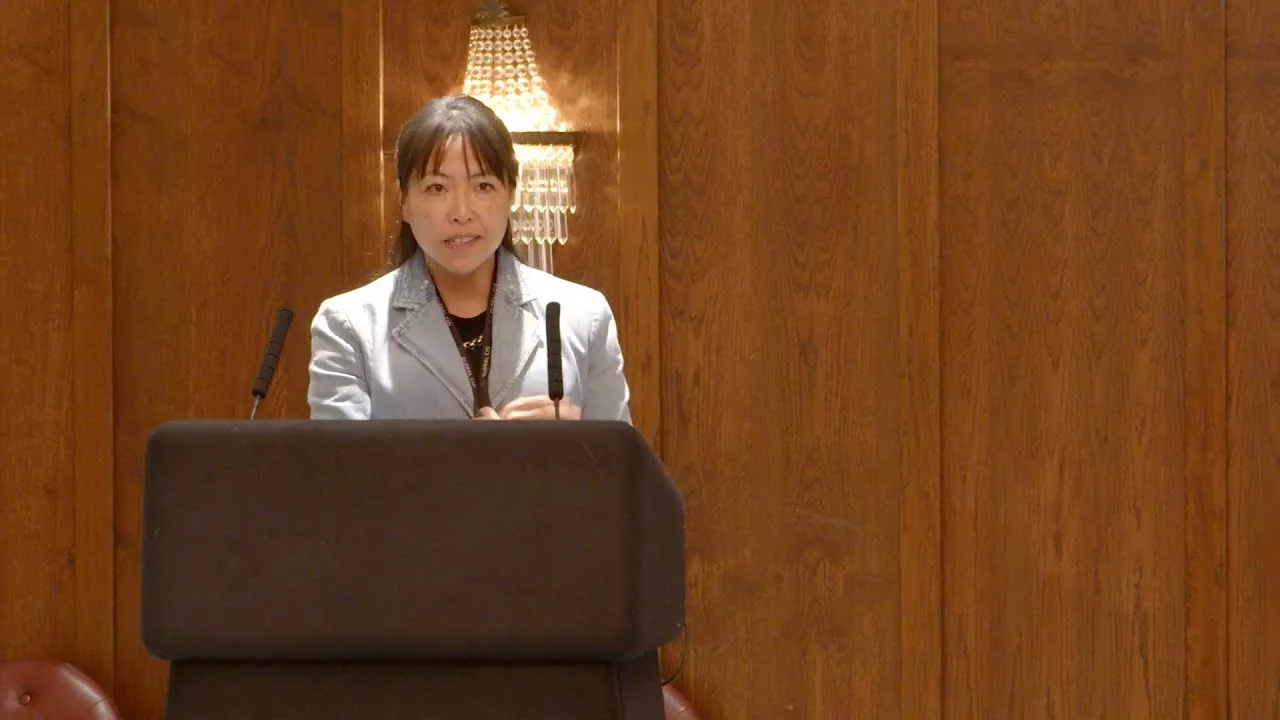

© Reuters. Turkish lira banknote is seen placed on U.S. Dollar banknotes in this illustration taken, November 28, 2021. REUTERS/Dado Ruvic/Illustration

© Reuters. Turkish lira banknote is seen placed on U.S. Dollar banknotes in this illustration taken, November 28, 2021. REUTERS/Dado Ruvic/Illustration

ISTANBUL (Reuters) -President Tayyip Erdogan said on Friday that Turks should keep all their savings in lira and that recent exchange rate volatility was largely under control after the lira weakened sharply in the last two months.

“I want all my citizens to keep their savings in our own money, to run all their business with our own money, and I recommend this,” Erdogan said in a speech in Istanbul.

“Let’s not forget this: as long as we don’t take our own money as a benchmark, we are doomed to sink. The Turkish Lira, our money, that is what we will go forward with. Not with this foreign currency, that foreign currency.”

Addressing a business group, Erdogan also called on Turks to bring their gold savings into the banking system and reiterated his unorthodox view that interest rates were the cause of inflation.

“For some time, we have been waging the battle of saving the Turkish economy from the cycle of high interest rates and high inflation, and taking it on the path of growth through investment, employment, production, exports and current account surplus,” the president said.

“Interest rates down, interest rates up. My friends, let us please take this out of our books. Interest rates make the rich richer and the poor poorer.”

Turks’ earnings have eroded in recent months due to a crash in the lira, though it rebounded from an all-time low of 18.4 versus the dollar last week after the introduction of a state scheme to protect local deposits from depreciation losses versus hard currencies.

The currency TRYTOM=D3 was at 13.295 at 0943 GMT, still down more than 40% this year, by far the worst performer in emerging markets.

The lira crisis was triggered by the central bank’s aggressive interest rate cuts, amounting to 500 basis points since September, carried out under pressure from Erdogan as part of a bid to boost credit and exports.

Related Articles

Disclaimer: Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs (stocks, indexes, futures) and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. Therefore Fusion Media doesn`t bear any responsibility for any trading losses you might incur as a result of using this data.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Note: This article have been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here