The Indian Venture and Alternate Capital Association (IVCA), representing private equity and venture capital funds, is seeking government help post RBI’s restrictions on alternative investment funds. This and more in the last edition of ETtech Top 5 for 2023! Thanks for reading us every PM.

Also in this letter:

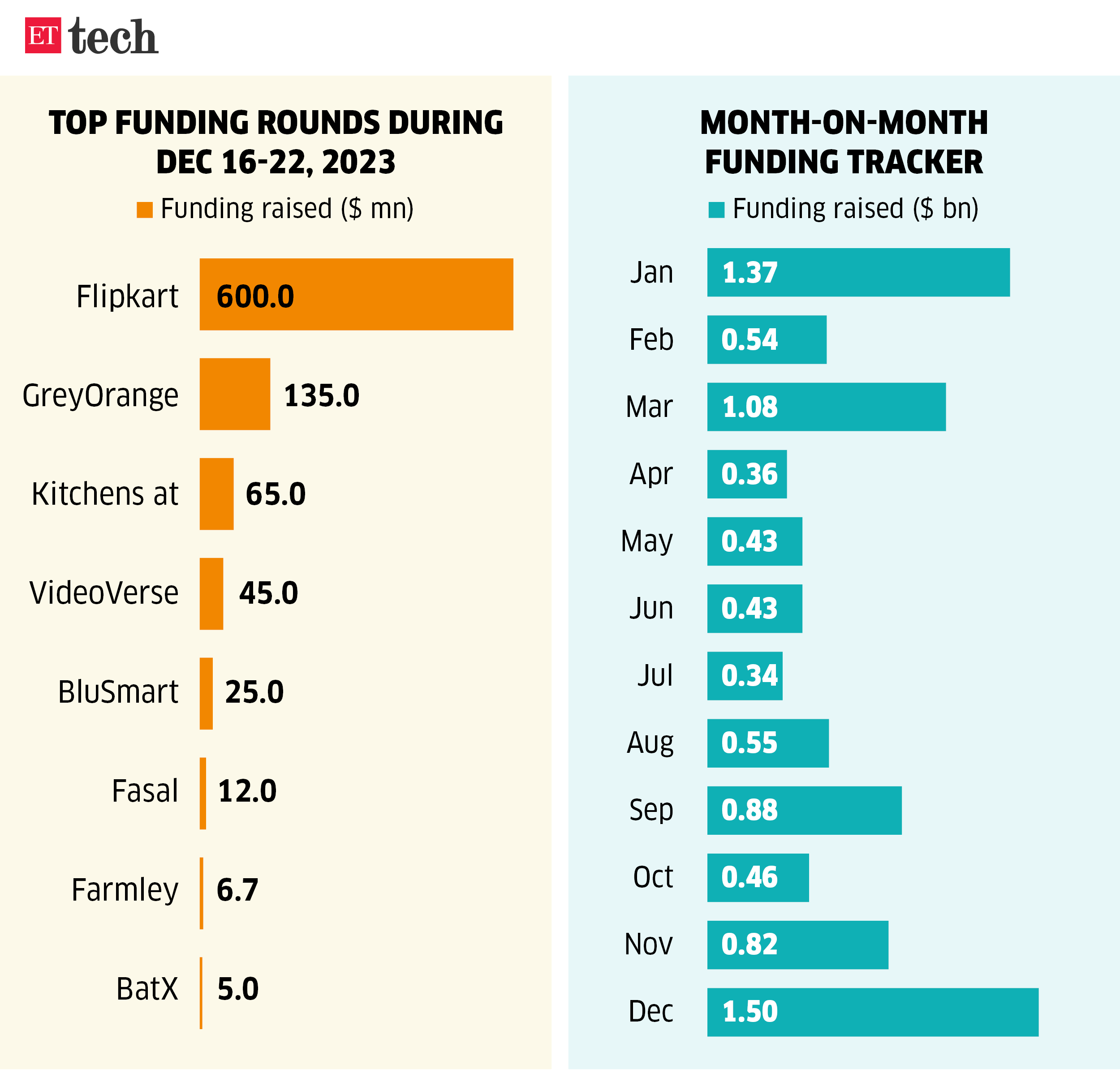

■ Kitchens@ bags $65 million funding

■ ETtech Deals Digest

■ Ajio to become profitable this month

Programming note: ETtech’s newsletter team will be off starting December 23. We will be back with a brand new edition of the newsletter on January 2, 2024. Wishing you all a Merry Christmas and a Happy New Year. Stay tuned to ETtech.com for all the news and updates. Also, follow us on @ETtech and other social media channels.

PE-VC body seeks govt’s help to ease AIF curbs

The Indian Venture and Alternate Capital Association (IVCA), an industry body representing private equity and venture funds, is in discussions with government officials to help ease the wide-ranging curbs the Reserve Bank of India (RBI) imposed earlier this week on alternative investment funds (AIFs).

Driving the news: An RBI circular issued on Tuesday prohibits banks and NBFCs from investing in AIFs to prevent questionable asset transfers. The RBI aims to prevent the evergreening of doubtful corporate loans, this can potentially choke institutional fund flows to the high-risk and lightly regulated AIFs.

Jargon busters: An AIF is a privately pooled investment vehicle established or incorporated in India that collects funds from sophisticated investors — whether Indian or foreign — for investment following a defined policy.

Evergreening of loans refers to extending new or additional loans to a borrower who is unable to repay the existing loans, thus concealing the true status of the non-performing assets (NPAs) or bad loans.

Tell me more: The industry is concerned about the close-ended nature of AIFs, where institutions with existing lending relationships with investee portfolio entities face a tight 30-day timeline from December 19, 2023, to liquidate investments, failing which they must provision 100% for such investments.

SIDBI, which loans funds to small industries, and various AIFs are simultaneously seeking clarity or relief amid the sudden changes.

Peak XV Partners-backed office sharing startup Awfis files IPO papers

Peak XV Partners-backed Awfis Space Solutions has filed its draft red herring prospectus (DRHP) with the markets regulator Securities and Exchange Board of India (Sebi) for an initial public offering (IPO). Awfis will issue fresh shares worth Rs 160 crore, in addition to an offer-for-sale (OFS) component of over 10 million shares.

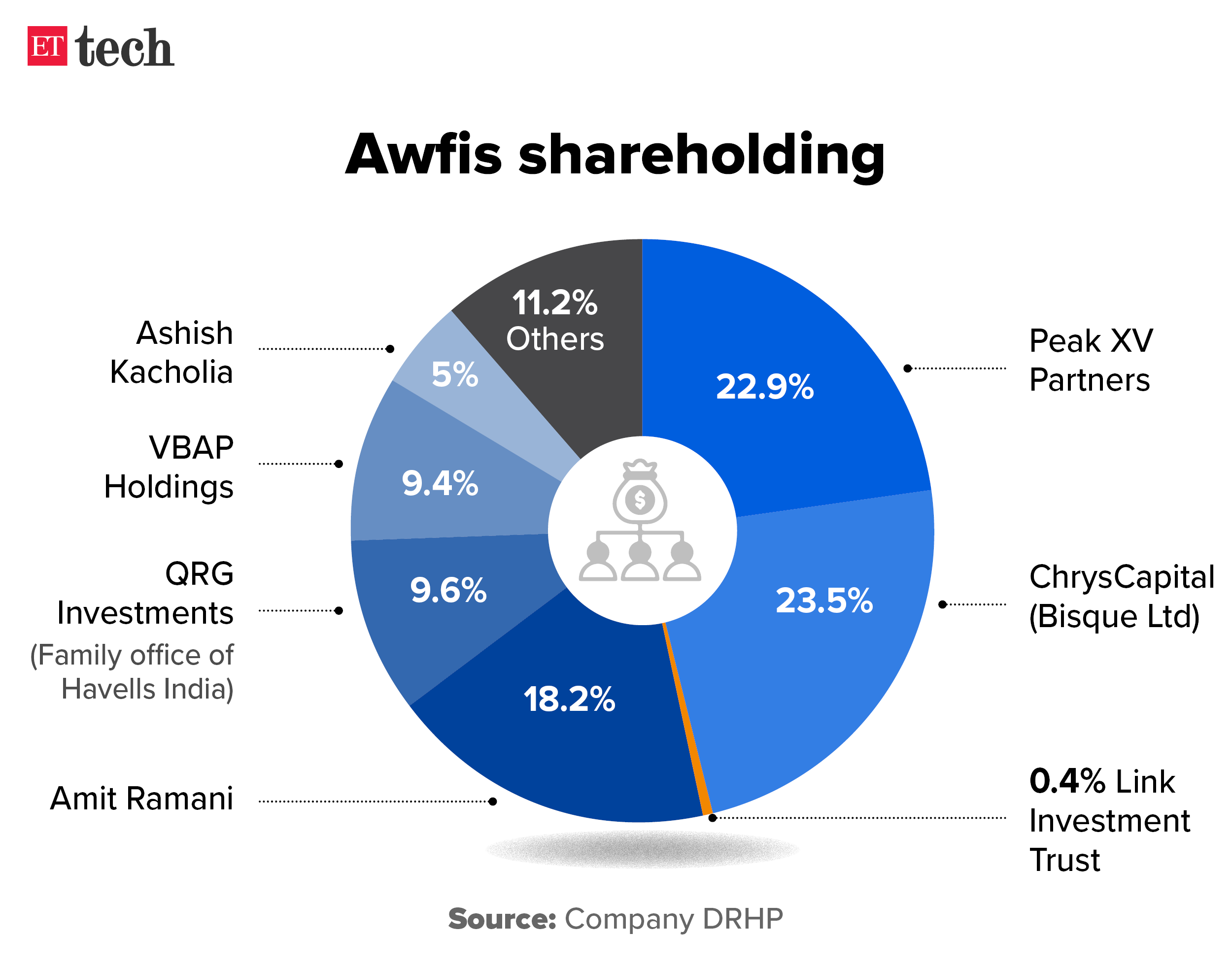

IPO details: Peak XV Partners, formerly Sequoia Capital India, will sell over 5 million shares in the office-sharing startup, with Mauritius-based investor Bisque Ltd, a unit of private equity firm ChrysCapital, also looking to sell nearly as many shares in the proposed IPO. Real estate investment trust Link Investment Trust will also sell over 75,000 shares in Awfis Space Solutions.

Shareholding pattern: Peak XV owns 15 million shares in the firm currently, aggregating to a 22.9% stake. Bisque owns a 23.5% stake, while founder and CEO Amit Ramani owns an 18.2% stake. Ramani is not selling any shares in the IPO.

As per the company’s last fundraising round, which happened in 2022, the company was valued at around $110 million.

Tell me more: According to the DRHP, Awfis’ operating revenue surged to Rs 545 crore in FY23, up from Rs 257 crore in FY22. In FY23, it reported a net loss of Rs 47 crore, down from Rs 57 crore reported in FY22. In the June quarter of FY24, it reported a loss of a little over Rs 8 crore and an operating revenue of Rs 188 crore.

Covid impact: The Delhi-based company logged a drop in FY21 revenue as a result of the pandemic-led disruption. It noted that it had provided its clients discounts aggregating to Rs 7.8 crore and Rs 4.3 crore in FY21 and FY22, respectively, and terminated eight centres during the two fiscals as a result of the impact of the pandemic. As of June 30, it had 121 operational coworking centres across 16 cities.

More IPOs in the pipeline: ET reported on December 20 that SoftBank-backed omnichannel retailer FirstCry is looking to file its draft IPO papers in the next few days to raise $500-600 million. While the firm’s valuation is not finalised yet, it may be pegged at around $4 billion.

Cloud kitchen service provider Kitchens@ raises $65 million

Cloud kitchen-focused startup Kitchens@ on Friday said it has raised $65 million in a funding round led by London-based private equity firm Finnest.

Deal details: The firm did not disclose the valuation at which the funding took place, but the investment came in primary funding, founder and chief executive Junaiz Kizhakkayil told us. The firm had earlier raised funds from the likes of DG Ventures and Beenext.

Kitchens@ will use the funds raised in this round for its omnichannel, multi-brand fine dining experience called Dinerium, the firm said in a statement.

In the works: Kitchens@ is looking to open 150 Dinerium locations in the next six months across the country, with seating capacities ranging between 600 and 1,500, where customers will be provided access to fine dining from across 15 brands, Kizhakkayil told ET.

More about Kitchens@: The Bengaluru-based firm provides services like ready-made kitchen setups, as well as supply chain and hiring support to cloud kitchens.

It works with restaurants like Taco Bell, Subway, Nando’s, Mainland China, Domino’s, Barbeque Nation, Chaayos and Wow Momos, according to its website.

Also read | Funding in Indian startups sinks to $7 billion, lowest since 2017

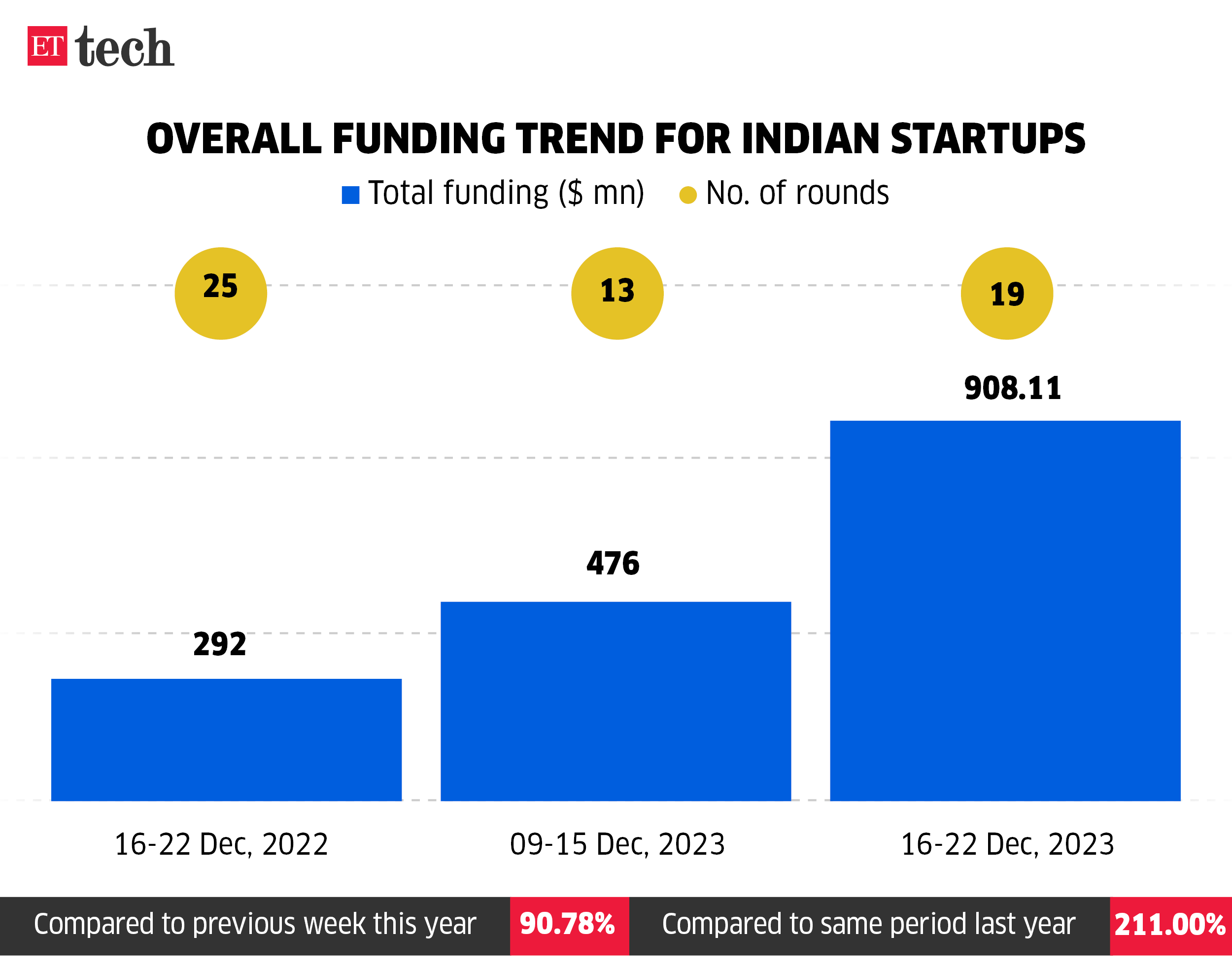

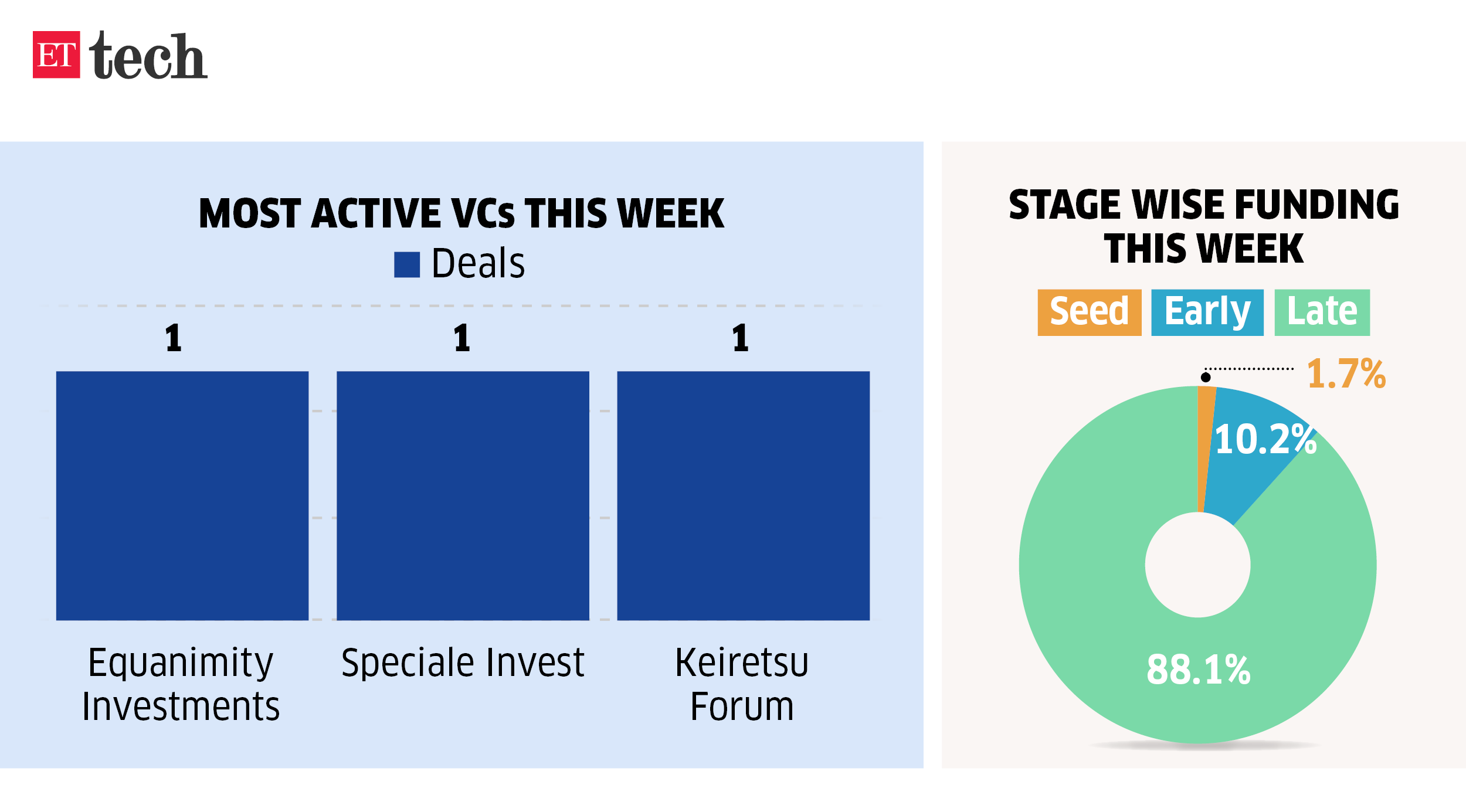

Indian startups raised $908 million this week buoyed by Flipkart’s mega funding

Weekly funding in Indian startups hit a 20-month high as part of a broader revival of venture capital deployment in technology companies in December this year.

The big push was because of Walmart’s $600 million capital deployment in Flipkart, as reported by us on December 21.

A total of 19 startups raised a cumulative of $908 million between December 16- 20, as per Tracxn data shared with ETtech.

On a year-on-year comparison, the week saw an increase of 211% in value from $292 million in the same week last year. Sequentially, it was 91% higher compared to $476 million.

“Venture capital firms and operators are allowing the market to settle down. They took a long pause for about 1-1.5 years to figure out patterns, in terms of which companies have been performing. Looks like deals are finally picking up,” a venture investor told us on the condition of anonymity.

Ajio set to become Reliance Retail’s first profitable online venture

Isha Ambani, director, Reliance Retail

Ajio, the online fashion business of Reliance Retail, is set to turn profitable this month, two senior industry executives told ET.

If this happens, Ajio will become the first online venture of the country’s largest retail group to achieve the milestone. It is expected to post Rs 6-8 crore in Ebitda in December, they added.

Path to profitability: Ajio achieved profitability for the following reasons:

- A premiumisation trend in the market helped Reliance, with a huge international brand portfolio, improve the average billing value.

- It brought down logistic costs by fulfilling most orders from physical stores nearer to the delivery point and reducing return rates.

Word for word: “Reliance wanted profitability in Ajio by this fiscal year and it is achieving it in December itself. The focus going forward will be on profitable growth since Reliance doesn’t want to burn money when the business has achieved scale,” one of the executives said.

Today’s ETtech Top 5 newsletter was curated by Gaurab Dasgupta in New Delhi and Megha Mishra in Mumbai.

Note: This article have been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here