Home » Regulation » Gensler suggests BNY Mellon’s crypto custody model could expand beyond Bitcoin and Ether ETFs

Sep. 26, 2024

BNY Mellon explores extending regulated crypto custody beyond ETFs.

Key Takeaways

- Gensler suggests BNY Mellon’s crypto custody model could apply to various digital assets.

- The crypto custody market is growing rapidly, with banks poised to benefit from secure, regulated services.

Share this article

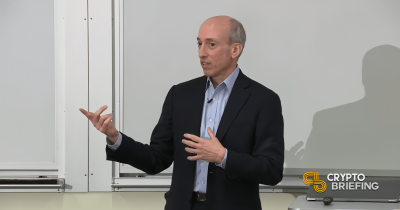

In comments to Bloomberg today, SEC Chair Gary Gensler discussed BNY Mellon’s crypto custody structure. He suggested that the model used for Bitcoin and Ether ETFs could be applied to other digital assets.

While the current approval applies only to Bitcoin and Ether ETFs, Gensler noted that the custody structure is not limited to specific crypto assets.

“Though the actual consultation related to two crypto assets, the structure itself was not dependent on what the crypto was, it didn’t matter what the crypto was.” said Gensler.

BNY Mellon now has the flexibility to extend its custody services to other digital assets if it chooses. Gensler emphasized that the “non-objection” is based on the structure itself, not the type of crypto asset, allowing other banks to adopt the same model for crypto custody.

The approval hinges on BNY’s use of individual crypto wallets, ensuring that customer assets are protected and segregated from the bank’s own assets in the event of insolvency. This wallet structure was developed in consultation with the SEC’s Office of Chief Accountant, leading to the agency’s “non-objection” decision.

This approval guarantees that the bank’s approach complies with regulatory requirements, preventing customer assets from being at risk during bankruptcy, a key issue that has plagued crypto platforms like Celsius, FTX, and Voyager.

The crypto custody market, estimated to be worth $300 million and growing by 30% annually, represents a lucrative opportunity for financial institutions. With non-bank providers typically charging much higher fees for digital asset custody compared to traditional assets, banks like BNY Mellon are well-positioned to capitalize on this growing demand by offering more secure and regulated solutions.

Share this article

Note: This article have been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here