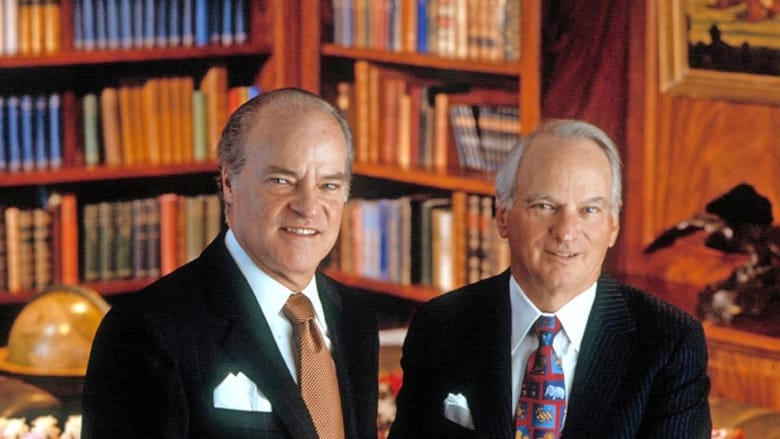

KKR co-founders Henry Kravis and George Roberts

KKR and Global Infrastructure Partners on Thursday announced the creation of a coalition to promote infrastructure investment in emerging-market economies of the Indo-Pacific Economic Framework, with the two US companies to serve as co-chairs of the initiative.

A brainchild of the US-led Indo-Pacific Partnership for Prosperity (IP3), the IPEF comprises the United States, India and 12 Pacific Rim economies with the notable exception of China. The new coalition’s stated aim is to accelerate investment in infrastructure and support IPEF economies in achieving their economic development, human capital and sustainability goals.

In addition to IP3, KKR and GIP — the latter of which is in the process of being acquired by asset management giant BlackRock — the coalition will include Singapore state investors GIC and Temasek Holdings, among others, the partners said in a release. The coalition estimates that its members collectively have more than $25 billion in capital that can be deployed into Indo-Pacific emerging-market infrastructure investments.

“The coalition brings together Indo-Pacific investors, knowledge partners, governments, and development experts around the achievable mission of closing the investment gap in IPEF partner countries,” said IP3 executive director David Talbot. “IP3’s unmatched network of public, private and non-profit leaders is excited to help lead the formation of this investment accelerator.”

Ivy League Expertise

Launched in May 2022, the IPEF seeks to advance the resilience, sustainability, inclusiveness, economic growth, fairness and competitiveness of the member economies, which also include Australia, Brunei, Fiji, Indonesia, Japan, South Korea, Malaysia, New Zealand, the Philippines, Singapore, Thailand and Vietnam.

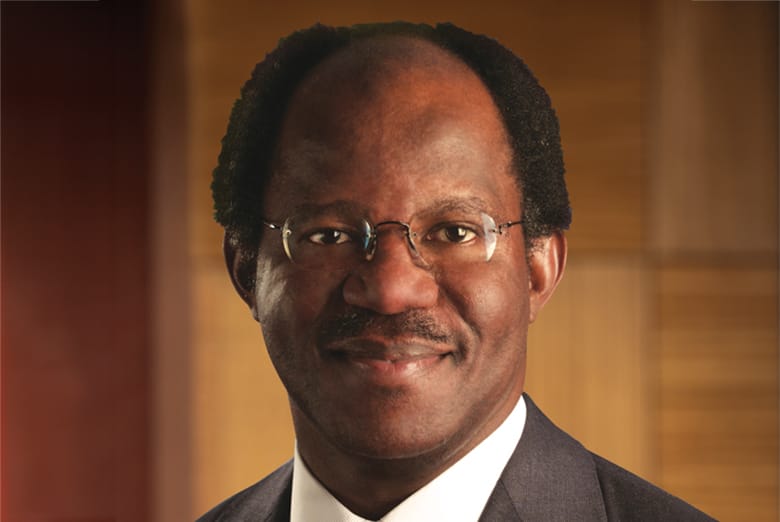

GIP chairman and CEO Adebayo Ogunlesi

The coalition’s initial focus is on scaled infrastructure investments across the energy, transport, water and waste, and digital sectors. The initiative will draw on the knowledge of the Center on Global Energy Policy at Columbia University’s School of International and Public Affairs.

The Indo-Pacific region needs accelerated infrastructure investment to support countries in achieving their economic ambitions, said Joe Bae, co-CEO of buyout giant KKR, which in January announced the $6.4 billion final close of its second Asia-dedicated infrastructure fund.

“As one of the largest infrastructure investors in Asia, we see tremendous long-term opportunities in the region’s infrastructure and look forward to collaborating with the coalition to increase the deployment of private capital in the Indo-Pacific region,” Bae said.

Fundraising Follows Suit

On the heels of KKR’s new vehicle, which has already deployed more than half of its committed capital across 10 investments, the last few months have seen the launch of infrastructure funds by US private equity firm Stonepeak and Dutch pension manager APG Asset Management.

Stonepeak in March announced the final closing of its first Asia infrastructure fund with capital commitments of $3.3 billion, exceeding the vehicle’s hard cap of $3 billion. The fund represents Manhattan-based Stonepeak’s first dedicated Asia strategy and targets infrastructure assets in the communications, transport/logistics and energy sectors.

APG, meanwhile, has teamed up with Japan’s GPIF to pursue opportunities to invest in infrastructure in developed markets. The two institutions in April announced the launch of a joint programme to focus on investment opportunities that align with the long-term strategies of both pension funds.

Note: This article have been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here