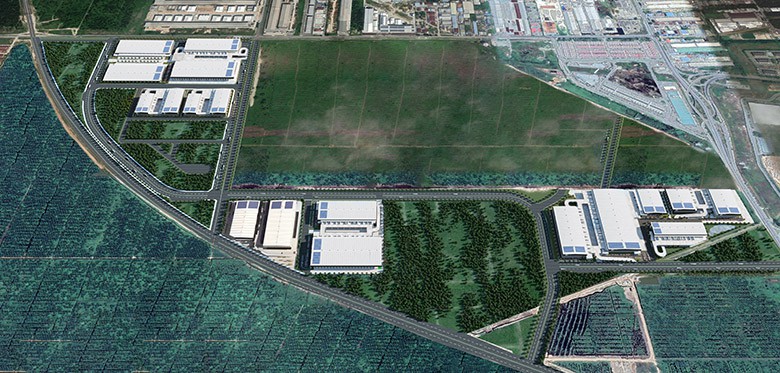

Sime Darby has allocated a site within its Bandar Bukit Raja township in Klang for the project

Industrial developer Logos continues to find fertile ground for expansion in Malaysia, where the Australian firm has teamed up with a unit of local conglomerate Sime Darby on a fund management platform for developing and investing in “build-to-suit to lease or sell” logistics assets.

Under the Singapore-incorporated joint venture, Sime Darby Property will hold 51 percent equity and become the first Malaysia-listed developer to launch development funds within the industrial and logistics sector, the company said Wednesday in a release. Sydney-based Logos will hold the remaining 49 percent in the JV, called Industrial Joint Venture Holdings, and lend its expertise in fund management and logistics development.

According to a Wednesday filing with Bursa Malaysia, the seed fund of the joint venture is targeting $200 million in capital commitments from accredited and institutional investors. Sime Darby Property has set aside a 177 acre (71.6 hectare) site for the purposes of the JV within its Bandar Bukit Raja township in Klang, home to Malaysia’s busiest container port and many industrial parks.

“The setting-up of fund management platforms is part of the value creation strategies we are introducing to broaden Sime Darby Property’s income streams in today’s challenging market,” said Azmir Merican, group managing director of Sime Darby Property. “We are pleased to partner with Logos Property and leverage on our synergies to develop investment-grade assets in Malaysia.”

Strategic Connectivity

Located 38 kilometres (23.6 miles) west of central Kuala Lumpur, Bandar Bukit Raja was selected by the partners for its strength as an established industrial township with strategic connectivity to essential infrastructure in the Klang Valley such as expressways, ports and airports.

Sime Darby Property managing director, Dato’ Azmir Merican

The facilities at the site are expected to draw on Logos’s experience in providing sustainable, integrated logistics solutions with green building certification, using the latest in automation and construction technology, Sime Darby Property said.

David Aboud, head of Malaysia for Logos, noted that Asia Pacific’s logistics sector has undergone major growth underpinned by the rise in e-commerce, manufacturing and diversification to decentralised supply chains.

“In Malaysia, this is resulting in a significant increase in demand from multinational and domestic customers for high-quality logistics space, which is currently not being well serviced by the majority of available stock in the market,” Aboud said. “In addition, the modern logistics sector is experiencing increasing sophistication in the build specifications demanded by users, including automation, and this is also a feature in the Malaysian market.”

Sime Darby Property’s existing investment and asset management business oversees 5 million square feet (464,515 square metres) of net lettable area across the industrial, commercial, retail and education sectors in Malaysia, Singapore and the UK.

Southeast Asia Drive

The tie-up with Sime Darby is the second big initiative in Malaysia announced this year by Logos, which in January launched a joint venture with local partner Global Vision to develop a $371 million logistics complex in the Klang Valley.

The site for the project is a 71 acre piece of land in Section 16 of the Shah Alam area of Selangor state, sitting close to the Federal Highway connecting Kuala Lumpur with Port Klang.

The Aussie warehouse specialist’s initial project in Malaysia was announced less than three weeks after the company had formalised a $200 million Indonesian joint venture with Canada’s CPPIB to expand its holdings in Southeast Asia’s most populous nation, where Logos also has a 20-megawatt data centre project with UK-based Pure Data Centres.

Last October, Logos acquired a project in northern Vietnam as part of a $350 million joint venture in that fast-growing market.

Backed by Singapore-based ARA Asset Management and Canadian fund manager Ivanhoe Cambridge, Logos has assets under management of over $17 billion, comprising more than 8.9 million square metres of property owned and under development.

Under the terms of a $5.2 billion acquisition of ARA proposed by ESR in early August, Logos is set to merge with its Hong Kong-listed competitor as part of what ESR chairman Jeffrey Perlman has termed the creation of the most power new economy real estate platform in Asia. That transaction is expected to complete early next year.

Note: This article have been indexed to our site. We do not claim ownership or copyright of any of the content above. To see the article at original source Click Here