MakerDAO dropped a DeFi bombshell at ETHCC! The $5 billion stablecoin DAI powerhouse just announced a radical shift in its reserves. Have you taken a seat? The platform is planning to invest a whopping $1 billion in tokenized US Treasuries. This audacious move aims to bridge the gap between the rock-solid stability of Treasuries and the wild world of DeFi. But will it work?

Big Players Join the Game

This significant step has attracted interest from major industry players, including BlackRock’s BUIDL, Superstate, and Ondo Finance. Carlos Domingo, CEO of Securitize and BlackRock’s issuance partner, expressed his enthusiasm, stating,

“We think this is a very good move from MakerDAO and we are excited to participate with Blackrock’s BUIDL,”

Robert Leshner, founder of Superstate, also praised the initiative, noting that Superstate’s USTB is the perfect partner for MakerDAO. Similarly, Nathan Allman, founder of Ondo Finance, highlighted the alignment with their mission of providing institutional-grade financial products for all.

Tackling the Crypto World’s Core Challenge

MakerDAO’s team has identified a crucial challenge in the crypto world: the need for a robust Real-World Asset (RWA) model for sustainability. This investment marks a significant restructuring under founder Rune Christensen’s Endgame Plan, aimed at bolstering MakerDAO’s position in the DeFi sector. By supporting its decentralized stablecoin with US government bonds and bills held off-chain, MakerDAO is leading the trend of RWA integration in crypto.

A Low-Risk, High-Yield Strategy

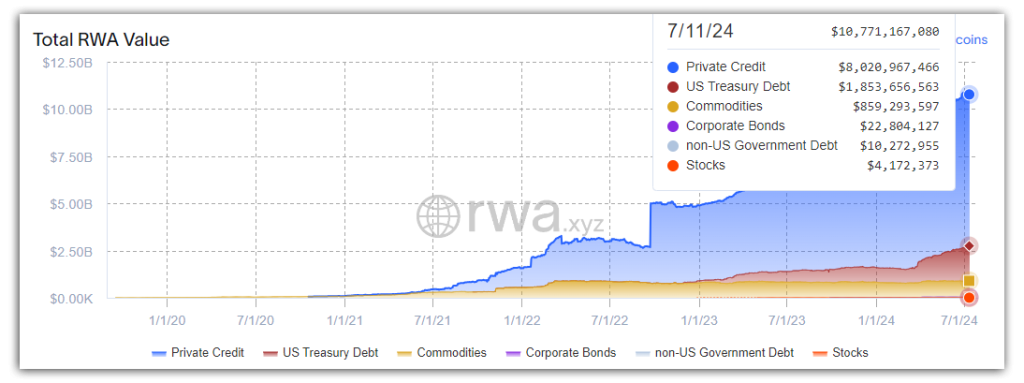

US Treasuries have become increasingly attractive for protocol treasuries, offering a low-risk instrument to earn stable yields. The market for tokenized treasuries has tripled in a year, reaching $1.85 billion. MakerDAO’s $1 billion allocation could potentially drive another 55% growth in this sector.

Following this announcement, the price of MKR has surged by 5.47%. This move aligns with the broader trend of cryptocurrencies gaining recognition from major financial institutions.

BlackRock, a trillion-dollar giant, views this space as “new finance” and is eager to participate in MakerDAO’s initiative. The program was announced at ETHCC in Brussels, with applications opening on August 12.

Regulatory Wins Boost Confidence

Recent regulatory victories, such as the SEC dropping investigations into Hiro Systems and Paxos, have also boosted confidence in the crypto community. This marks a significant win for the industry, as the SEC has dropped two consecutive investigations in just two days.

With these strategic moves and growing institutional interest, MakerDAO is set to reinforce its leadership in the DeFi space, paving the way for more robust and sustainable crypto innovations.

Also Read: Top 3 Metaverse Tokens For 3X Surge This Bull Rally!

Let’s discuss – is this a good move?

Was this writing helpful?

No Yes

Note: This article have been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here