![]()

Journalist

- PEPE’s price increased by over 3% in the last 24 hours.

- A few market indicators were bearish on the memecoin.

After a week of price decline, PEPE’s price once again gained bullish momentum. This latest uptrend might continue further as the memecoin broke above a crucial level. Let’s have a better look at what’s going on with PEPE.

PEPE’s bullish breakout

CoinMarketCap’s data revealed that PEPE witnessed a major price correction last week as its value dropped by over 2%. However, things got better in the last 24 hours.

The memecoin’s price surged by over 3%. At the time of writing, PEPE was trading at $0.00001216 with a market capitalization of over $5.8 billion, making it the 22nd largest crypto.

Thanks to that, over 83 percent of PEPE investors were in profit, as per IntoTheBlock’s data.

In the meantime, the memecoin managed to break above a bullish pattern, hinting at a continued price rise.

World of Charts, a popular crypto analyst, recently posted a tweet highlighting an interesting development. As per the tweet, PEPE broke above a bullish pennant pattern, which could result in a 30% bull rally.

The pattern emerged on PEPE’s chart in July, and since then it has been consolidating inside the pattern. If this analysis is to be believed, then PEPE might soon touch $0.000017 in the coming weeks.

What to expect from PEPE

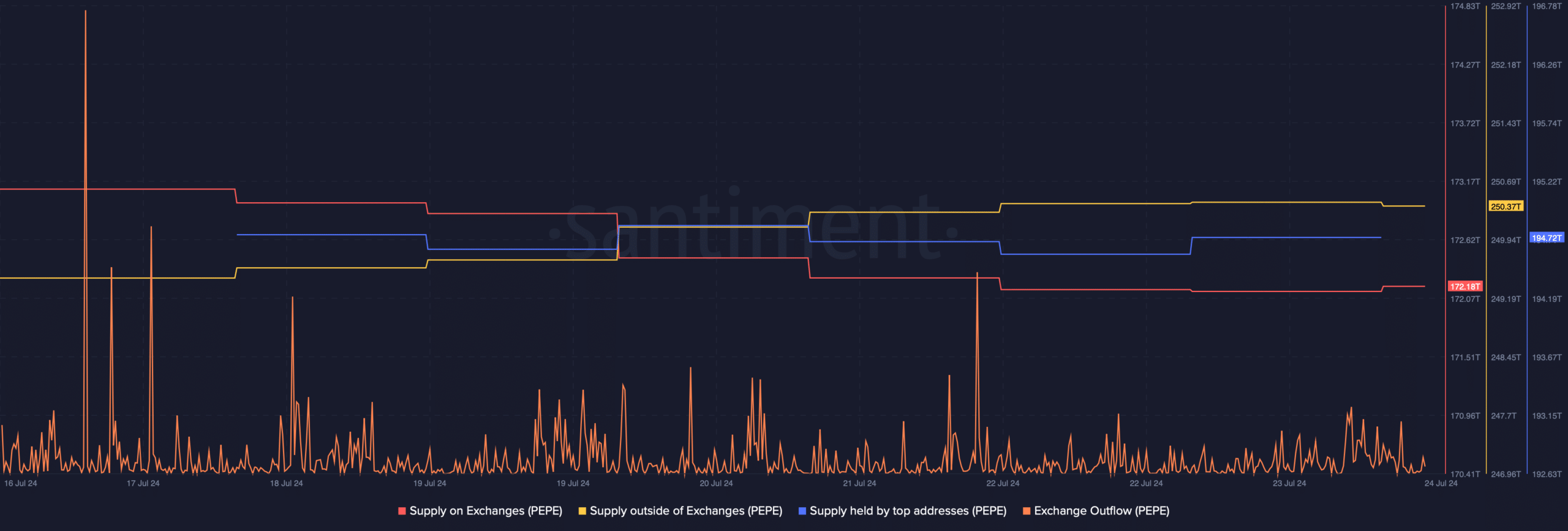

AMBCrypto then checked Santiment’s data to see what metrics suggested. As per our analysis, the memecoin’s supply on exchanges dropped while its supply outside of exchange increased, suggesting that buying pressure increased.

The memecoin’s exchange outflow also spiked last week, further establishing the fact that buying pressure was rising.

However, whales didn’t make a major move last week, which was evident from the flat supply held by the top addresses chart.

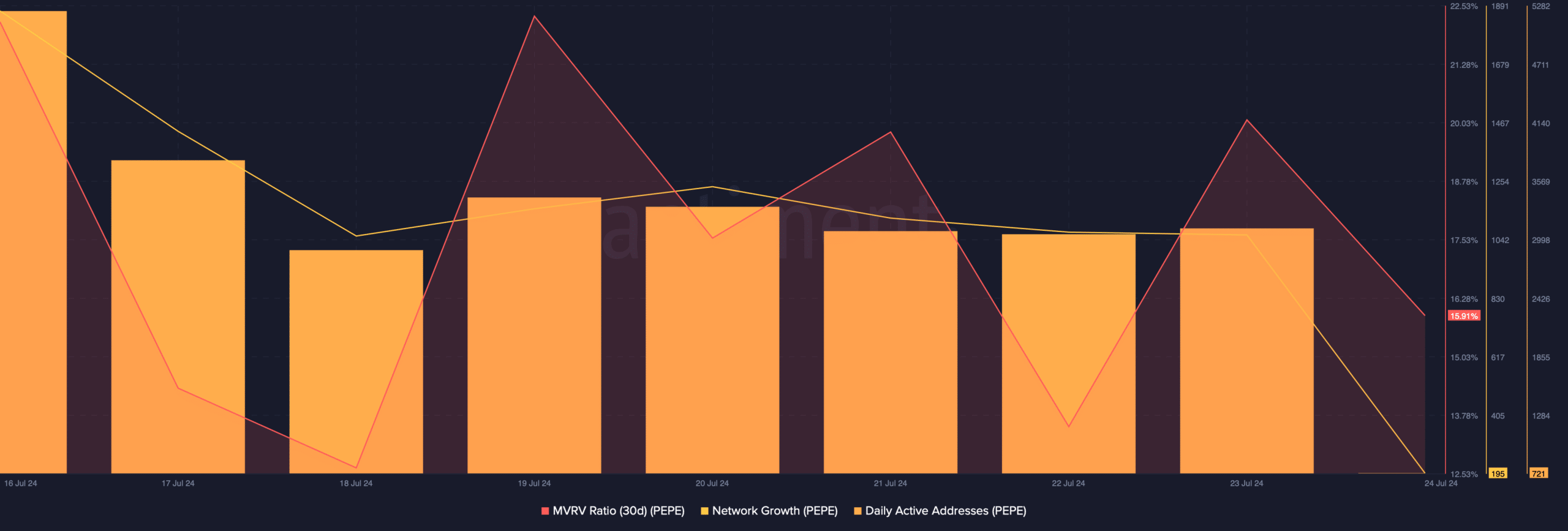

Apart from the rise in buying pressure, another bullish metric was the MVRV ratio, as it remained high last week. Its daily active addresses also remained pretty stable last week.

However, its network growth dropped. This suggested that fewer addresses were created to transfer the token last week.

Read Pepe’s [PEPE] Price Prediction 2024-25

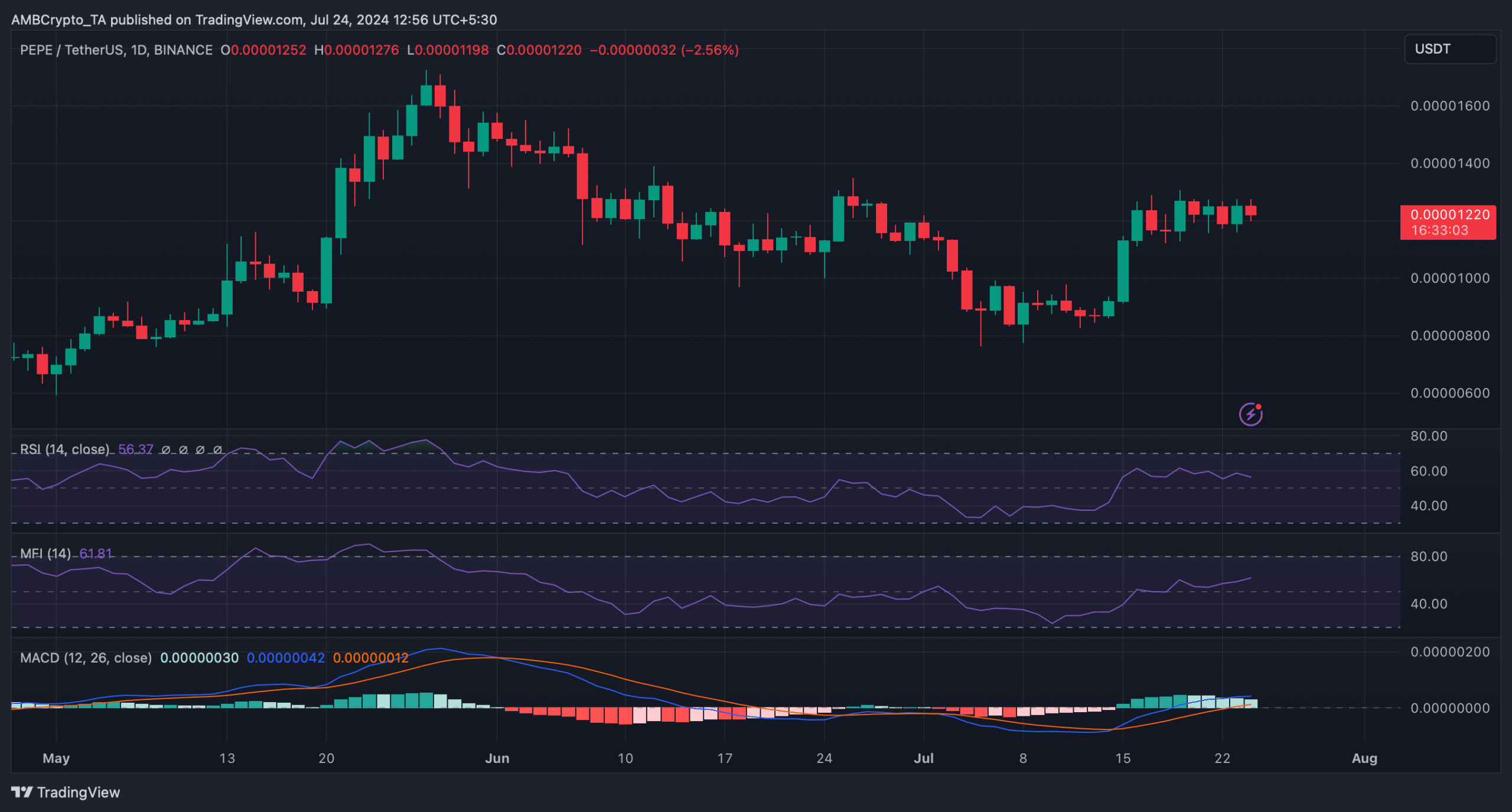

AMBCrypto then planned to check the memecoi’s daily chart. As per our analysis, the MACD displayed the chances of a bearish crossover.

The Relative Strength Index (RSI) registered a downtick, further suggesting that the chances of a price correction were high. Nonetheless, the Money Flow Index (MFI) registered an uptick, hinting at a continued bull rally.

Note: This article have been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here