Financial companies in the U.S. have been regulated by the Consumer Financial Protection Bureau (CFPB) since it was founded following the financial crisis of 2007 and 2008.

In 2010, the CFPB was created when it was authorized by the Dodd-Frank Wall Street Reform and Consumer Protection Act. The legislation was intended to improve accountability and stability in the financial system to protect consumers from abusive practices. It also aimed to end government bailouts.

The agency is in the news now because Republicans — soon to be in power in the House of Representatives — have resolved to counter its influence.

Rohit Chopra, the CFPB director, is in the line of fire from Republicans such as Rep. Patrick McHenry (R-N.C.) who has accused him of using the agency to acquire too much power.

McHenry and Chopra Exchange Views

In a hearing before the House Committee on Financial Services last week, McHenry, the ranking member on the committee, had some words of warning for Chopra.

“Next month there will be a new majority in the House of Representatives. I think you’ll wish you tried harder to play by the rules,” he saidaccording to BankingDive.

One letter to Chopra, signed by 12 Republican senators, made it clear in September what the argument was about.

The letter highlighted concerns about how banks are treated by the agency, particularly regarding fees the banks charge consumers.

“Charging fees that customers chose to pay should not be disturbing or illegal, and yet, the CFPB appears to have developed a particular disdain for banks charging their customers for services, pejoratively calling overdraft protection ‘junk fees,'” the letter said.

At the hearing, Chopra said that the CFPB is trying to improve transparency, particularly involving remittance costs. He focused his arguments on those fees that are involved in money exchanges using a transfer, often done internationally.

“When someone is sending a remittance, the cost to them is a mix of any immediate fee plus any exchange rate delta, and in many cases, the consumer cannot really know how much money is going to end up on the other side,” Chopra said at the hearing.

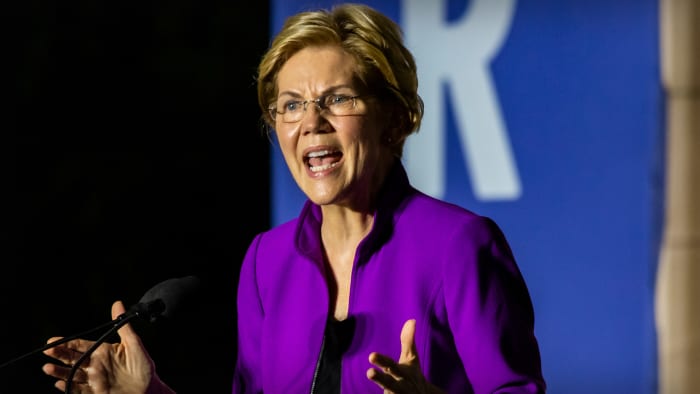

Sen. Elizabeth Warren Weighs In

In an October statement by Sen. Elizabeth Warren (D-Mass.), she urged the CFPB to eliminate hidden fees on remittance payments.

“When consumers are not aware of the true cost of a remittance payment, they are left with little ability to select the most cost-effective option,” she wrote on her website. “This reduces competition in the payment provider market, incentivizing remittance payment providers to hide fees and providing them with an opportunity to artificially inflate prices.”

Consumer advocates say they have found that the lack of transparency around these costs has put consumers in a position of forcing them to pay larger costs for remittances than they might otherwise pay if more transparency was part of the process.

“By adopting this disclosure method, the CFPB would help consumers make more informed decisions, allowing for more money to flow to family members abroad rather than being clawed away by exorbitant fees,” Warren’s website reads. “Further, the CFPB should rescind the permanent exemption for non-covered third-party fees and encourage the adoption of new technology that would provide transparent, pre-transfer cost information.”

Note: This article have been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here