The potential approval of a Bitcoin ETF (Exchange Traded Fund) is bound to open new opportunities for traders. The expectations surrounding this event impact the market now, but an expert believes they will have a more substantial effect in the coming months.

As of this writing, Bitcoin trades at $37,400 with a 1% profit in the last 24 hours. Over the previous week, the cryptocurrency stayed in the green with a 3% profit, holding the critical level of $37,000 despite the increase in selling pressure.

The Lucrative Strategy In Anticipation Of Bitcoin ETF Approval

As Bitcoin’s value soars with a remarkable 125% increase this year, a new trading strategy emerges, promising high returns in the wake of the anticipated Bitcoin ETF. A seasoned market analyst, Markus Thielen, unveils insights into leveraging the evolving crypto market dynamics for profitable trading in an essay posted by options platform Deribit.

Thielen’s analysis reveals an “unusual” trend in the Bitcoin market: despite its significant rally, the 30-day realized volatility remains at a modest 41%, starkly contrasting to the 5-year average of 63%.

According to the analyst, this subdued volatility reflects a declining interest in leveraged Bitcoin options, a direct consequence of institutional players entering the crypto arena.

These players, holding significant Bitcoin assets, will likely sell volatility, fostering a more stable market environment that mirrors traditional financial markets.

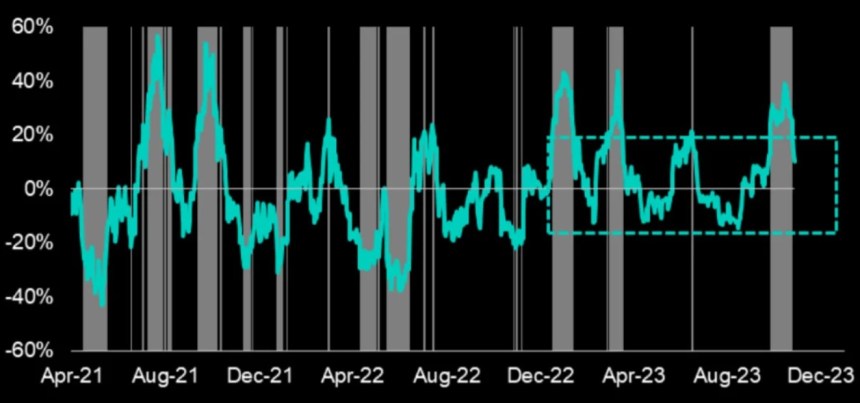

In this landscape, the strategy of selling strangles (120% call and 80% put) on a 30-day rolling basis stands out. According to Thielen, this approach has shown profitability in approximately 23% of cases over the past year, as seen in the chart below, marking a significant improvement from the decentralized finance (DeFi) summer’s high-risk profile.

At that time, DeFi protocols attracted billions in capital to the crypto ecosystem contributing to the incipient Bitcoin rally. While there are differences in the current market dynamics, options players are likely to benefit from this strategy.

This strategy, particularly effective during low-risk periods, suggests a window of opportunity for traders to capitalize on before introducing institutional influence.

Institutional Involvement Expected to Stabilize Bitcoin Market

The anticipated launch of the Bitcoin ETF is set to transform the market further. This event is expected to recalibrate the put/call ratio, which leans heavily toward calls.

Thielen compares it to the S&P 500, where the put/call ratio has been more balanced. The Bitcoin market might soon witness a similar equilibrium, presenting an opportunity for traders to harness volatility through a sell-put strategy.

Furthermore, Thielen notes that the post-ETF approval phase could be the last chance for traders to exploit high volatility levels. Once institutional players begin systematically selling volatility, the market is expected to enter a phase of reduced price fluctuations, making volatility-based strategies less effective.

The analysis also touches upon Bitcoin’s correlation with broader market indicators like the VIX index. While the Bitcoin market has maintained high volatility relative to the VIX index, this gap is anticipated to narrow, offering traders a strategic edge in timing their trades effectively.

In conclusion, as the Bitcoin ETF approaches and institutional participation increases, savvy traders can look towards selling strangles as a strategic approach to capitalize on the current market conditions.

Cover image from Unsplash, chart from Deribit and Tradingview

Note: This article have been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here