- USD/CAD still down for the week and pointing to the upside.

- US Dollar mixed on Friday between lower US yields and risk aversion.

- Key events for next week: Canada CPI (Tuesday) and FOMC meeting (Wednesday).

The USD/CAD printed a fresh daily high on Friday at 1.3772, amid a weaker Loonie and a mixed Greenback. After moving away from the bottom, the pair is about to post a small weekly loss.

The bad and the ugly

Data released on Friday showed the Canadian Industrial Product Price Index dropped 0.8%, a surprise considering market expectations of a 1.6% increase. The Raw Material Price Index fell 0.4%, below the estimate 0%. The economic figures did not help the Loonie, that is among the worst performers on Friday.

Next week, the key report from the Canadian economy will be February’s Consumer Price Index (CPI) on Tuesday. It is expected to show an increase of 0.4% MoM, and the annual rate slowing from 5.9% in January to 5.5%.

The US Dollar is mixed on Friday, attempting a recovery as stocks in Wall Street deepen losses. US yields are down by 4% on average, with the 10-year at 3.41%, slightly above March lows.

Markets remain anxious with the banking turmoil and next week is the FOMC meeting. The consensus is still for a 25bps rate hike but the end of the tightening cycle is seen sooner than previously thought. The change in expectations weighed on the Greenback.

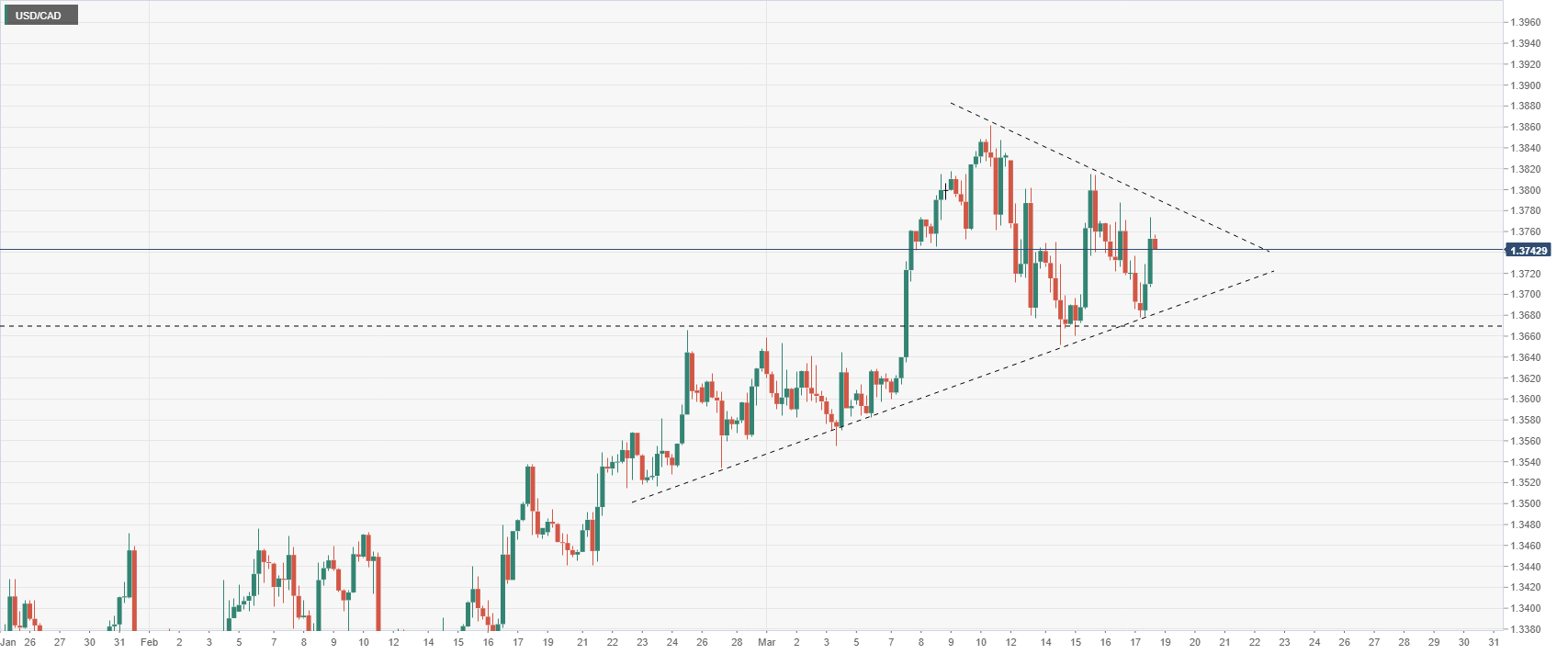

Higher lows, lower highs

The USD/CAD has been making higher lows and lower highs during the last sessions. On Friday, it reversed from a two-day low at 1.3676 and jumped to 1.3763. The short-term direction is not clear.

The pair remains above the 20-day Simple Moving Average (1.3655) and also above the 1.3660/70 key support area. While above that two supports, the outlook looks constructive for the USD/CAD.

USD/CAD 4-hour chart

Technical levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Note: This article have been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here