Here’s where hundreds of billions of dollars for climate technology is going.

This article is from The Spark, MIT Technology Review’s weekly climate newsletter. To receive it in your inbox every Wednesday, sign up here.

I don’t know if there’s a single conversation I’ve had about climate technology over the past year that didn’t reference the Inflation Reduction Act at least once.

I’m probably an exception to the rule, though. As a climate reporter, I’m firmly in the camp of people who think about climate change all the time—but not everyone does. And if you haven’t heard of this law, you’re not alone. According to a new poll, 71% of people in the US have heard little or nothing about the Inflation Reduction Act. In case you fall into this group, let me hit the high points for you:

- It’s often referred to as the IRA for short

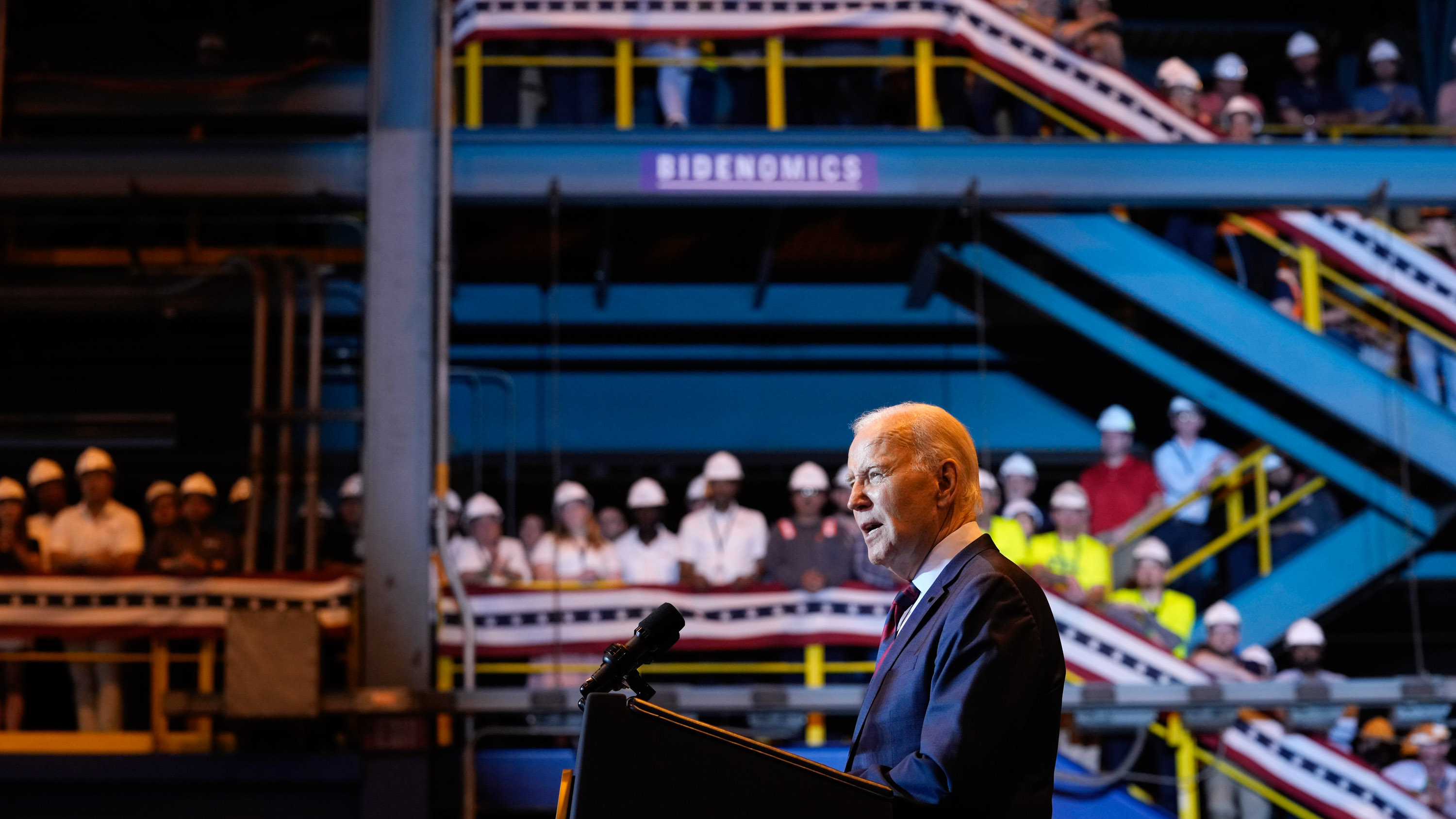

- Signed into law by President Biden on August 16, 2022 (a year ago today!)

- Included an estimated $369 billion in funding for climate change

- Made up of grants, loans, and a whole lot of tax credits

That’s a metric boatload of money, and people in climate have been speculating about what it will all mean ever since we got the first version of the bill more than 365 days ago.

I just published a story about where things stand with US climate tech policy after one year of the IRA. Check it out, and for the newsletter this week let’s consider what’s changed and what’s next for the breakthrough climate law.

Manufacturing

Then: My colleague James Temple and I wrote about the Inflation Reduction Act, which was then still a bill, as soon as the draft text was released in late July 2022. It was clear at the time that this would be a very big deal for US climate action:

Ryan Fitzpatrick, director of the climate and energy program at Third Way, said it’s an ambitious and politically pragmatic bill designed to boost US manufacturing, provide support where job sectors are shifting, and build out the infrastructure needed to shift to cleaner, modern energy systems.

“This would be the largest investment of its kind in American history,” he said.

Now: While a lot of the funding still hasn’t made it out the door yet, there are early signs that this boost in US manufacturing is well underway. There’s a constant flurry of companies citing the IRA while announcing massive investments in new manufacturing facilities in the US for clean technologies.

Take First Solar, the largest US solar panel manufacturer. Just two weeks after the IRA became law last year, the company pledged to expand its factory operations in the US and build a $1.2 billion factory in the Southeast, directly citing the climate law in its announcement. A few weeks ago, the company made another announcement about plans to scale even further and build yet another billion-dollar factory.

In total, companies have announced over $76 billion in private investments in climate technology manufacturing since the IRA was signed into law.

Electric vehicles

Then: There were early concerns that restrictions in the EV tax credits could limit how many vehicles would wind up qualifying for them, limiting their effectiveness.

The rules lay out that consumers would only get the full $7,500 credit for a new EV if the vehicle is made from materials and batteries from the US (or free trade agreement partners). The rules attached to the credits were aimed at boosting US production of battery minerals, components, and cells. At the time, it wasn’t totally clear exactly how everything would get interpreted, and just how restrictive these would wind up being.

Now: We’ve gotten some clarity on most of the EV tax credits, and it seems like the agency has largely erred on the side of allowing more vehicles to qualify. But even today, there are looming questions on this major program.

Namely, there’s a bit that excludes EVs that have a “foreign entity of concern” involved in their supply chain starting in 2024. That term hasn’t really been defined yet—though there’s a chance that China, which dominates several parts of the EV supply chain, will fall into that category.

Check out my story on the EV credits from last year for more on what that could mean for battery prices and EV ownership. I’d also recommend looking back at a newsletter from my colleague Zeyi Yang about how EV batteries could be the next point of tension between the US and China.

Greenhouse gas emissions

Then: The number I heard over and over last year was 40%—experts said that the IRA would cut US emissions by 40% from 2005 levels by 2030. It was more than what the country was on track for (around a 30% to 35% cut) but less than what the country needs to do to meet international targets (a 50% reduction).

Thinking about how modeling experts go from hundreds of billions of dollars to an expected emissions cut broke my brain a little, so I dove into the weeds and spoke with several of them for a story last August about how predicting the results of economic policies like the IRA is tricky.

At the time they said that we can assume that lower prices means more uptake of products like EVs and solar panels, and we know how much those products cut emissions. But they also pointed out that there are still a lot of complicating factors. People don’t always behave rationally, for example. It can also be hard to tease out how much policies push people to adopt new products that are already getting pretty cheap on their own. That all means we should probably take these predictions with a bit of caution.

Now: The emissions effects from the IRA’s policies are still mostly projections. We won’t know for a while exactly how well all this money translates into climate action. But early signs in manufacturing and EV uptake are very positive.

For even more on how well the IRA might work, and what’s coming next for the breakthrough legislation, check out my story from earlier today on the legislation’s first anniversary.

Related reading

For more on what’s in the IRA and what experts thought at the time, check out our initial coverage from last summer, as well as my follow-up stories on the EV tax credits and how emissions modelers worked to figure out what the money would mean for climate progress.

This opinion piece from Jonas Nahm (now a senior economist for the Biden administration’s Council of Economic Advisers), published last November, lays out how the IRA ties climate action with economic success.

My colleague James Temple took on the topic of carbon capture subsidies in the IRA. There was (and is) concern that investing in carbon capture could extend the life of fossil fuel plants. But James points out that the subsidies could be crucial in hard-to-decarbonize sectors like steel and cement.

Another thing

The US just invested over $1 billion in carbon removal. The funding is mostly going to two direct air capture hubs—one in Texas and the other in Louisiana.

By some estimates, we may need to remove billions of tons of carbon dioxide from the atmosphere each year to stay below 2 °C of global warming. That’s a daunting figure, one that could require trillions of dollars to pull off. For more on this funding and how carbon removal fits into climate goals, jump into this new story from James Temple.

Keeping up with climate

Last week, wildfires tore through the island of Maui in Hawaii, killing over 100 people and burning hundreds of acres. Climate change is making Hawaii drier, putting the islands at greater risk for harmful fires. (Vox)

One of the clearest outcomes of climate change is rising temperatures. There are great data visualizations in this story outlining how that heat affects so many parts of our society, as well as ecosystems around the world. (Bloomberg)

A judge just ruled that the state of Montana must consider climate change when approving new oil and gas projects. The ruling comes after a group of young people sued the state, arguing that climate change infringed on their rights to a healthful environment. (New York Times)

The western US is getting dry, and this LA Times opinion piece lays out why it might be time to ditch “nonfunctional grass” in the state. I say let’s take this one step further and pull more lawns out in favor of native wildflower patches. (LA Times)

There’s been another delay on the details of the most anticipated pieces of the massive US climate bill—a tax credit program for hydrogen fuel. Don’t expect the rules, which could decide whether this program helps or hurts emissions, until at least October. (Heatmap News)

The phrase “circular economy” is used so much in marketing, especially in plastics, that it’s basically lost all meaning. Here’s how the term has been warped into quasi-greenwashing mush. (Grist)

Plans to build offshore wind farms in New Jersey are running up against local opposition, despite the fact that turbines would be placed 15 miles offshore. (Washington Post)

The National Oceanic and Atmospheric Administration just upgraded its forecast for hurricane season: the Atlantic has a 60% chance of an above-normal season, with 14 to 21 named storms expected and between two and five major hurricanes. (Inside Climate News)

Just for fun

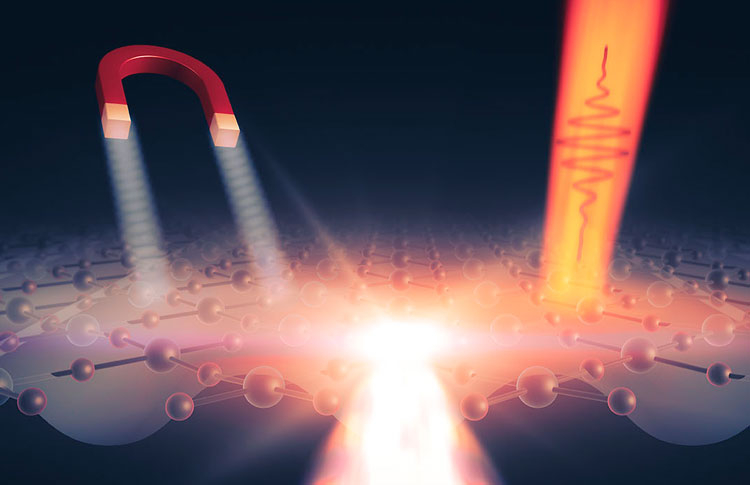

It’s not often that physics hype enters the mainstream online consciousness, but buzz about room-temperature superconductors briefly took over my social media over the past few weeks.

Researchers in South Korea found a material, dubbed LK-99, that they said displayed superconductivity—meaning it can conduct electricity perfectly, without losing any. It would have been huge, if true.

Unfortunately, it’s been a few weeks, and no other researchers have been able to replicate the findings. For more on the hope and hype and what all this says about technology and climate progress, check out this story from Scientific American.

Note: This article have been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here