Some people can already use Apple Pay Laterwith the company promising that it will come to “all eligible users” in the next few months. But while you will be able to use it soon, the question is: Should you?

On the surface, it seems like a decent option. It’s interest-free, there’s no application form to fill out, there’s no impact on your credit rating, and you’re dealing with Apple rather than a bank or finance company. But there are a few things to consider …

How it works

Let’s start by looking at how Apple Pay Later works.

Once you’ve decided what you want to buy, you apply for the service within the app. You’ll be asked how much you want to borrow, and prompted to agree to the terms. Apple then carries out a “soft” credit check, which means it checks your rating but doesn’t record the fact that this has been done, so it won’t be visible to other lenders.

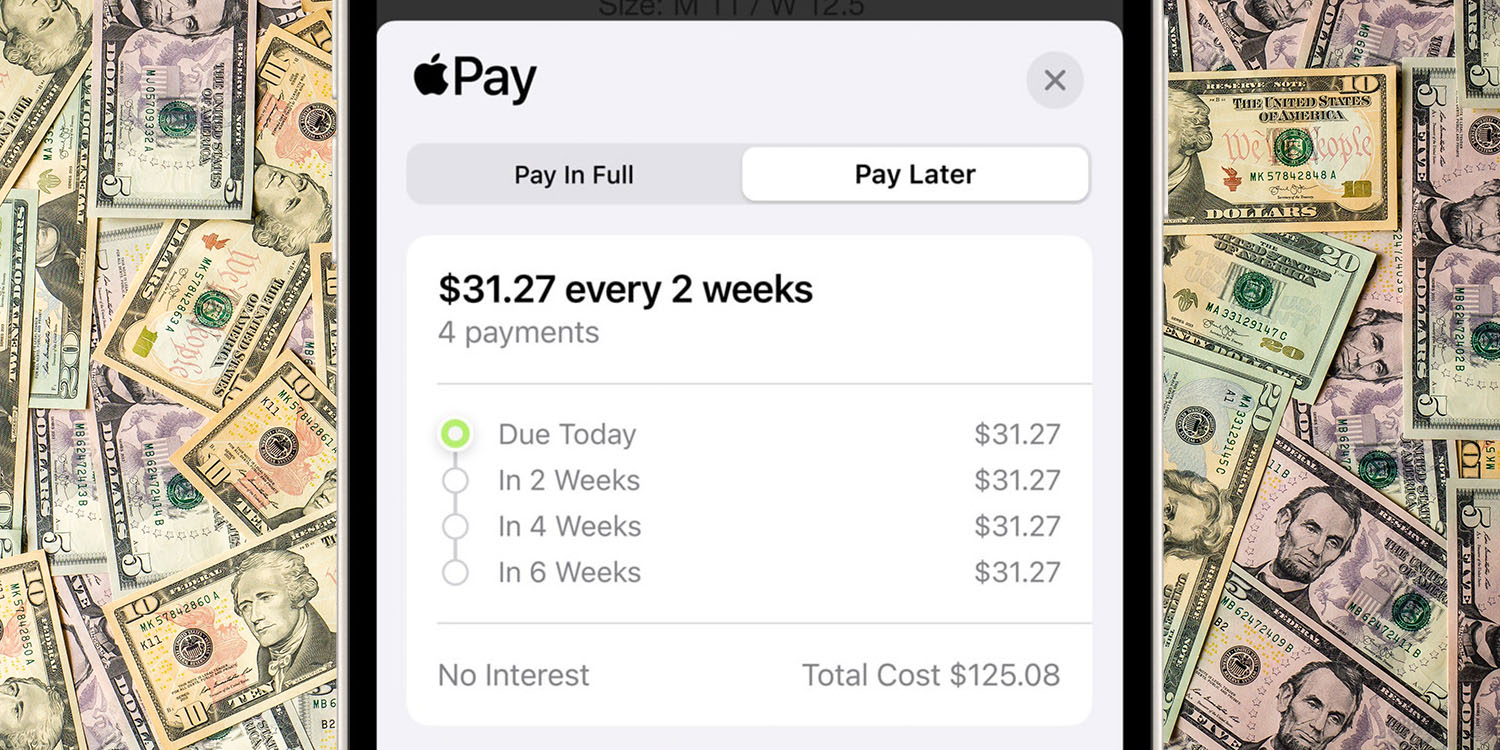

If you’re approved, then you can go ahead and make your purchase, selecting Apple Pay as the payment method. You’ll then see a new tab asking you to choose between Pay in Full and Pay Later. Select the latter, and you’re all set.

To repay the loan, you pay in four equal installments every two weeks, which is where the first of two downsides comes in ….

You’re only financing 75%, not 100%

That first installment is due on the day you make the purchase. So 25% of the cost has to be paid immediately, meaning that you’re only financing 75% of the cost, not 100%.

You’re only getting credit for six weeks

The remaining 75% of the cost has to be paid off within six weeks – which is not much longer than the typical 30-day interest-free period you get when using a credit or charge card. But it’s actually worse than this …

Only 25% of the cost is financed for six weeks

We’ve already noted that you have to pay 25% up-front. You then have to make payments in two weeks, four weeks, and six weeks. So the actual credit periods you are getting are:

- First 25%: None

- Next 25%: Two weeks

- Third 25%: Four weeks

- Final 25%: Six weeks

The maximum amount you can finance is $1,000

Unlike credit and charge cards, where your typical credit limit will be measured in thousands of dollars, and may run into five digits, the upper limit for Apple Pay Later is $1,000. That may not even buy you an iPhone, let alone a MacBook.

You don’t get any rewards

Using a credit or charge card will usually earn you points, which can be converted to cash or other things like airline miles. You get these rewards even if you pay off your balance in full each month to avoid interest charges. Apple Pay Later, in contrast, gives you nothing.

A credit or charge card is usually a better deal

If you compare the above with a credit or charge card, you can see that the latter is usually a better deal:

- You’re financing 100% for 30 days, not various percentages for various periods.

- You can generally finance several thousand dollars or more.

- You get cashback or other rewards for using the card.

So at best, Apple Pay gets you an extra week – for just 25% of the total. At worst, you get the same credit period for the full total; are limited to smaller purchases; and get no rewards.

Are there any reasons to choose Apple Pay Later?

If you carry a balance on your credit card, then you’d pay interest on your purchase, so Apple Pay Later is a better choice here, because it’s interest-free so long as you pay it off in full.

The $1,000 limit might be a positive thing for some people. If you’re prone to over-spending, then the lower limit may encourage you to be more responsible and opt for a cheaper model.

Finally, if you can’t get other credit, Apple likely has more relaxed loan criteria given that the amount of credit is small, and the loan period both fixed and short.

But it’s not risk-free

As with any “no fee, interest-free” credit deal, that’s only true so long as you keep up the payments. If you don’t, then it’s unclear how Apple will handle the matter, but it’s entirely possible you’ll then run up fees and charges. Additionally, while the original credit check was a soft one, Apple says that it may report payment history to credit agencies – so if you miss any payments, that likely will impact your credit rating.

The golden rule with any credit is: Only use it if you can comfortably afford the repayments, and are confident your financial position will remain stable for the credit period.

What are your views? Can you see any other reasons to use Apple Pay Later? Please share your thoughts in the comments.

Add 9to5Mac to your Google News feed.

FTC: We use income earning auto affiliate links. More.

Note: This article have been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here