![]()

Journalist

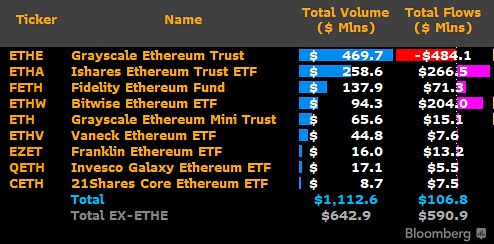

- ETH ETF’s first-day results outperformed analysts’ estimates of 15-15% of BTC ETFs.

- BlackRock’s ETHA led the way, but Grayscale bled out nearly a half-billion in outflows.

U.S. spot Ethereum [ETH] ETFs had a remarkable debut, clocking over $1 billion in trading volumes. Grayscale’s ETHE, alongside BlackRock and Fidelity ETH ETFs, saw over $100 million in day 1 trading volumes.

The rest, including Vaneck, Franklin and Invesco Galaxy, saw their ETFs hit daily trading volume above $10 million apart from 21Shares.

From a flow perspective, Bloomberg data revealed that the products logged $107 million in net inflows, led by $266.5 million from BlackRock’s ETHA and $204 million from Bitwise’s ETHW.

However, Grayscale’s ETHE was the only one with outflows totaling $484.1 million, while its mini version recorded a $15.1 million inflow.

ETH ETF first day results beats analysts’ estimates

Despite Grayscale’s outflows, the above +$1 billion in trading volume and over $100 million in net flows beat analysts’ estimates.

Bloomberg analyst Eric Balchunas had earlier projected that the products would outperform their ‘20% of BTC ETF’ estimates if BlockRock crossed $200 million in volume.

“Using BlackRock’s ETF as a proxy, $ETHA volume after first hour will be around $50m. If it can pass $200m by EOD, it will be outperforming our ‘20% of BTC’ estimate (given $IBIT did $1b first day).”

Interestingly, ETHA hit $258 million in volume by the end of Tuesday’s trading session. That translates to about 26% of BlackRock’s IBIT first-day volume, beating the estimates.

Commenting on the stellar results, Zaheer Ebtikar of crypto hedge fund Split Capital also reiterated that the day 1 results outperformed analysts’ estimates.

“Final figures on our end showing about $1.3 billion in total volume across ETH ETFs. Roughly 28% of BTC’s debut and substantially higher than most estimates between 15-20%.”

In fact, some products like Vaneck Ethereum ETF (ETHV) eclipsed its BTC ETF based on day 1 performance. Reacting to the explosive results, VanEck’s head of digital asset research, Mathew Sigel, said he was ‘proud’ of the fete.

“And proud that $45M of $ETHV traded, beating our day 1 $HODL volumes of $26M!”

However, Grayscale’s ETHE’s outflow fears seem warranted after a $484.1 million outflow on the first day. This was way greater than the GBTC’s $95.1 million outflow during its debut on 11th January.

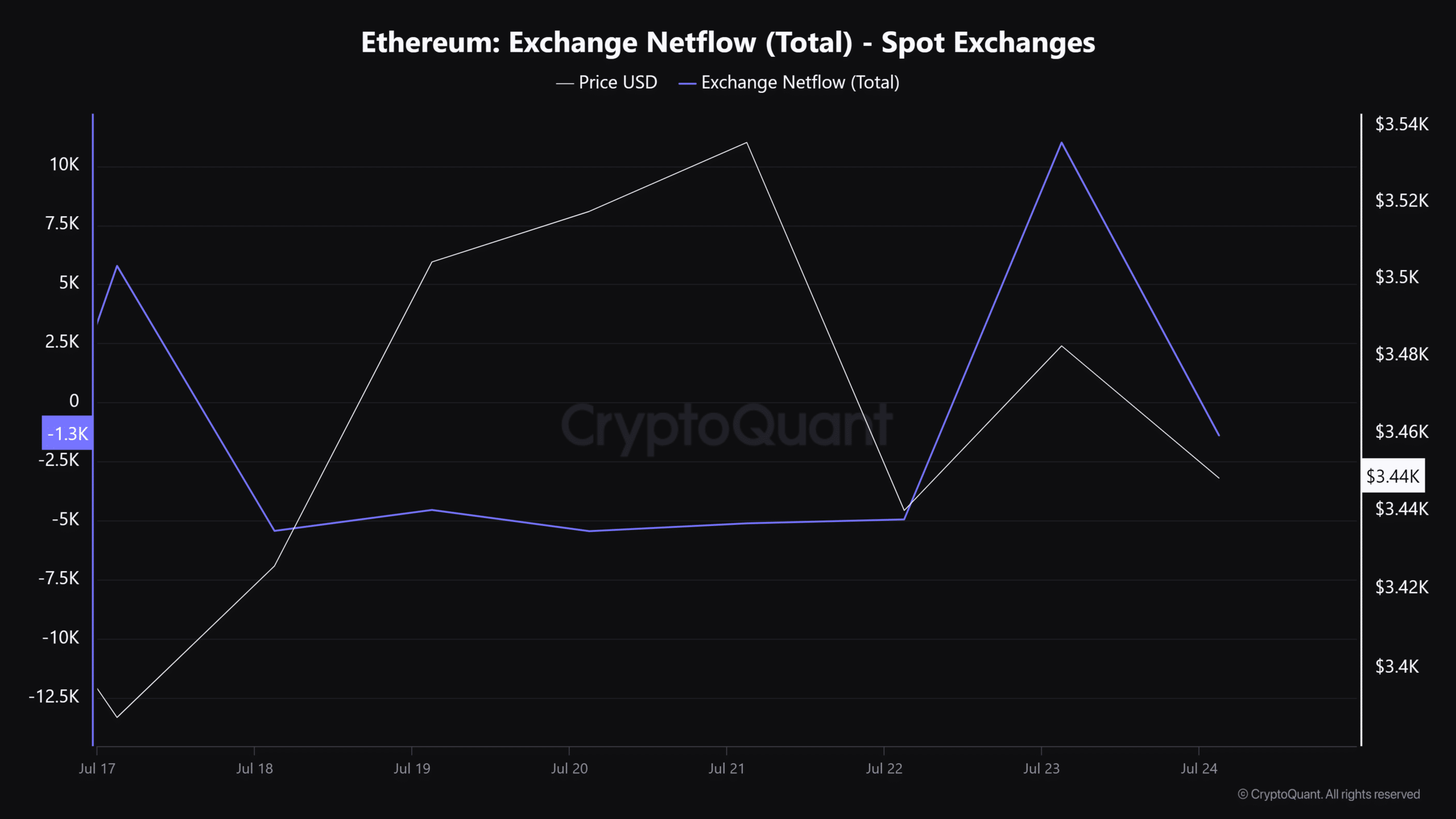

Meanwhile, the ETH price rose negligibly on the ETF debut day. It rose 1.25% and hit $3.54k but declined slightly below $3.5k as of press time.

However, the ETH spot market had no significant sell pressure after the ETF debut, as denoted by a drop in Exchange Netflow.

This meant more ETH was moved from exchanges than in, underscoring increased accumulation of ETH sent to personal wallets.

Note: This article have been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here