Home » Bitcoin » Bitcoin ETFs record largest single-day inflow since June as Bitcoin touches $73K

Oct. 30, 2024

Investors were likely rushing into IBIT due to recent price increases and fear of missing out on future gains, said Bloomberg ETF analyst Eric Balchunas.

Key Takeaways

- Investors flocked to US Bitcoin ETFs on Tuesday, pouring in a record $870 million.

- The surge coincided with Bitcoin’s 7% weekly gain, propelling the crypto above the $73,000 mark.

Share this article

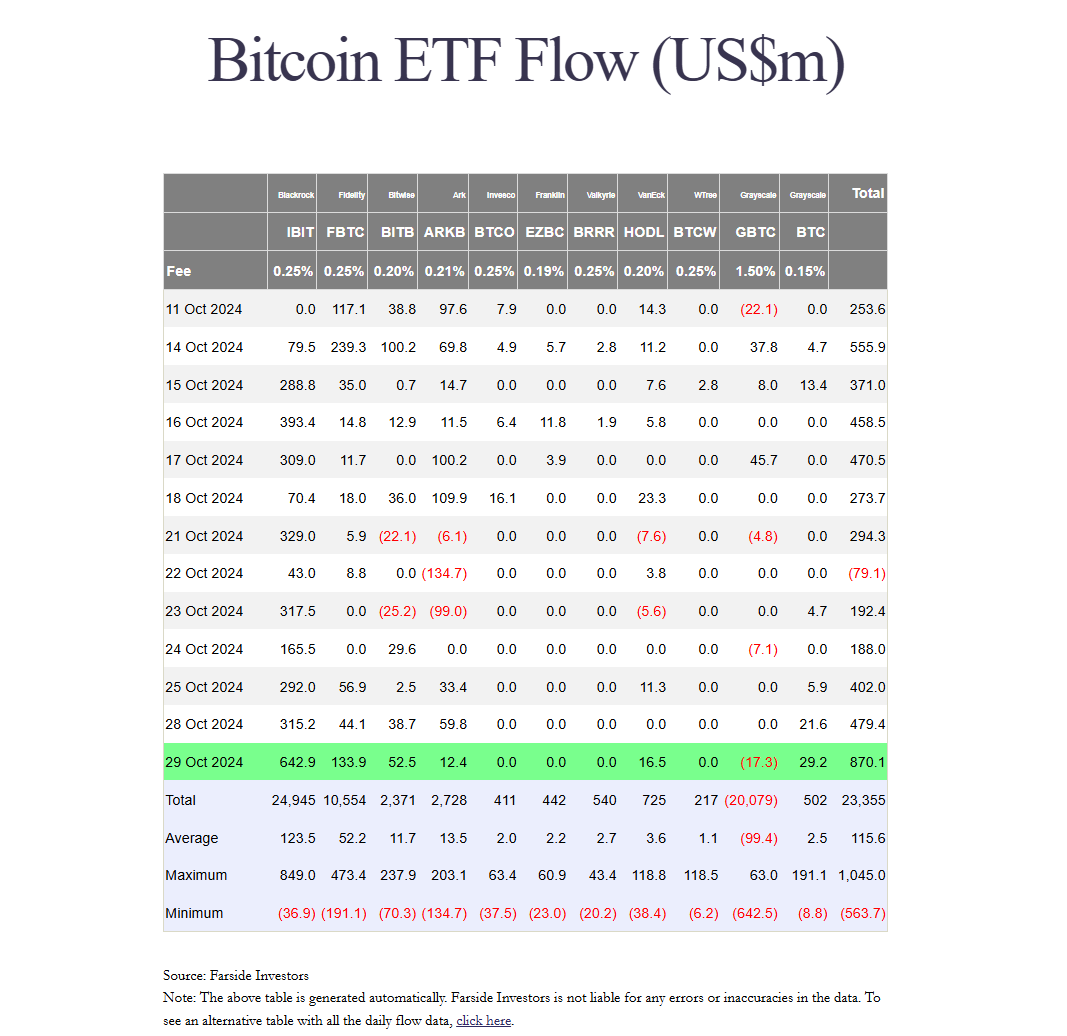

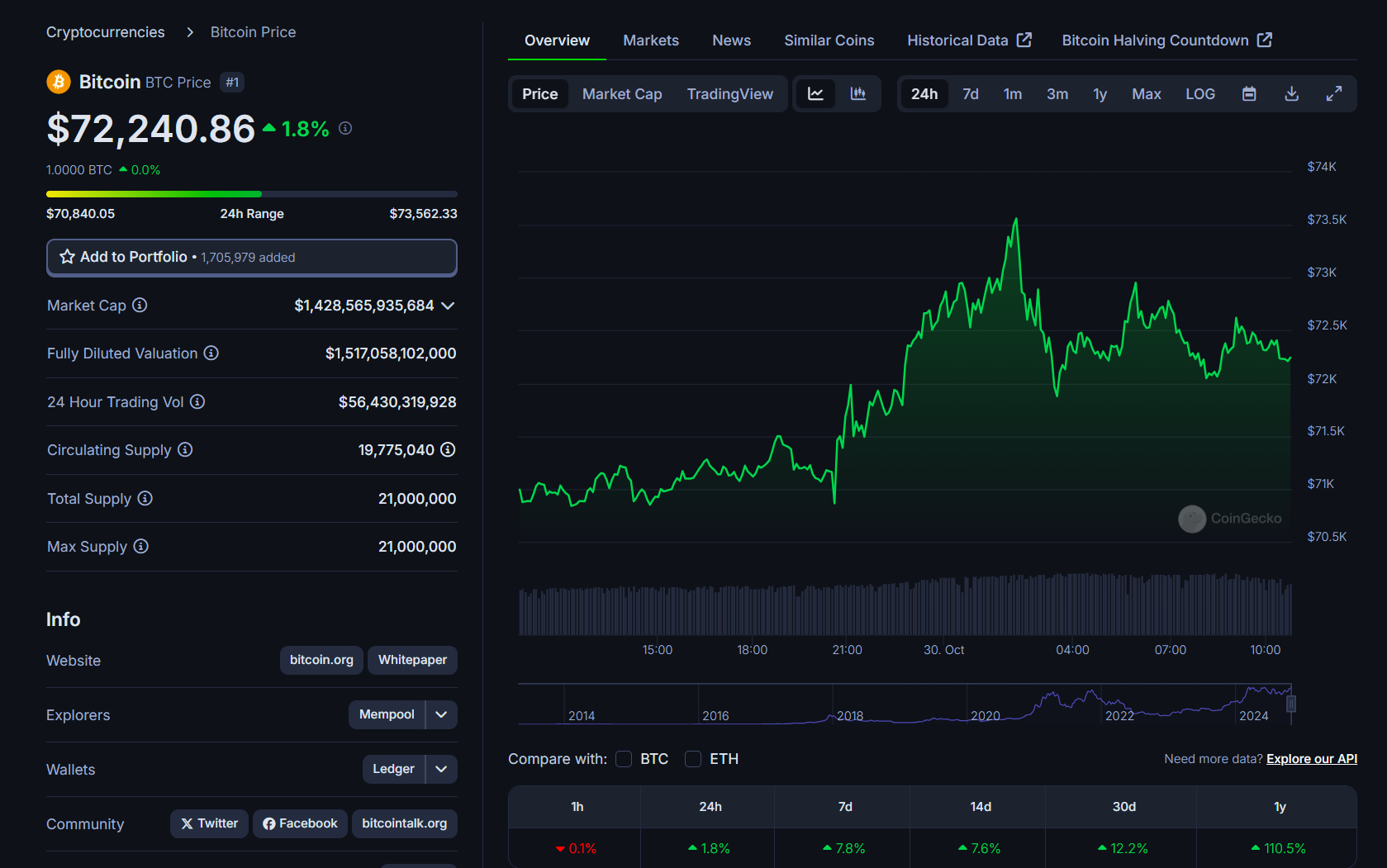

US spot Bitcoin ETFs saw a massive $870 million net inflow on Tuesday, the largest single-day influx since June 4, according to data from Farside Investors. The stellar performance came on the same day Bitcoin broke the $73,000 level, marking a 7% increase over the past week, CoinGecko data shows.

BlackRock’s IBIT continued its hot streak, drawing a record $643 million in net inflows yesterday. This marked IBIT’s largest net inflow since March 12 when Bitcoin neared its record-high.

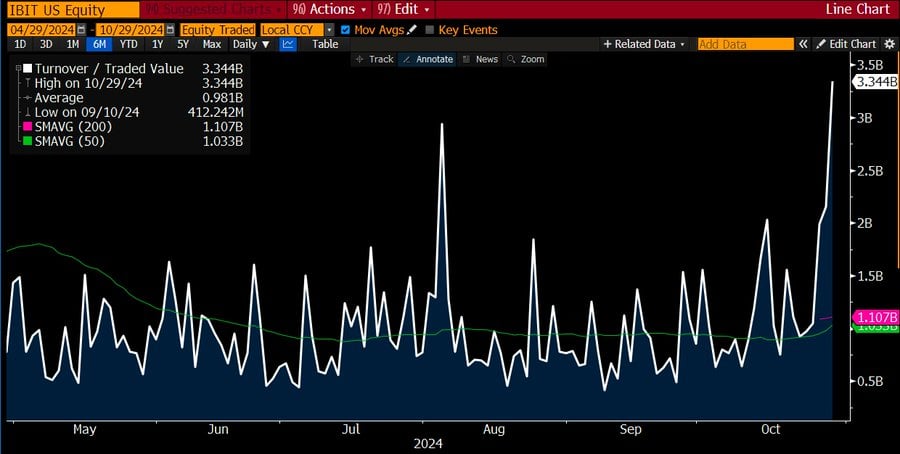

According to Bloomberg ETF analyst Eric Balchunas, IBIT’s trading volume hit $3.3 billion on Tuesday, which was the highest volume in 6 months. However, it was unexpected since Bitcoin was up 4% on the day.

Typically, ETF volume spikes during market downturns or crises, he explained, suggesting that the high volume might be due to a “FOMO-ing frenzy,” similar to what happened with the ARK Innovation ETF (ARKK) in 2020.

In a separate post following Tuesday’s inflow reports, Balchunas confirmed that investors rushed to buy IBIT due to recent price increases and fear of missing out on potential gains.

Not only IBIT but other competing Bitcoin ETFs also reported gains yesterday.

Fidelity’s FBTC attracted approximately $134 million in net inflows while Bitwise’s BITB, Grayscale’s BTC, VanEck’s HODL, and ARK Invest’s ARKB collectively captured over $110 million in net capital.

In contrast, Grayscale’s GBTC saw $17 million in redemptions. The fund still holds around 220,546 BTC, valued at nearly $16 billion.

US Bitcoin ETFs may surpass Satoshi Nakamoto’s holdings soon

US spot Bitcoin ETFs are poised to surpass the holdings of Satoshi Nakamoto by the end of the year, according to Balchunas. Currently accumulating approximately 17,000 BTC weekly, these ETFs are expected to exceed 1 million BTC next week, potentially overtaking Nakamoto’s estimated 1.1 million BTC by December.

Despite potential market volatility, Balchunas remains optimistic about the ETFs’ growth trajectory.

COUNTDOWN: US spot ETFs are scheduled to hit 1 million bitcoin held by next Wed and pass Satoshi by mid-December (before their first birthday, amazing). They’ve been adding about 17k btc a week. That said, anything can happen, eg a violent selloff and all this is delayed albeit… pic.twitter.com/lsU1xSP2Zd

— Eric Balchunas (@EricBalchunas) October 29, 2024

Bitcoin crossed $73,500 yesterday, just $170 away from its previous all-time high, based on CoinGecko data. Bitcoin was trading at $72,200 at press time, up around 1.8% in the last 24 hours.

Share this article

Note: This article have been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here