![]()

contributor

- ETH dropped below $3k amidst greater outflows from ETFs

- Some analysts are now predicting a drop below $2k for the altcoin

On the back of great crypto volatility amid Bitcoin’s own instability, altcoins are getting hit. In the middle of this downtrend, ETH has suffered the most over the last 7 days after dropping below $3k on the charts. As expected, this decline has worried analysts about the possible negative impact of Spot ETFs on Ethereum since their launch two weeks ago.

The sustained downside has seen various analysts predicting a further decline. For starters, the founder of Schiff Gold, Peter Schiff, believes that ETH will fall below $2k now. On his official X page, he noted,

“Ethereum itself is now trading below $3K. It won’t be long before it breaks $2K. #Gold rose 2% this week.”

This pessimism arose after ETH reported a 10.74% decline over the past few months. The timing here is especially important since many in the community welcomed Spot ETH ETFs positively. However, they seem to have had little positive impact on the crypto’s price on the charts.

ETH ETFs’ high outflows

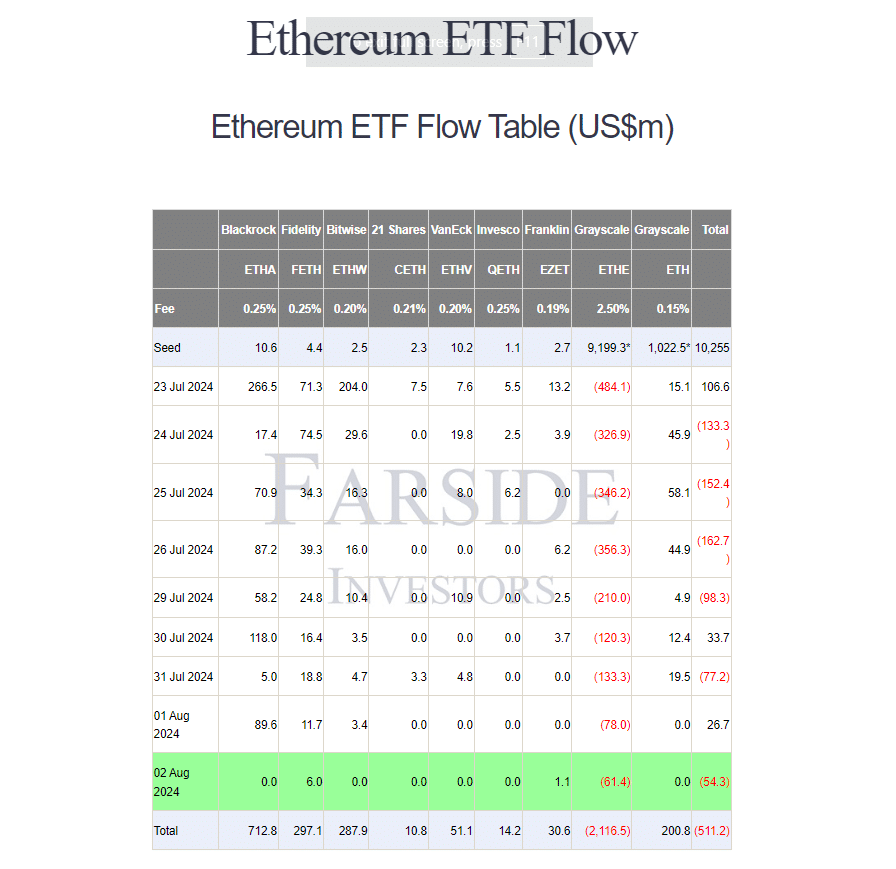

Notably, since the launch of Spot ETFs ETFs on 25 July, they have seen massive outflows. Since the launch, ETHE has noted a record high of $2.1B in outflows.

Since 2 August alone, Ethereum spot ETFs recorded total net outflows of over $54.3 million. This involved various ETFs, including ETHE with a single day outflow of $61.4M, Fidelity with $6M inflows, and EZET with $1M inflows. Simply put, since the launch of these products, outflows have continuously risen, facilitating investor caution and lack of confidence.

Peter Schiff, a known crypto-skeptic, was quick to point this out, adding,

“Ethereum ETFs have been trading for just two weeks and are already down 15%. They closed the week on new lows#Bitcoin fell 10%.”

What do the price charts say?

At press time, ETH was trading at $2985.86 after a 5.29% decline on the daily chart. The altcoin also registered a fall of 8.88% on a monthly basis. On the contrary though, the crypto’s trading volume rose by 20.10% over the last 24 hours.

AMBCrypto’s analysis revealed that ETH is now at the end of a strong downtrend. At press time, the Chaikin Money Flow was below zero at -0.02 – A sign that ETH seemed to be closing in the lower half of its range on the daily charts. This, because of higher selling pressure than buying pressure.

Additionally, the MACD was below zero at -62, indicating that the short-term EMA was below the long-term EMA.

Such findings suggest that the market may be seeing strong downward momentum, with sellers dominating the market.

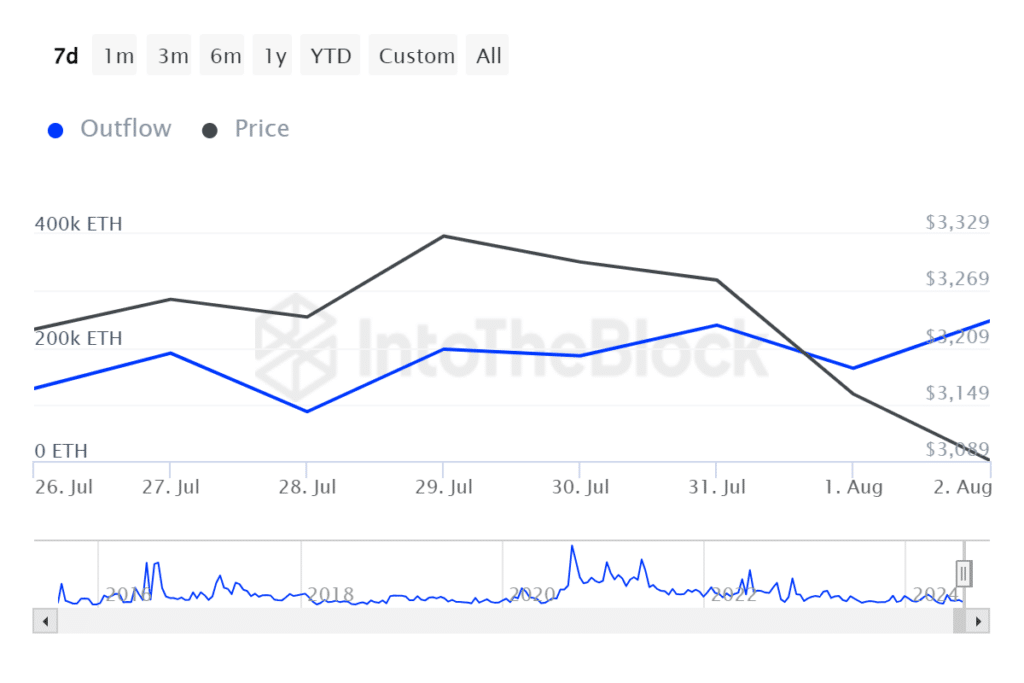

Looking further, data from IntoTheBlock highlighted that large holders’ outflows have increased over the last few days. The outflows spiked from a low of 127.79k to 246k.

Simply put, large investors have been selling their ETH tokens – Causing selling pressure while further driving the price down.

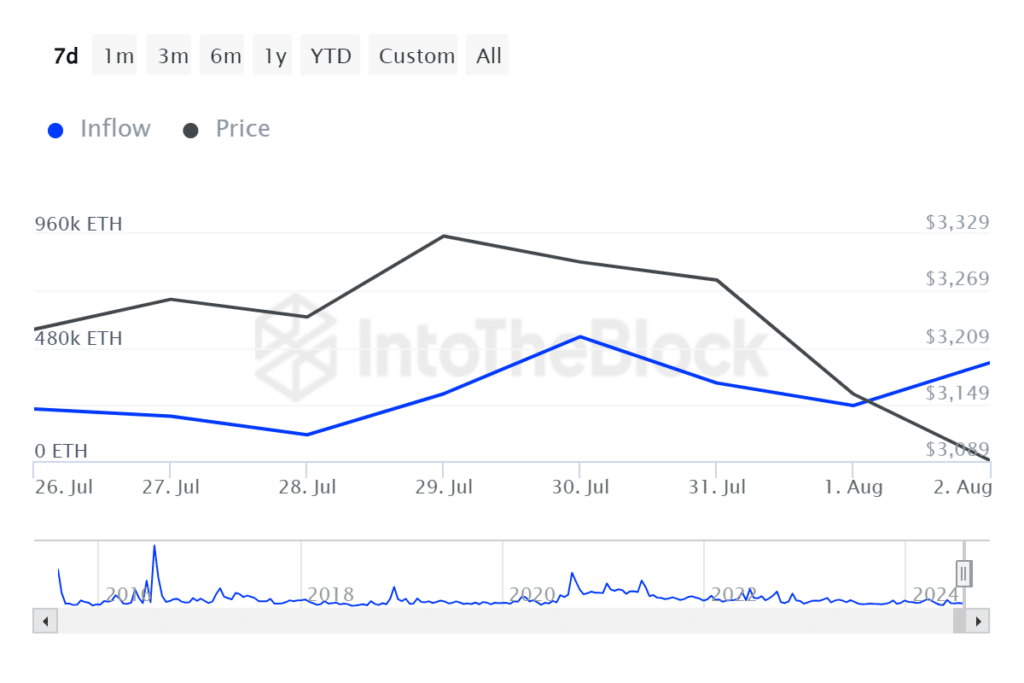

At the same time, inflows fell from a high of 525.82k to a low of 234.62k. Reduced inflows imply that sellers dominate the market – A bearish signal.

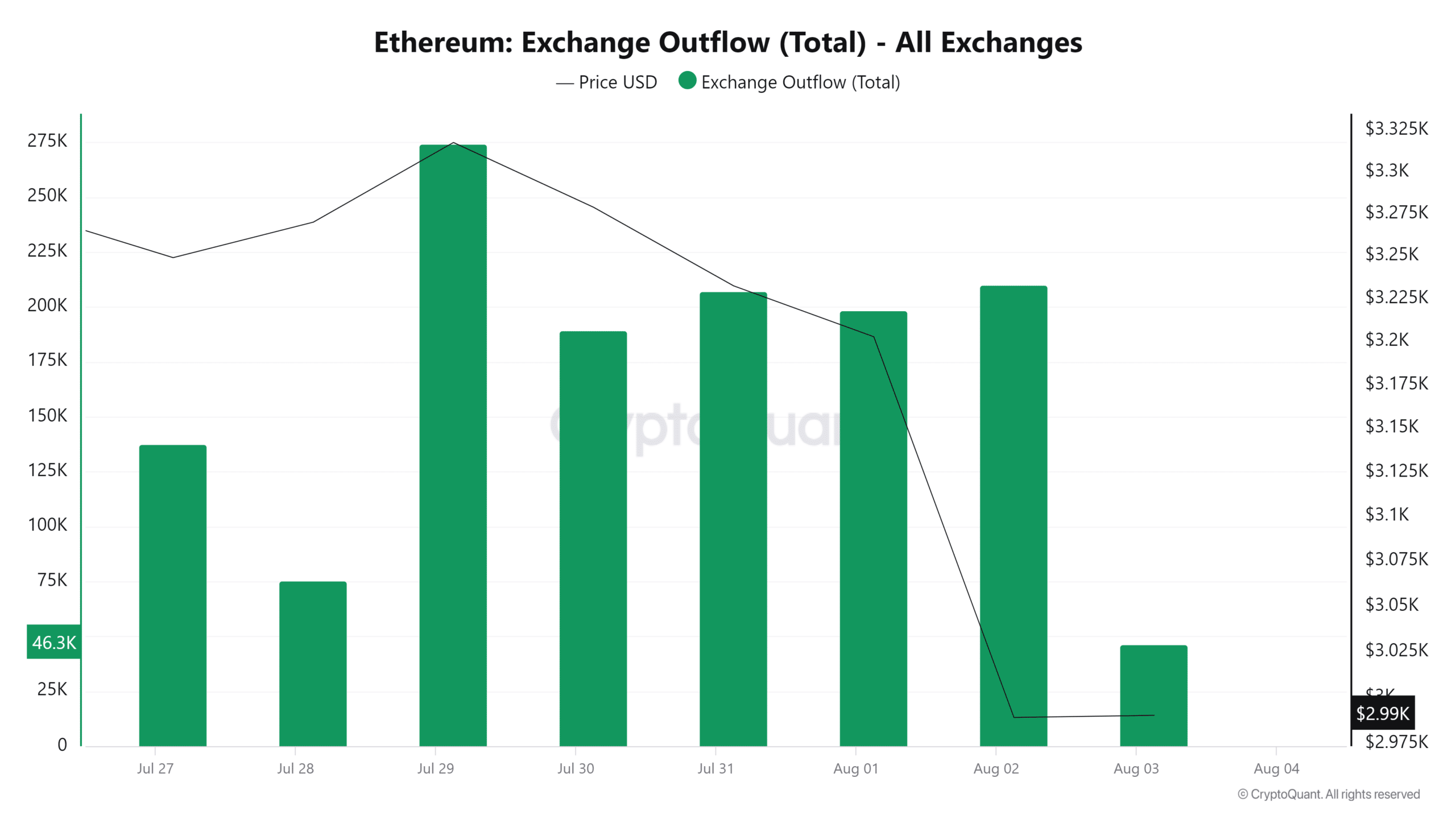

Finally, the decline of ETH exchange outflows further proves this as it shows a lack of investor confidence in potential price hikes in the short term.

Therefore, if the ongoing market sentiment and conditions prevail, ETH will decline to the critical support level of around $2810.87. A retest at this level has historically pushed Ethereum’s price to $3560.

Thus, just as Bitcoin declined during the first few weeks of ETFs, ETH will likely replicate this pattern and bounce back.

Note: This article have been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here