Key facts:

The sum equals more than 4.2 billion dollars.

Huobi’s activities are heavily influenced by Chinese regulations.

Huobi Pool, one of the largest bitcoin mining pools in the world, withdrew 100,000 bitcoin (BTC) from the funds generated and destined to the maintenance of this activity in China . It is speculated that the decision may be linked to the strong restrictions imposed by the Chinese government on all activities with cryptocurrencies in the country.

According to the price index of CriptoNoticias, the movement of funds made by Huobi is equivalent to USD 4.257 million. The operation was

You could also interest you

With the strengthening of bans on activities with cryptocurrencies, considered illegal in the Asian country, Huobi reported that will no longer open new user accounts in mainland China. And not only that, but also will begin to progressively close existing accounts as of December 31, 2021.

This account closure will imply that many people will be withdrawing their funds from the exchange in the next three months. Therefore, this movement of Huobi bitcoin from its mining pool could be read as a backup action to face this stage with sufficient liquidity, as suggested by Into The Block in its publication.

In fact, this is a fund migration process that seems to have already started. According to a post by Twitter user CryptoVallor , Cryptoquant data reflects a movement of more than 4,000 bitcoin from the Huobi exchange to its Binance peer on September 29.

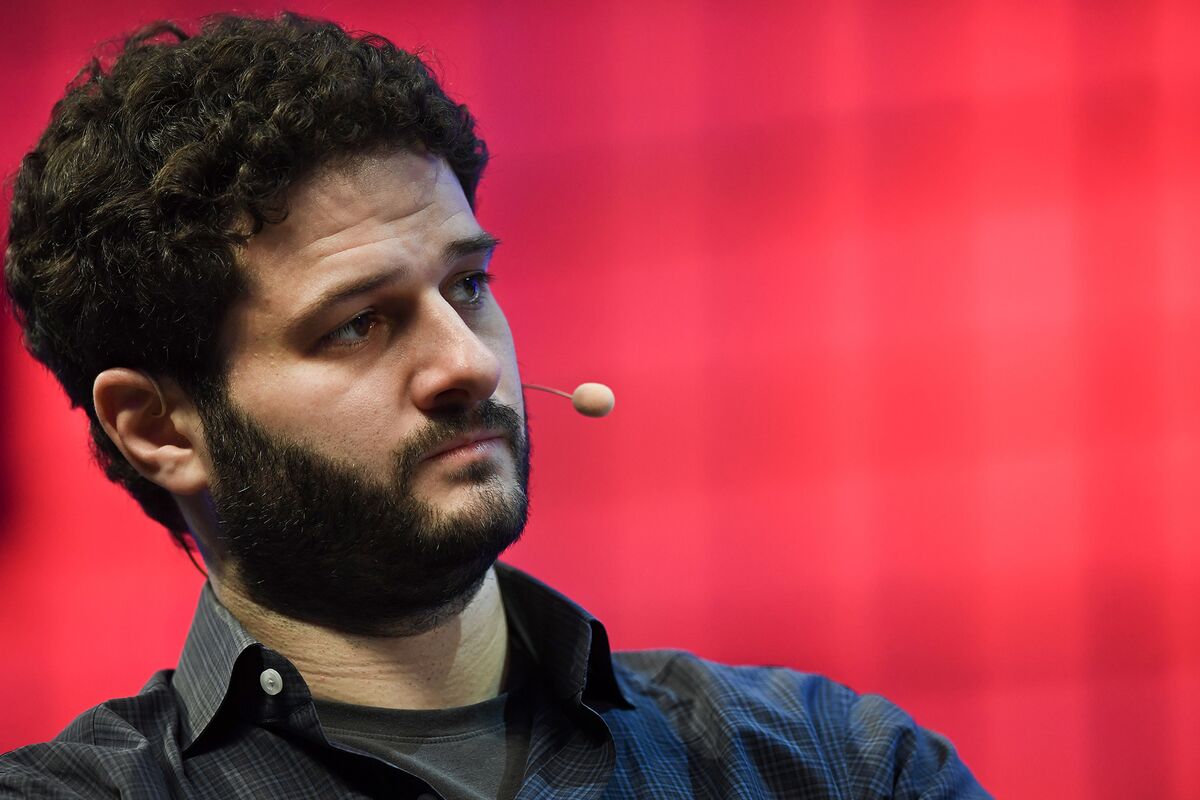

As one of the ten mining pools with the highest processing power in the world (image above), the news is gaining momentum. Is that China is an important bastion in this sense worldwide, and even the warnings and confiscations suffered by miners in the country during 2021 have generated certain operational difficulties for the Bitcoin network in the second quarter of the year. Despite this, the situation It stabilized by the end of July, as reported by this media.

Other consequences of China’s measures

The events in China in the last month have had their repercussions on the cryptocurrencies. On the one hand, both the financial crisis due to the possible default of the Evergrande real estate company and the government’s measures regarding cryptocurrencies seem to have had their impact on the price of bitcoin , as reported by this media .

On the other hand, Ethereum has also been affected by recent events. The main novelty has to do with the closure of Sparkpool, the Ethereum mining pool with the highest hash rate, which announced his termination total operations after being forced to leave China for the reasons already mentioned.

Since Sparkpool’s announcement until Wednesday, September 29, ether (ETH), the network’s cryptocurrency, had had a decrease of approximately 10% in its price, according to data from CoinMarketCap.

Note: This article has been indexed to our site. We do not claim ownership or copyright of any of the content above. To see the article at original source Click Here