Establishing a new order of charter capital of the bank

In the last months of the year, the bank started a sprint to increase charter capital from paying dividends in shares, issued to existing shareholders to private placement for strategic shareholders.

It can be seen that in the 2021 plan, increasing charter capital becomes one of the important goals set by banks. The immediate cause of the race to increase capital is to meet the minimum capital adequacy ratio (CAR) as prescribed. Only when capital adequacy is ensured, banks are able to receive a higher ceiling of credit growth.

Accompanying, the increase in charter capital also helps the bank to raise the credit growth rate. high capacity in risk management, investment in system development, expansion of branch network, investment…

According to the plan approved by the General Meeting of Shareholders, in 2021, a series of banks The company will launch billions of shares in the market through dividends and private placement to strategic shareholders, selling ESOP shares (bonus shares or selling to employees). It is estimated that in 2021, there will be about VND 82,000 billion to add charter capital to the banking system, an increase of 31% compared to 2020.

But data from VietstockFinance shows that, although there are 19 banks that have set a target to increase capital in 2021, after the first half of the year, only 4/19 banks have recorded capital increase.

SCB has successfully offered 478.8 million shares to the public, attracting an additional VND4,788 billion of new capital, raising capital charter capital from 15,232 billion dong to 20,020 billion dong.

Although the plan in 2021 is to increase capital to more than 26,674 billion dong, as of June 30, 2021, SHB has completed raising capital to VND 19,260 billion by issuing more than 175 million shares to pay the 2019 dividend rate of 10%.

SHB said that it is also completing the application to submit to the State Bank (SBV) the plan to increase The charter capital has been approved by the General Meeting of Shareholders in 2021, in which the dividend payment in 2020 is paid to existing shareholders at the rate of 10.5% in shares and shares are offered to existing shareholders by the method of exercising rights at the rate of 10.5%. rate of 28%.

VIB also issued more than 443 million bonus shares with a rate equivalent to 40% from the bank’s equity, increasing its charter capital from VND 11,094 billion to VND 15,531 billion.

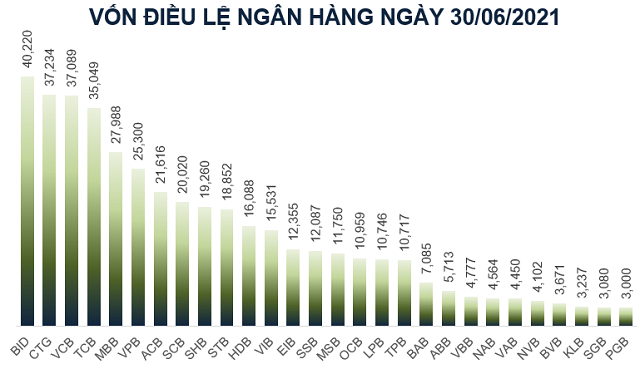

As of June 30, 2021, BIDV (BID) is the bank with the highest charter capital with VND 40,220 billion, surpassing even VietinBank (CTG , VND 37.234 billion) and Vietcombank (VCB, VND 37,089 billion). Leading in the group of private commercial banks is Techcombank (TCB, VND 35,049 billion), followed by MB ( MBB, VND 27,998 billion.

The source: VietstockFinance. Unit: Billion VND

Sprint to increase capital

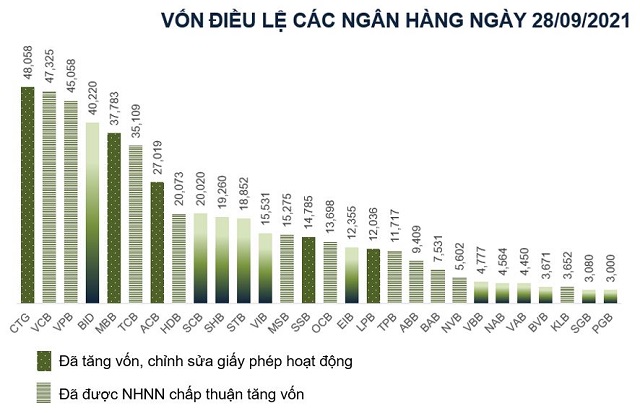

Starting to In the second half of the year, banks rushed to increase capital, 5 more banks increased their charter capital and 8 banks were approved by the State Bank to increase capital.

VietinBank has issued more than 1.08 billion shares, equivalent to the issuance rate of 29.1% to pay dividends. Thereby, successfully increased charter capital from VND 37,234 billion, to nearly VND 48,058 billion. The capital source for implementation is profit after tax, fund deduction for the years of 2017, 2018 and the remaining profit after tax, fund deduction and cash dividend of 2019. This capital increase also makes VietinBank a bank. had the highest charter capital in the system as of September 28.

MB also increased its charter capital from VND 27,987 billion to nearly VND 37,783 billion through issuing more than 979.5 million shares to pay dividend 2020 at the rate of 35%.

Besides, some banks have also been approved by the State Bank of Vietnam to increase charter capital such as Vietcombank, VPBank (

On September 20, the Prime Minister has just approved the additional investment plan of more than 7,657 billion VND for Vietcombank according to the report of the State Bank to maintain the ownership rate of the State Bank of Vietnam. water. Additional capital comes from dividends to State shareholders, through Vietcombank issuing shares to pay dividends from the remaining after-tax profit of 2019 after setting aside funds and paying dividends in cash. . Currently, the State owns 74.8% of Vietcombank’s capital.

Previously, Vietcombank’s 2021 General Meeting of Shareholders approved a plan to increase capital from VND 37,089 billion to VND 50,401 billion, through 2 components. Firstly, Vietcombank will issue more than 1.02 billion shares, equivalent to 27.6% from the remaining undistributed after-tax profit after paying the 2019 dividend (8% in cash). Second, Vietcombank will privately offer 6.5% of its charter capital, equivalent to issuing more than 307.6 million shares to a maximum of 99 institutional investors.

VPBank (VPB) was also approved by the State Bank to increase charter capital by a maximum of nearly VND 19,758 billion in the form of share issuance to pay dividends from undistributed profits and issue shares to increase charter capital from Investment and development fund and reserve fund for supplementing charter capital.

According to the plan, VPBank will issue a maximum of nearly 1.98 billion shares to shareholders, the ratio issued account for 80% of the total number of outstanding shares at the time of right-handling. The total value of issuance at maximum par value is nearly VND 19,758 billion.

After completing the issuance, the charter capital of VPBank

will increase from nearly VND 25,300 billion to VND 45,058 billion, becoming the private commercial joint stock commercial bank with the highest charter capital in the industry (behind VietinBank and Vietcombank).

MSB announces the last registration date to close the list of shareholders entitled to share distribution The dividend 2020 in shares is October 8, the ex-dividend date is October 7. The plan to issue another 352.5 million shares to pay 30% dividend of MSB has been approved by the State Bank to increase charter capital from 11,750 billion dong to 15,237 billion dong.

If it is estimated that banks that have been approved to increase capital are successful, as of September 28, VietinBank’s charter capital (48,058 billion dong) is the highest in the system, followed by Vietcombank (VND 47,325 billion) and VPBank (VND 45,058 billion). Then there are BIDV (40,220 billion dong) and MB (37,783 billion dong).

Nguồn: VietstockFinance. Đvt: Tỷ đồng

Cát Lam

Note: This article have been indexed to our site. We do not claim ownership or copyright of any of the content above. To see the article at original source Click Here