The highest oil price in many years

Oil prices rose, with US crude hitting its highest level since 2014 and Brent rising to a three-year high, after OPEC+ producers struggled to meet currently planning to increase production.

At the end of the session on October 5, Brent crude oil increased by 1.3 USD, or 1.6%, to 82.56 USD/ barrel, earlier in the session sometimes reached 83.13 USD/barrel – the highest in 3 years. West Texas Intermediate crude oil prices rose $1.31, or 1.7%, to $78.93 a barrel, at times rising more than 2% to $79.48 a barrel – the highest in nearly seven years. Both oils gained more than 2% in the previous session.

Since the beginning of the year, oil prices have increased by more than 50%, adding to the pressure of inflation. The outbreak caused oil consuming countries such as the US and India to worry that the economy would be difficult to recover after the Covid-19 pandemic.

At the end of September 2021, the Commission The OPEC+ Joint Technical Committee (JTC) expects oil supply to be short this year by 1.1 million bpd (bpd) and possibly a surplus of 1.4 million bpd next year. However, despite the pressure to increase output, OPEC+ is concerned that the 4th wave of global Covid-19 infections may affect demand recovery.

A sharp increase in global natural gas prices could cause power plants to switch from gas to oil, said Gary Cunningham, director of market research at Tradition Energy. That means crude oil price remains supported even if there is a short-term pullback.

Highest natural gas price 12 years

U.S. natural gas prices rose more than 9% to 12-year highs, as rising global prices boosted demand US exports of liquefied natural gas increased sharply.

Natural gas price for November 2021 on the New York Stock Exchange increased by 54.6 US cents, equivalent to 9, 5% to 6,312 USD/mmBtu – the highest since December 2008.

Natural gas price for November 2021 term in Europe increased by more than 21% and period December 2021 term increased 23% to a new record high, due to concerns that some European countries will not have enough gas to heat next winter. Natural gas prices in Asia also surged to near record highs, as China and other major liquefied natural gas (LNG) buyers compete for the availability of goods to meet demand for the fuel. super cool.

Gold price drop

Gold price drop strong 1.2%, as the strong US Treasury yields and the dollar made gold less attractive, along with investors waiting for the US nonfarm payrolls data later this week. .

Spot gold on the LBMA floor fell 0.5% to $1,760.3 per ounce, the first drop in four sessions and December 2021 gold futures on the LBMA exchange. The New York Stock Exchange fell 0.4% to $1,760.9 an ounce.

The dollar rose to a nearly 1-year high against a basket of major currencies this week. earlier, making gold more expensive to buy with other currencies. At the same time, the 10-year US Treasury bond yield rose to its highest level since June 2021 (1.5670%) from 1.5223%.

US nonfarm payrolls data is expected to continue to improve the labor market, which may prompt the US Federal Reserve to begin easing monetary stimulus before the end of the year.

Copper price fell

Copper price fell due to strong USD ahead of US nonfarm payrolls data later this week and lingering concerns about China Evergrande.

Three-month copper futures on London bourse fell 1 .2% to 9,144 USD/ton.

Rubber price in Japan increased

Rubber prices in Japan increased, after the new Japanese government pledged to take any measures necessary to support the economy.

The price of rubber for March 2022 on the Osaka floor increased by 3.2 JPY or 1.5% to 211 JPY/kg.

Minister New Economy Daishiro Yamagiwa said, The Japanese government will take all necessary measures to support the economy affected by the pandemic.

Coffee prices fall

Arabica coffee prices fell more than 4%, as rain boosted coffee crop yields in top producing country – Brazil.

Robusta coffee futures November 2021 on London floor fell 37 USD, equivalent to 1.7% to 2,111 USD/ton.

At the same time, the price of arabica coffee for December 2021 on ICE dropped 8.45 US cents, or 4.2%, to 1,919 USD/lb, after reaching a 2-month high (2,0685). USD/lb) in the previous session.

Sugar price increased

The price of raw sugar in March 2022 on ICE increased 0.16 US cents or 0.8% to 19.85 US cents/lb.

At the same time, the price of white sugar for December 2021 on the London floor increased by $ 4.9, or 1%, to $ 507.5 / ton.

StoneX broker said that the global sugar supply is expected to improve in the 2021/22 season, due to volume increased in Asia and Europe.

Soybean prices increased, maize and wheat prices decreased

Soybean prices in the US increased by 1.3%, as a rising energy market spurred demand for soybean-based biofuels.

On Chicago floor, soybean oil futures in November 2021 increased by 15-3/4 US cents to 12.51-1/2 USD/bushel, soybean oil futures in December 2021 increased 2.31 US cents to 61.14 US cents/lb. The price of corn for December 2021 futures fell 3-1/4 US cent to 5.37-1/2 USD/bushel. Wheat futures December 2021 fell 11-3/4 US cents to 7.44-3/4 USD/bushel.

Price palm oil rose 4%

Malaysian palm oil price rose 4% to a record high (4,786 ringgit/ton), due to crude oil prices The price of palm oil for December 2021 on the Bursa Malaysia exchange increased by 3.38% to 4,738 ringgit

1,134.17 USD)/ton.

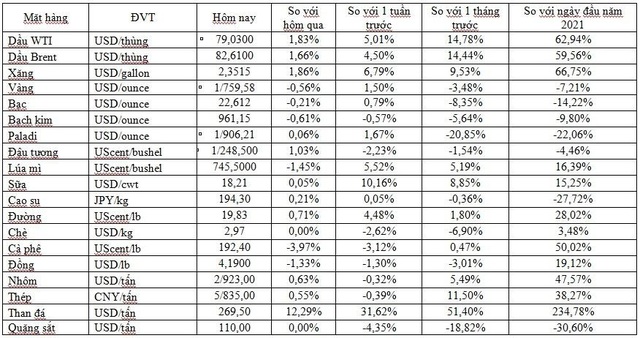

Prices of some key commodities in the morning of October 6:

Minh Quan

According to Young Intellectuals

Note: This article has been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here