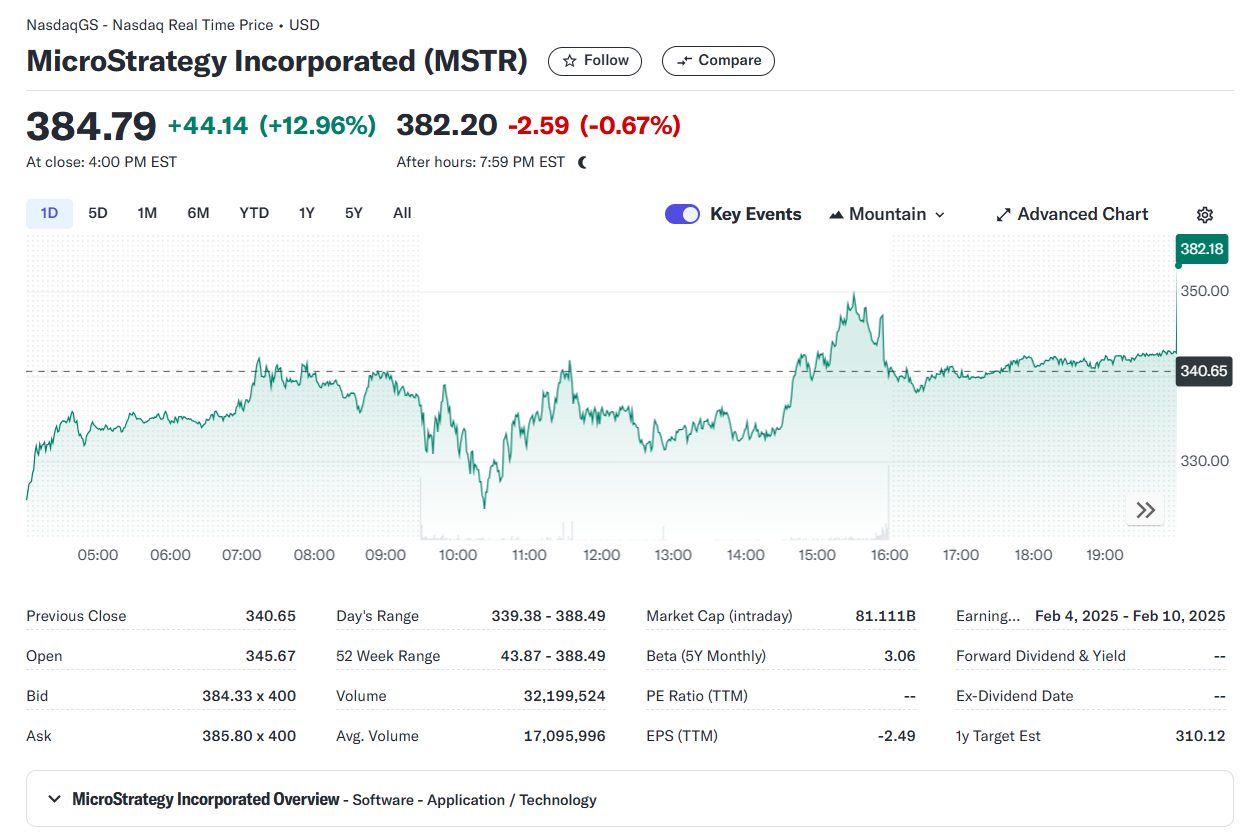

Home » Bitcoin » MicroStrategy stock soars to record high following $4.6 billion Bitcoin buy

Nov. 19, 2024

Since the beginning of this year, MicroStrategy’s stock has surged by 500%.

Key Takeaways

- MicroStrategy shares ended at a fresh record high after a $4.6 billion Bitcoin purchase.

- The company aims to raise $1.75 billion through zero-interest convertible notes to buy more Bitcoin.

Share this article

Shares of MicroStrategy (MSTR) soared approximately 13% to a record closing high on Monday after the company disclosed it had acquired $4.6 billion worth of Bitcoin and revealed plans to raise $1.75 billion to bag more coins.

MicroStrategy’s stock has outperformed many other stocks in the S&P 500 index in terms of year-to-day return. Data from Yahoo Finance shows that MSTR has shot up over 500% so far in 2024, while Microsoft’s shares (MSFT) have been up around 11%.

At this point, Michael Saylor’s bet on Bitcoin is paying off substantially. Not only does MicroStrategy’s stock gain, but its Bitcoin holdings also yield big returns.

With 331,200 BTC purchased at an average price of $88,627, the company comfortably sits on roughly $13.7 billion in unrealized profits.

MicroStrategy plans to issue senior convertible notes with a 0% interest rate maturing in December 2029, using the proceeds to acquire more Bitcoin.

This follows similar debt issuances, including an $875 million convertible senior notes offering in September with a 2028 maturity date, and another issuance in June maturing in 2032.

Using convertible notes, MicroStrategy effectively gains access to interest-free/low-interest capital that is used to purchase additional Bitcoin. The company’s bet is on Bitcoin’s continued price growth over subsequent market cycles.

The convertible notes provide investors with the option to convert their debt into shares of MicroStrategy. This conversion feature is attractive, especially given the company’s impressive stock performance.

If MicroStrategy’s stock continues to rise, bondholders can convert their notes into shares and benefit from this appreciation. If they choose not to convert, they will receive their principal back upon maturity, making it a low-risk investment.

The essential risk lies in the unpredictable volatility of Bitcoin prices. A drastic decline in its value might compromise MicroStrategy’s financial integrity and result in losses.

Share this article

Note: This article have been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here