The power shortage crisis in China disrupts the commodity market

Commodity manufacturers in China are having production interruptions due to power shortages and Beijing’s output controls.

The production of metals from aluminum to steel has been disrupted for several months as power consumption controls have been implemented in many of China’s major industrial hubs . Currently, factories producing high-quality goods are starting to take a hit, thereby posing risks to the world’s second-largest economy.

And yet, the energy crisis has spread to the food sector, which is Beijing’s top priority at the moment.

Food security

Ensuring enough food for China’s 1.4 billion people is China’s top priority. However, the power shortage forced soybean processors in the northern regions to close and pushed up fertilizer prices.

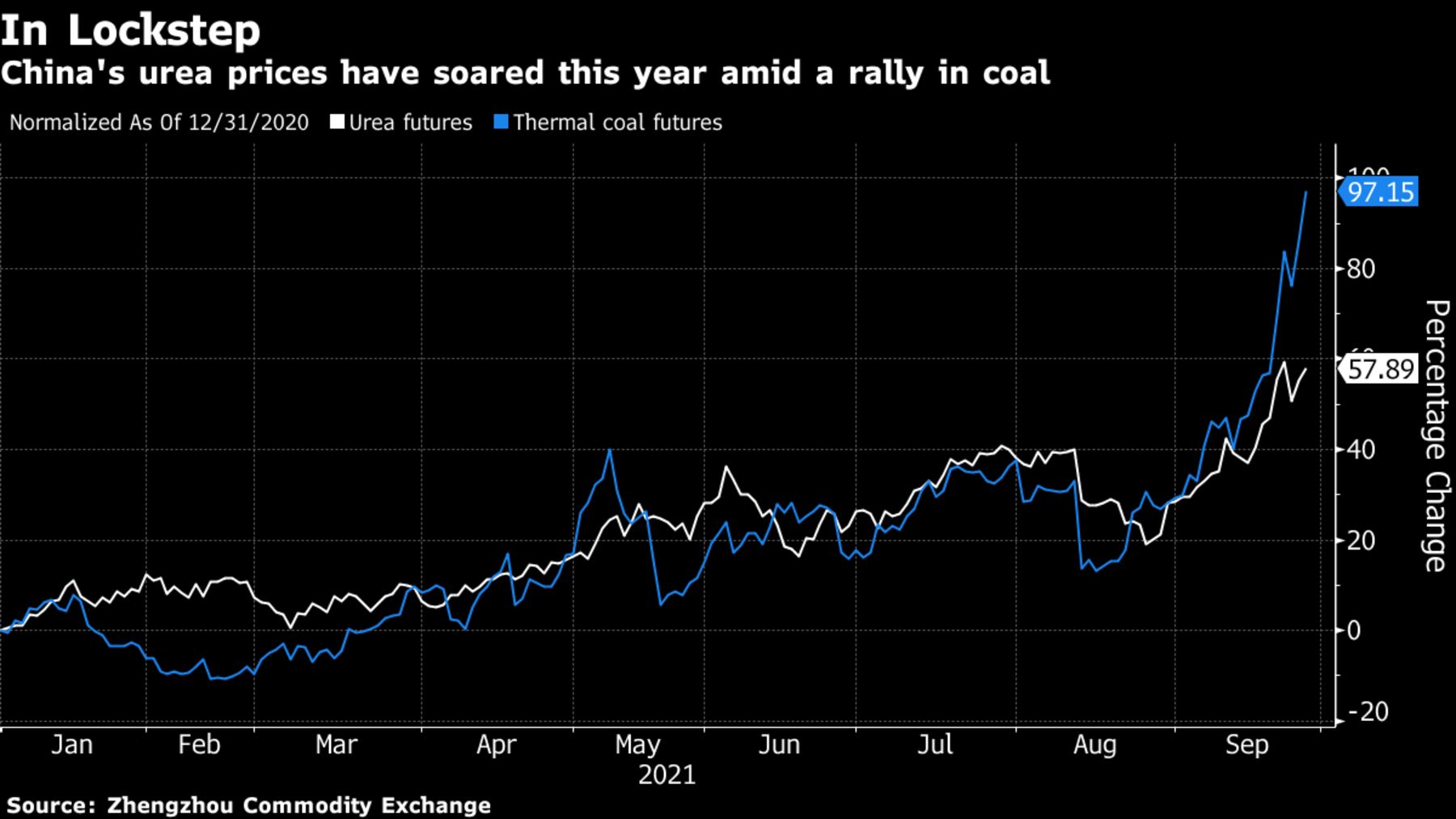

Fertilizer and coal prices

Some soybean mills by Louis Dreyfus Co., Bunge Ltd. and Yihai Kerry are among those affected. So far, the impact has been somewhat mitigated as demand for soy-based foods – used as animal feed – has weakened due to lower pork prices. However, if factories are shut down, this could delay soybean purchases from the biggest buyer and reduce exports to the US.

There is also concern that China’s policy moves may reduce the operating capacity of corn processors, which specialize in products such as starch, Chinese company Huatai Futures said in a report.

As fertilizers play an important role in overall food security, Beijing is also strengthening control over the rise of fertilizer prices. This week, a Chinese state-owned company said it had been fined for raising the price of fertilizer products. Earlier, China warned of excessive hoarding and price increases.

Metals

Amid the power shortage crisis in the world’s top consumer of base metals, metallurgical and manufacturing plants are production interruption in the past few months. This will affect supply and demand from copper to tin. By far, the hardest hit industry is aluminum smelting, which consumes a lot of electricity.

According to an estimate by Goldman Sachs, the power shortage caused a decrease in aluminum production capacity by 3 million tons (ie 8% of China’s total capacity) and pushed the price of this metal to a high level. highest since 2008 this month. The possibility of tightening more electricity consumption in winter (which is the season with high demand for electricity) will put pressure on this industry.

Aluminium price movements

Steel production was interrupted

Steel mills – China’s main target in the output-cutting campaign – are also affected by the tightening of electricity consumption and thereby reduce demand for iron ore (the main raw material in the world). for steel production) in recent months. Iron ore prices have fallen by 50% from their peak in May and at times dropped the threshold of $100/ton. More than 80 Chinese steel mills suspended production for maintenance in September 2021, according to Mysteel.

Nickel prices also rose to their highest levels since 2014 this month, but Worries about the electricity crisis in China have clouded the outlook for stainless steel consumption. In Fujian province, China’s key stainless steel production hub, some mills have begun to suspend production, with China’s monthly stainless steel output falling by more than 0.5 million tons, according to Mysteel.

Price of iron ore and steel bar

Silicon price peaked

The impact of the crisis on some smaller commodities was even greater. In particular, silicon prices quadrupled to a record this month after China imposed production control measures. The rise in silicon prices could make it more difficult for aluminum producers because they use silicon as an alloying ingredient in specialized products.

Manufacturing controls could also hit the price of polysilicon, an important input for solar manufacturers, according to research firm Shanghai Metal. Markets.

![]()

Vu Hao (According to Bloomberg)

Note: This article has been indexed to our site. We do not claim ownership or copyright of any of the content above. To see the article at original source Click Here