- The Securities and Exchange Commission added Valkyrie’s spot Bitcoin ETF application to its official docket, signaling an official review of the filing.

- Other institutions and the public have 21 days to submit their comments on the possible impacts of Valkyrie’s filing, per the commission’s deadline.

- Valkyrie refiled its Bitcoin exchange-traded fund application after wall street titan BlackRock submits its own application on June 15.

- The asset manager named Coinbase as its surveillance partner in a July 5 filing after the SEC deemed previous submissions inadequate.

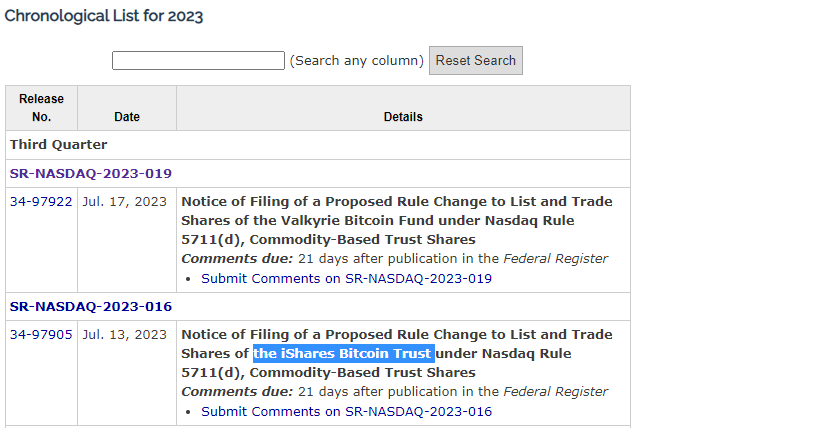

The Federal Register of the U.S. Securities and Exchange Commission shows that a second spot Bitcoin ETF filing was added for official review. Indeed, Valkyrie’s submission to list a Bitcoin exchange-traded fund on the NASDAQ is now listed on the commission’s calendar.

The SEC also accepted the iShares Bitcoin Trust for review on July 13.

Valkyrie is one of several financial juggernauts like BlackRock in the race to offer U.S. customers access to a fund that invests directly in Bitcoin. The company’s ETF named the Valkyrie Bitcoin Fund under the proposed ticker ‘BRRR’ – a nod to a meme about mimicking the sound of money printing – was added to the SEC’s docket on July 17.

According to the SEC’s review procedure, a 21-day comment period has opened for Valkyrie’s application. During this time, other institutions and the public are welcome to submit opinions on how Valkyrie’s spot Bitcoin ETF might impact financial markets, the fund’s risk to investors, and other possible outcomes should the SEC approve the application.

Spot Bitcoin ETF Marathon

Valkyrie’s resubmission was an update to its original ETF filed in 2021. The amended application filed on July 21 named Coinbase as its partner for a contentious market surveillance agreement shortly after wall street titan BlackRock opened the floodgate with its own spot Bitcoin ETF filing on June 15.

Since BlackRock’s move, other would-be ETF issuers like WisdomTree, Fidelity, and Invesco have made a punt with their own respective applications. Former SEC Chair Jay Clayton opined bullish sentiment regarding the chances of a successful filing from at least one of these players.

Note: This article have been indexed to our site. We do not claim legitimacy, ownership or copyright of any of the content above. To see the article at original source Click Here